I did not appreciate Elon Musk until I read Ashlee Vance’s biography entitled “Elon Musk: Tesla, SpaceX and the Quest for a Fantastic Future”. The author is clearly a Musk advocate and he looks past Elon’s shenanigans to find a once in a century mind working from what he calls “First Principles” on important projects like privately funded space exploration and clean energy independence. First Principles are grounded in chemistry or physics like electrons are faster than internal combustion. Michael Barnard from Clean Technica explains the physics as follows:

“Teslas use electricity in batteries instead of physical fuel. Getting electrons from a battery to an electric motor is much faster than getting fuel from a gas tank to a piston. Electrons travel much faster along a wire than fuel does along a fuel line, and the electrons basically go straight to the place where they are needed, while the fuel goes through a fuel pump, then to a fuel injector, then is sprayed into a piston, and then is ignited, turning into force which drives the piston to finally create torque. “

Tesla and SpaceX are stunning endeavors. Tesla is often misunderstood as an automotive company, when at its core Tesla is really an energy storage company. For Musk, SpaceX is more about propagating our species than it is about commercial pursuits like putting satellites in orbit and resupplying the space station. The implications of each endeavor are simply transformative.

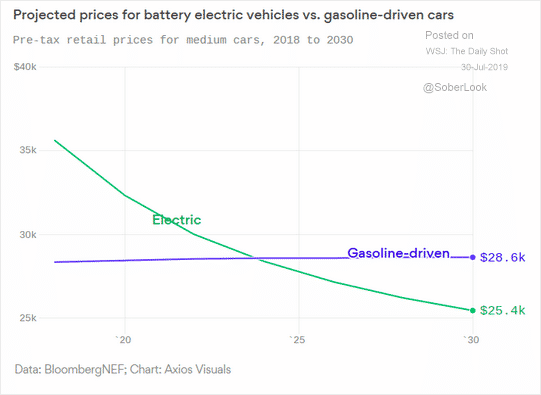

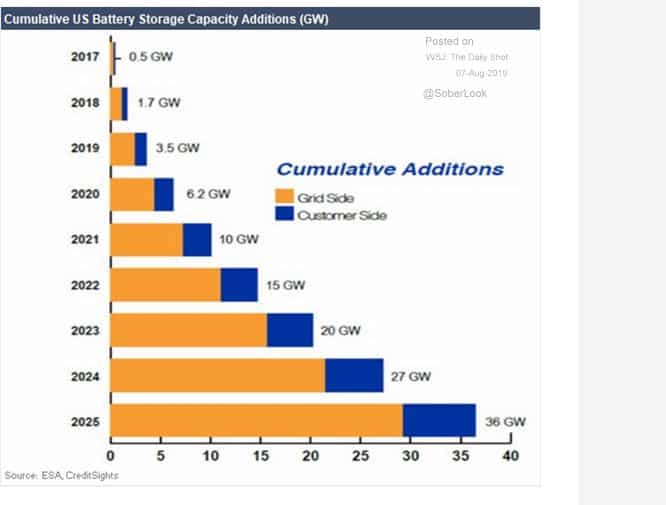

Below is a graph predicting the crossover point where the cost of an electric vehicle will be less than an internal combustion vehicle. The second chart presents the predicted increase in battery storage capacity through 2025.

Not everyone agrees with this crossover timeline. In 2016 speaking in Oslo Tony Seba an educator, author, futurist and a disciple of disruptive energy technologies predicted a crossover in 2020 for electric vehicles. His speech is a little bit light on facts and dates but the general thesis is powerful (https://www.youtube.com/watch?v=2b3ttqYDwF0).

The span of disruption from energy storage is vast. The electric vehicle will obsolete the internal combustion engine because of the cost curve shown above, and when you consider a Tesla is really a computer on wheels with only 18 parts, new technologies like 5G will make vehicle maintenance continuous and cheap. Even if the internal combustion engine can tie the electric vehicle, cheaper maintenance, and environmental concerns will move the world to electric vehicles.

The losers are almost every vehicle company that does not have an EV strategy as well as the vast supply and service chain that supports them. Maybe the only old economy survivor will be the tire industry.

The Equity Markets Are Weighing Tesla

At a $41 Billion market cap the stock market is weighing Tesla. When you read equity research the analysts are all over the map on its future. It has $14 Billion of debt. It has great unit sales, but gross profit margins have been sacrificed for revenues. Cash flow is strong, but Tesla is underinvesting in growth capX. Manufacturing problems are hurting fulfillment of the order book. Most of the senior management team is jumping ship including the CFO and CTO. The CEO, Elon Musk, seems to have an emotional stability issue and, now, he is alone and completely in charge.

Tesla’s Financials Did Not Look Too Bad

Rather than listening to the rhetoric- remember there are a lot of competitors facing a blank wall of oblivion if Tesla succeeds – I just looked at the numbers. I was shocked that Tesla makes any money or for that matter any cash money, but it does. Granted its profit margins are low for a cutting edge, disruptive technology company (18-19%), but if I were Musk I would prioritize revenues over profits, especially when the electric vehicle has a huge post sale advantage in maintenance.

Tesla Has Two Years of Cash

Since I simply do not know enough “first principles” and cannot opine about the 16% annual reduction in the cost of battery storage technology predicted by Tony Seba, I don’t know if Musk can accelerate profitability by reducing battery costs just as his tax subsidy expires. I just know that I have seen much worse-including decades of marginal profitability from Amazon.

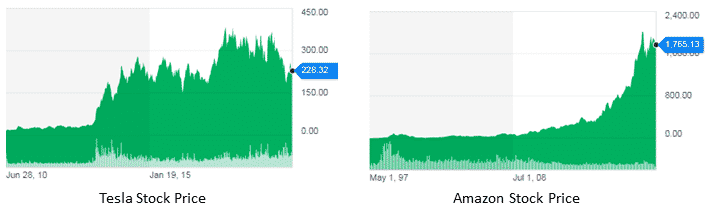

People forget that AMZN had only $10.8 Billion of revenues and a gross margin of $2.45 Billion (22.6%) in 2006 and a small net income. Its market cap at the end of 2006 was $16.25 Billion. In 2018 the leverage of AMZN’s disruptive business model produced $232 Billion of revenues and $93 Billion of gross profit (40.2%). Its market cap is now $900 Billion. In 12 years, its market cap has multiplied 55 times. Here are the two stock charts side by side.

After reading Vance’s biography you realize Elon Musk always seems to do his best when he is alone with his back to the wall. Disrupting the world’s auto industry is like free soloing El Captain. There is no route, no rope, no slips and no going back.

Losing Talented People Is A New Thing For Musk

However, I am disturbed by talent migration. In his early endeavors at Space X and Tesla, Musk was able to recruit the best engineers in the world simply for the chance to transform the world. If talent is now leaving Tesla, it may be a signal that Tesla’s business model is in trouble. That probably means that the energy storage cost curve is not as steep as Musk’s first principles suggested. He doesn’t have the cash to wait for a 2025 crossover on the cost curve shown above. He needs it now.

An interesting investment idea may be to buy TSLA’s debt. They have issued mostly convertible debt, but there is a small private placement of straight debt. In a bankruptcy, the straight debt might vote as a separate class. If TSLA fails, the debt holders will become the equity holders without conversion and there are a number of investors who would be interested if you shed $41 Billion of market value.