I have always loved Triscuits and peanut butter. It was a staple of the McCreary family diet for more than 20 years. As time passes, I have noticed less salt, less fat, and less taste in modern day Triscuits but most of all I think the volume of Triscuits you get in the modern box is probably ½ of what I got as a kid.

Shrinkflation

Why this is important to measuring food inflation is grocery stores almost universally use “unit pricing” to measure comparable value and shrinking volumes make products more expensive. So, if I am right and the box of Triscuits has half the product volume, the product is twice as expensive. So called “shrinkflation” is a profit protecter and consumer goods companies, including food companies, use it as a pricing strategy.

I was happy to see The Wall Street Journal tackle the subject of food inflation in an April 9 article by Stephanie Stamm titled “How Far Does $100 Go After Five Years of Food Inflation” click link to read. This is a story you do not hear because core inflation, the so-called Consumer Price Index or what economists call CPI-U, is calculated without regard to food and energy inputs. Evidently food and energy prices are too volatile to be reliable markers of core inflation? The irony is food and energy are added back in the calculation of CPI for measuring annual cost of living increases in Social Security!!!

So, there are really two Consumer Price Indexes. The one without food and energy is called “core” CPI and it is what the Fed uses when it is setting interest rates and monetary policy and reporting its progress in fighting inflation. The second CPI is what I call COLA CPI and it is what Social Security uses for cost-of-living adjustments to annual benefits. I know which CPI I would trust.

Eliminating Food Is Nonsense

Energy prices are certainly volatile, but in a period of scarcity food is a critical component of inflation because it is a universal necessity and in the USA there are governmental programs subsidizing food so demand is not entirely checked by economic affordability.

In fact, changes in unit pricing of food may be one of the most reliable markers of inflation and I cannot understand why food is 10-15% of a household budget but eliminated in the benchmark for monetary policy but then added back in calculating what retirees need in social security raises. Think about the most important marker of runaway inflation in Argentina. It is always the price of a loaf of bread in Buenos Aires!!!

Inflation In An Election Year

The WSJ knows inflation is a political “hot tamale” and it does not want to offend large advertisers or major corporations so it has told the food inflation tale through an interactive article that avoids showing the reader the whole elephant in a topic sentence like this: Food prices as measured by changes in unit pricing of major food groups like eggs, milk, flour and coffee have increased dramatically since 2019 due to rising input costs like labor and transportation as well as shrinkflation and supply chain disruptions.

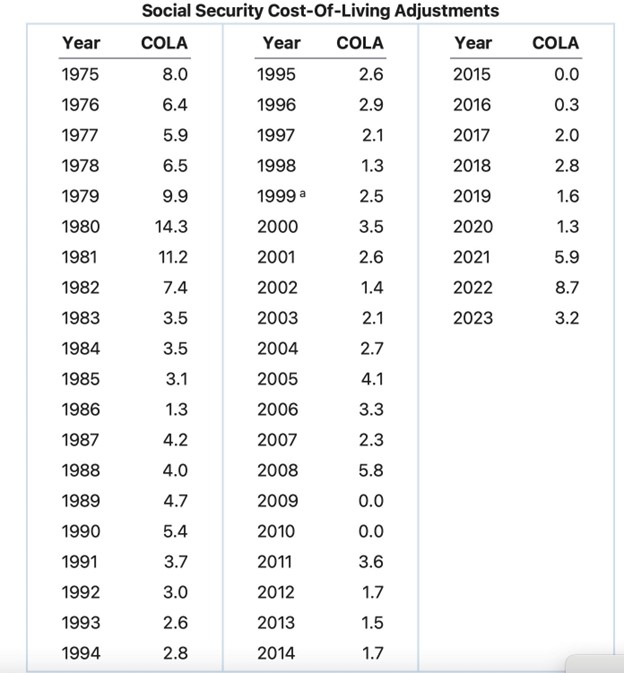

Instead, the WSJ article looks at a Nielsen study of a market basket of 31 essential grocery items totaling $100 in 2019 and then asks what that same basket would cost in 2024. The answer is $137 for a compound growth rate of 6.5% but that may also be misleading given 2019 and 2020 showed almost zero change in the COLA CPI. Food inflation has been dramatic and recent (2021-23). A history of COLA adjustments to Social Security is shown below.

The article does provide a footnote admitting it did not consider shrinkflation in calculating the real unit price inflation which I expect, based on my Triscuit experience, could create a material change in the cost of that basket of goods.

I also think including food in the consumer price index will better portray the stickiness of inflation and signal to investment markets the difficulty of exorcising it. The stock market rally that began in late October 2023 and has produced an eye popping 25% return for the S&P 500 through March ’24 is mostly endowed by misplaced confidence in inflation taming and the corresponding expectation of falling interest rates. My food experience says otherwise. What about yours?

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.