Can you recall your first experience with bubblegum in your hair? It was stickier than you thought and your attempts to eradicate it only spread it more? More painful, however, was you looked like a dork for two weeks after your mother cut out patches of your hair.

Inflation is a lot like bubblegum in your hair. I am pretty sure we will make it worse before we submit to the dork treatment and cut it out.

I just can’t buy the idea that a series of 19 interest rate increases from 0.25% to 5.5%, and a tepid program of selling off $757 Billion of the Fed’s balance sheet since April 2022 is going to be enough to tame inflation. My doubt is reinforced by M2 stats, the high yields on money market instruments, evidence of large savings reserves, and dramatic increases in wages which have lagged price increases but are thought to be more permanent.

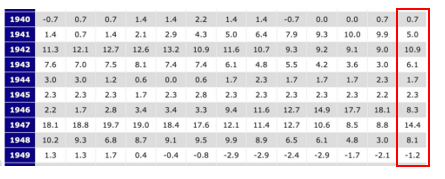

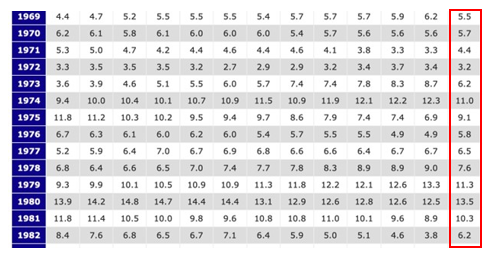

To check my theory, I looked at the history of inflation fighting for some clues. During the period during and after World War II running from 1940 to 1949, it was 10 years before repetitive low single digit inflation was restored. During the 1970’s it took more than 15 years for inflation to abate. The three charts below show those two periods and our current period. The annual inflation rate is shown in the red box for all periods. What struck me was the high number of false signals followed by a recurrence of stubborn inflation at higher rates. This is amateur sleuthing, and there are many explanations for the patterns, but it seems fair to conclude that inflation lingers longer than you might expect. Here are the three charts from Coin News Media Group calculated using changes in the consumer price index as a proxy for inflation.

1940 to 1949

1969 to 1982

2021 to 2023

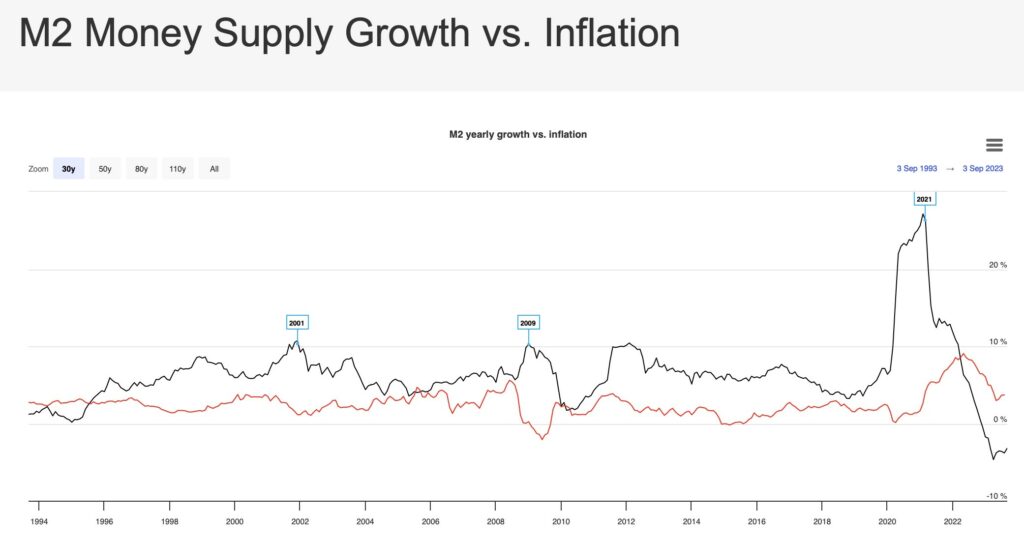

I also looked at the history of M2 – a proxy for spendable money in circulation – from 1943 to 2023, and how it influences inflation for those periods. The black line in the chart below is the reported GROWTH RATE for M2 from the previous month, and the red line is the reported inflation rate for the previous month (NOTE: the chart shows a falling black line – that just means the rate of growth is slowing. Only went below zero for last 6 months). There seems to be a direct correlation between periods of large M2 growth and periods of high inflation. Notice that the highest period of M2 growth ever recorded was during the Covid era. What worries me is the peak inflation rates occurring in 2000 and 2008, both periods of high M2, were just under 10%. The Covid era’s money creation was many multiples larger but high inflation has only been recorded for 2022.

If you add in lagging indicators like wage growth which show up later in an inflation cycle, even a Fed Governor can see that inflation is probably still a major concern notwithstanding the Fed signals of a pause in interest rate increases.

Quite possibly the big pot of money still in circulation is forestalling a recession and confusing investors about what comes next?

I am not asking you to agree with this suggestion, but I am considering a new way of thinking about asset allocation. I got this idea from the October 13 issue of “Grants Interest Rate Observer” in a short article about a speech Michael Hartnett, Chief Investment Officer of Bank of America, recently delivered to attendees at Grant’s Autumn Investor Conference.

He proposed replacing the 60/40 stocks/bonds allocation which has been a durable winner from 2008 to 2022. Instead, he is considering 25% cash, 25% commodities, 25% bonds and 25% equities. He also wonders whether the world will continue to finance our deficits and for how long US capital markets will be the only place for investment assets in every class.

He does not believe interest rates have peaked, so a bond rally is unlikely other than a short-term movement in an election year. Without saying it he would also recommend keeping duration short on your bond allocation. While he also thinks there is a 25% position for equities, he predicts the US Dollar will fall as the Fed exercises yield control and the annual government interest obligation grows larger than our annual defense budget.

His call on commodities is simply an inflation hedge. If any one of the readers really understands how you invest in diversified commodities as an inflation hedge, please let me know.

Finally, cash is no longer trash. Short term money market instruments are all yielding 5%+. This adds an element of optionality to the equally-balanced portfolio. You get paid $25X the return you used to get on cash in a money market account with the Fed providing REPO liquidity to many of these products.

The value of an option that pays you 5% to wait for the right time to move into a longer duration asset class is priceless.

Most importantly, this is not a recommendation. For me it is a thought experiment with hundreds of fast moving variables to upset it. However, the two things I will count on as a bedrock of an investment philosophy are inflation will linger longer than anyone predicts, and wage increases will be stickier than bubblegum in your hair.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.