As we start a new investment year and take inventory of bad habits to avoid and good ones to enhance, I come back to some value investing principles foremost of which is first do no harm or spoken in investment language, avoid losses. However, had you burrowed into your foxhole during the second half of 2023 determined to avoid every false signal of expected prosperity you would have missed the party of the decade.

I can remember another party my oldest daughter and a bunch of her friends got invited to in 9th grade. They were good students, rule followers, risk avoiders and clueless about parties, especially ones they got an invitation to. My advice to my daughter as she left to join her friends for the party of the year was “be sure you leave before the cops come.” The look on her face was dismissive but also embarrassed for her father’s ignorance about operating in the “modern” freshman social scene.

We all know how it ended. The cops came. She was part of the round up. Luckily, she did nothing wrong and she returned home. The next morning at breakfast she asked me “How did you know the cops would come?” My less than fatherly response was “any party of the year you are getting invited to is one where the parents are out of town, the hosts have already lost control, and fear of missing out has increased the odds the least experienced will be the ones the cops round up.” Though she will never admit it, I became a pretty reliable source of info about parties of the year.

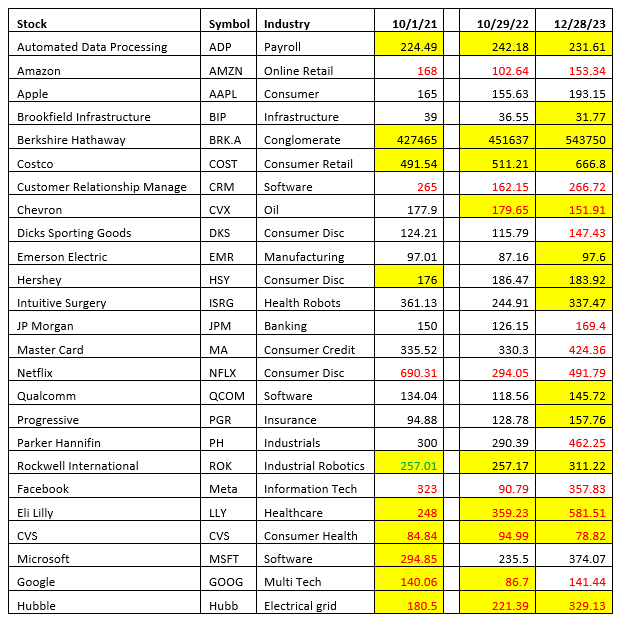

Fast forward to December 2023, and one of my best friends and I are talking about the U.S. stock market comeback in the last 6 months of 2023. It was nothing short of miraculous. I know this because I have been tracking about 40 stocks since October of 2021, when the U.S. stock market sold off in response to rising interest rates, threats of recession, stubborn inflation, and nosebleed mortgage rates. The market remained depressed throughout 2022 as well as the first 5 months of 2023. Here is my spreadsheet for ’21 and ‘22:

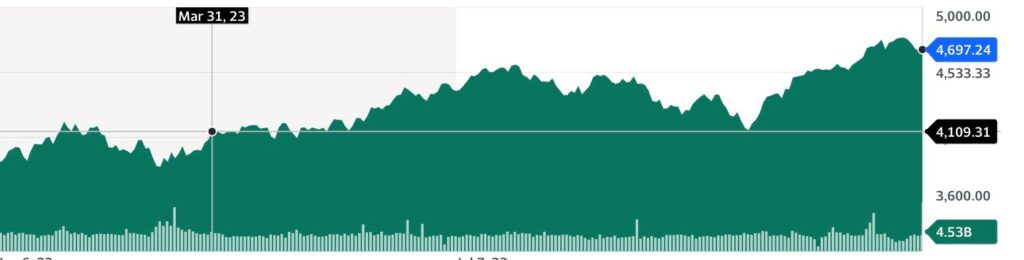

The first three months of 2023 was a repeat of 2021 and 2022, with investors bracing for either a recession or a hard landing. However, sometime in April the parents decided to go out of town as the Fed signaled it was done with interest rate increases. At about the same time ChatGPT, and artificial intelligence became recognized as the next new thing. Companies like Google, Meta, Microsoft, and Amazon went from doldrums to drumbeats of a new era. Every company with proprietary data and the prospect of mining that data to further enhance its investment moat started to move up and the FOMO invitation about a party in the stock market reached even the most reluctant investors.

The ensuing momentum made every past “party of the year” looks lame by comparison. Here is a chart of the S&P 500 from June 1 to December 31:

The rally left almost all of the stocks I have been following at exactly the same trading price that existed before the precipitous market reversal in 2021. Only Netflix has not fully recovered yet. All of those concerns about recession, layoffs, inflation, rising interest rates especially home mortgage rates, at 8-10%, the wall of debt maturities in 2024 and 2025 and credit card debt and rising default rates vanished like a David Copperfield magic trick.

If you had capital and participated, you were saved by FOMO and the party of the year. If you were part of the cohort without capital, you were left in the same place you were in 2021- ravaged by food inflation and facing unrelenting increases in interest rates and an uncertain employment picture. The Fed saved its friends with capital, but left everyone else in a much worse place.

Fear of missing out may not be the bedrock mantra of value investing but it sure worked this time. As long as the Fed is on the sidelines there will be other seductive invitations to the 2024 parties of the year. Having a fair degree of skepticism may be the right loss avoidance perspective. Just remember if you are getting invited this time, the parents are surely out of town, the party is already out of control, and you are the most likely to be arriving just when the smart money is bailing out the back door.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.