Over the last 50 years I have observed many changes to how credit is created and financed. For the longest time banks were the only providers of credit and each bank set its own prime rate as the baseline for the interest rate the best borrowers could obtain. If the prime rate at Chase Manhattan Bank was 4% the best borrowers could probably borrow at 4.0% and the average credit customer might pay Prime plus 2% or 6%.

Over time the prime rate gave way to the ten-year treasury bond as the risk-free rate for bonds that traded in the US Bond market and LIBOR (London Interbank Bank Offered Rate) became the benchmark for credit like bank debt.

Banks and Business Development Companies (“BDCs”) financed those enterprises that were not eligible to participate in the bond market, including a wide swath of middle market and lower middle market private equity.

As the bond market matured investors like pension funds, retail customers, publicly traded investment vehicles like ETFs, and insurance companies all starting providing debt liquidity. They created another market that we now call private credit and it has trillions of dollars available. Oaktree is an example of a firm that provides private credit and there are hundreds of organizations participating in every nook and corner waiting for bargains.

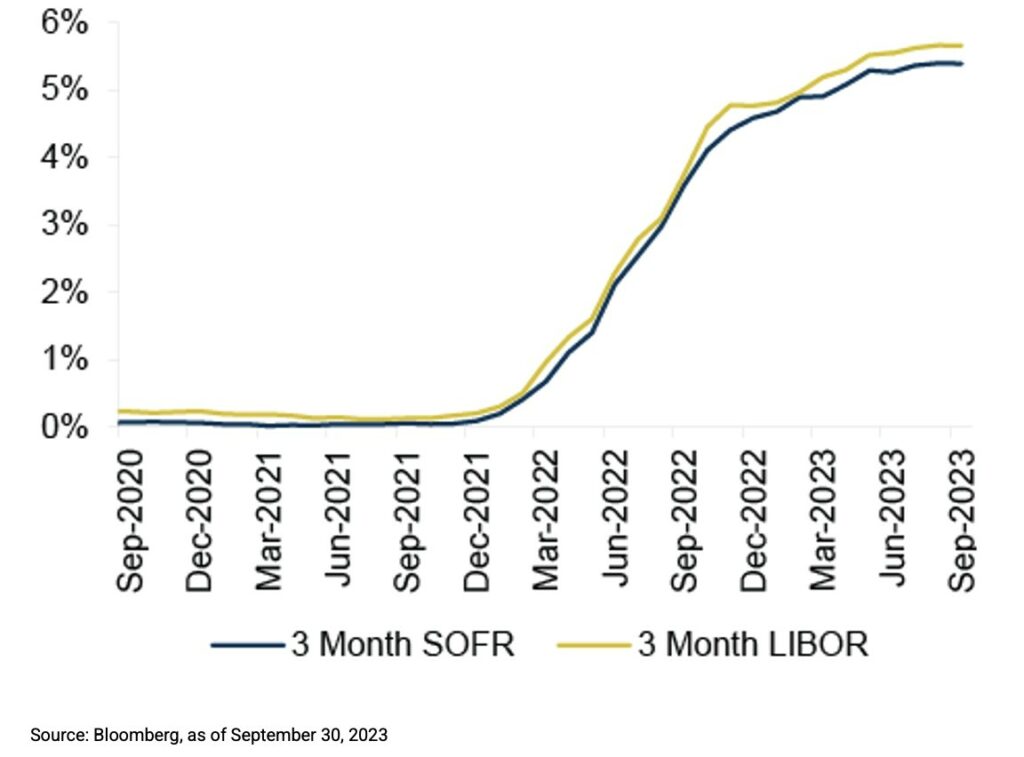

In 2019, 2020, and 2021, the market for leveraged loans by banks was quite accommodative. Banks would advance 2.5-3.0 x the EBITDA of the borrower in a purchase transaction by a private equity firm and with Libor and Sofr near zero the interest rate on those bank loans ran from 4 to 5%. Those loans carry variable interest rates which are reset as benchmarks like SOFR (Secured Overnight Fed Rates) climb.

The current interest rates for bank leveraged loans are not benevolent. Here is a chart from Bloomberg showing the sudden and dramatic rise in the baseline SOFR. The headline interest rate being offered by most lenders in the lower middle market and loans to riskier borrowers in other bank categories is now SOFR + 5% or 9-10% and interest on loans to riskier borrowers in dicier credit categories is even higher. Here is the LIBOR/SOFR chart:

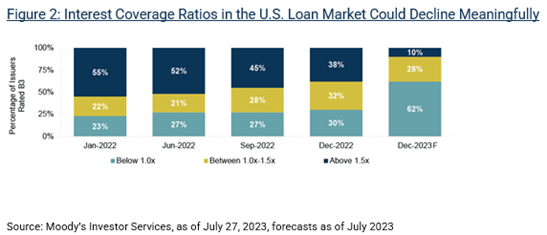

With this dramatic doubling a troubling deterioration of the the interest coverage ratios for bank loans is beginning to emerge. The chart shown below from Moody’s looks at B3 rated credits which are customary for most middle market private equity capital structures. In January 2022 only 23% of those loans had interest coverage less than 1x which meant fewer than 25% of these companies’ free cash flow was insufficient to repay even interest. The forecast for December 2023 is much worse with an estimated 62% of the loans having interest rate coverage below 1x.

Oaktree’s Q3 2023 Credit review also asserts that a towering wall of loan maturities will be staring us in the face as we turn the calendar to 2024. There is a significant bulge in maturity dates for leveraged loans issued in a near zero base rate environment and Oaktree believes 40% of that market will come due in 2024 and 2025.

For that 40% maturity pool Oaktree predicts 62% will not be able to cover their new interest expense on their outstanding debt without stopping capital expenditures and cutting costs and, even then, there will be no wiggle room for preventing payment defaults.

Where Did You SourceYour Debt?

So now the credit inquiry is more about the market in which you obtained your credit. A private credit package with a lower leverage structure based on a variable rate and an imminent maturity, like many bank loans, is actually much more vulnerable than a more highly-leveraged credit brethren in the bond markets where maturities are extended, interest rates are fixed, principal payments are low, covenants are light, and access to all kinds of investors including speculators at one extreme, and savants like Oaktree at the other assure there is usually some kind of liquidity.

The Fed Will Protect Its Banks

Forget about finance for a minute and remember the Fed is charged with protecting the US banking system. They bailed out SVB and they will bail out most of the other banks that hold senior loans that may face default as the mother of all maturities roils the private credit markets in 2024 and 2025. Also, Oaktree observes this is not the place for untrained investors, but it may be the right place for private debt funds who have the sophistication, systems, and heft to buy bank assets and provide capital to prevent another banking crisis.

For now, banks and business development companies will be protected as a top priority and inflation fighting by the Fed will stay on hold until that crisis passes.

Inflation Is Not Defeated

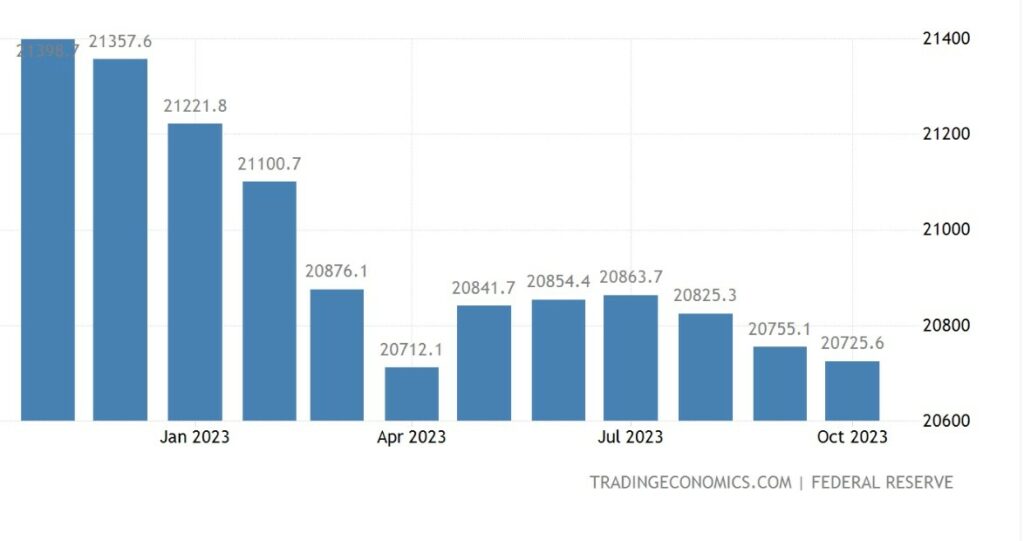

My final word for 2023 is inflation is still not defeated. Everyone knows it including the Fed but right now lower interest rates are the prime objective. Here is a chart from Trading Economics showing the level of M2 (money in circulation) as we close out 2023. Please notice the historic levels of money in circulation have only dropped by 2.9% from the peak and there will be no more austerity in the coming election year.

Enjoy the stock market rally and have a wonderful holiday season and a productive New Year. More to write about in 2024 where I think we will find austerity is not the Fed’s prime objective.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.