In the 1980’s, against the backdrop of 18% interest rates, politicians and the financiers each staked out their turf. The financiers ceded the power to legislate, tax and create entitlement programs to the politicians and the politicians let the financiers run a legal monopoly known as the stock and bond markets where wealth creation trickled down to those with capital. It was a harmonious accord, but that was before the financiers lost credibility in 2008. They sold the world worthless financial products predicated on the US housing market which was supposedly safe and secure and a bedrock of American capitalism.

The politicians took note of the financiers’ irresponsibility and concluded they could do that too. So, in the aftermath of the Great Financial Crisis in 2008 for the period beginning in 2010 and ending in 2021 the politicians discovered the Modern Monetary Theory and the Federal Reserve Bank.

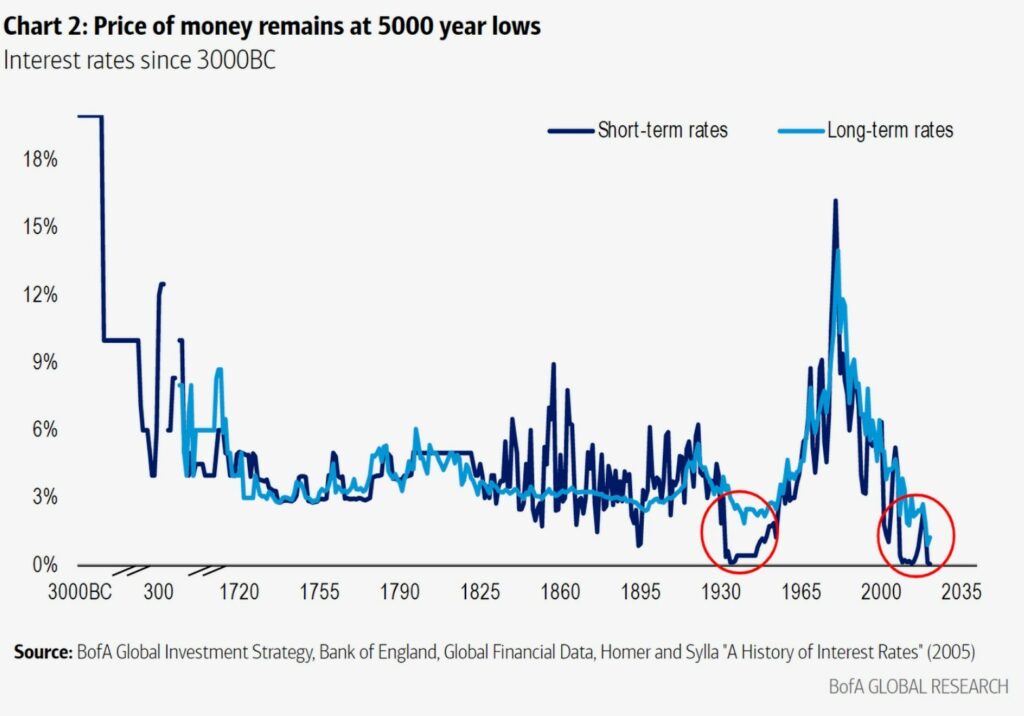

Demonstrative of my thesis is this chart showing the history of interest rates through recorded time starting in 3000BC and continuing until 2021. Please note except for the Great Depression in 1930 the period after the GFC with almost zero interest rates stands out as an historical outlier.

In a recent letter from James Grant in his monthly Interest Rate Observer dated February 2, 2024, in an article titled “The Inflation We Choose” Mr. Grant provides a history lesson about the recent period: “Combined the Republican and Democratic administrations have boosted the gross debt by $14.1 Trillion. It’s as much as the sum of the entire public debt accumulated through the 4th quarter of 2010. Nothing puts the fiat money era in starker relief than the fact it took the United States 222 years to borrow what the efforts of Presidents Trump and Biden have achieved in not quite 8 years.”

Magic Prosperity Machine

While history before the GFC put the politicians and financiers in separate, walled-off domains where each got what they wanted without any commonality of design, after the GFC the politicians and financiers discovered a magic money machine (“MPM”) which made them equally motivated to run it daily for their mutual benefit. The MPM was built on several important structural changes in the operation of the world’s economy.:

- Lesson from GFC – You can trash the world’s economy and no one can do anything about it when the U.S. Dollar is the reserve currency for the world.

- Lesson from the Fed’s easy money policy to restore prosperity – You can manufacture wealth by dropping interest rates from 18% to zero and printing money through quantitative easing (buying your own treasury bills and notes irrespective of interest rates offered).

- Lesson for Debtors – When interest rates are near zero you can afford an infinite amount of debt.

- Lesson from Europe – You can even demand purchasers of your bonds pay you to give them back 100% of the principal – negative interest rates.

- Lesson from the stock and bond markets – You can manufacture wealth by dropping interest rates and printing money. It all ended up in a market controlled by financiers. Meanwhile the politicians all stayed elected for sending trillions of dollars of Covid-19 and inflation relief money, not funded by anything, to the electorate whether they needed it or not.

Then Inflation Spoiled the Sure Thing

Even though the financiers knew about the risk of inflation from all that money printing and sustained interest rates below 1% and certainly suspected it as early as 2021, ignoring inflation let the Magic Prosperity Machine (“MPM”) extend beyond monetary curfews.

MPM Yearnings in an Election Year

Two-and one-half years later with interest rates of 10-year treasuries now approaching 4.5% and home mortgages at 8-9% and 5-6% for bank debt for businesses like private equity and real estate development politicians and financiers alike are yearning for Magic Prosperity. If the Fed would just do some easing and drop interest rates and have the Fed buy the Treasury’s issuance of treasury bills and notes – in essence finance itself – all would be well again. Inflation is tamed and this is an election year. The stock and bond markets will both rally; incumbents will win.

You could feel the disappointment from Wall Street and Washington when Jerome Powel interpreted the latest job creation numbers (350,000 new hires) as a sign the economy was still red hot and maybe inflation was not yet tamed. Trump reacted to this Fed discipline by suggesting Jerome Powell would not have a job if he became President for a second time. He understands low interest rates and a weak Fed. Mr. Biden has not threatened to fire Mr. Powell but so far, the Magic Prosperity Machine has worked well for his administration, especially the tremendous stock market rally in the second half of 2023.

The Newest Version of the Fed Put

The “Financial Times” also understands why the markets are rallying. In an article “The Fed Put Is Back – and In A Stronger, More Flexible Form”, written by David Zervos and published on February 9, 2024, (click link to read) FT correctly assesses the US markets parsing of the concepts of “Can” and “Will”. Here is how Mr. Zervos explains his thesis: “For me, the most important part of a Fed policy forecast in 2024 does not involve using the deceptively hubristic word will; rather, it focuses squarely on the far more humble can. Here is my version of the outlook for monetary policy in 2024: The Fed can cut quickly, and the Fed can expand the balance sheet aggressively, if things get messy. That has huge ramifications for the performance of riskier assets such as equities. Specifically, it implies that the Fed put structure — the idea that the central bank will intervene to support markets and economies in times of turmoil — is back in place.”

Anyone who can multiply or divide will tell you the U.S. cannot afford more debt and certainly not higher for longer interest rates. With $35 Trillion of Federal promises including Social Security, Medicare, and Medicaid our biggest risk is perceived governmental insolvency. Political outcomes will not change perceptions, but they may change regimes. Mr. Powell is appointed through 2026, but I suspect he is on a shorter lease than that.

In the meantime, watch for the Reddit crowd to reemerge chanting “YOLO- you only live once- and investment in straw companies like GameStop attempting to spin gold once again. That may be your cue.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information preparedfrom third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.