Many of our blog readers have asked about Bitcoin (Ticker: BTC). This corresponds to the development of multiple ETF’s earlier this year, the halving of the reward paid to Bitcoin miners in April and Jamie Dimon rendering his annual opinion that Bitcoin is a “fraud”.

Background On Bitcoin

Here is a description of Bitcoin taken from the Coin Base website, “Bitcoin (BTC) is a decentralized cryptocurrency that was first described in a 2008 whitepaper by an individual or group of individuals using the alias Satoshi Nakamoto. Officially launched in January 2009, Bitcoin is a peer-to-peer online currency that allows transactions to happen directly between equal and independent network participants without the need for any intermediary. Bitcoin is digital money that cannot be inflated or manipulated by any individual, company, government, or central bank. Bitcoin is recognized as one of the initial cryptocurrencies to come into use and has inspired the development of thousands of competing projects. There will only ever be 21 million BTC. Bitcoin is highly divisible, with its smallest unit, i.e. 0.000 000 01 BTC, called a “satoshi” or “sat.” As bitcoin’s value has risen, its easy divisibility has become a key attribute.

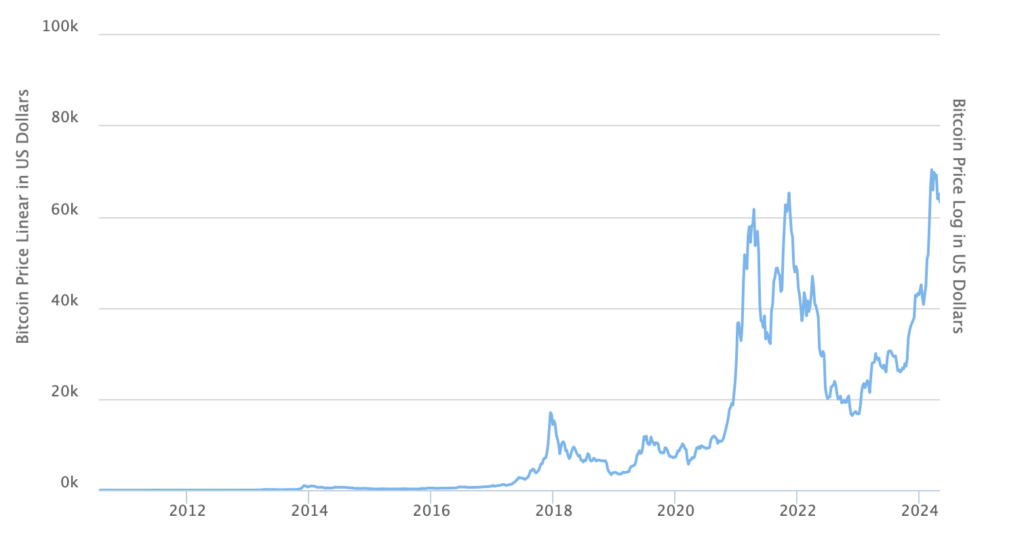

Here is a chart of BTC performance since inception:

Coinbase is the leading dealer in BTC and it has a public listing on the NASDAQ under the ticker symbol COIN. Here is a chart showing the stock performance of Coinbase since inception:

History

I first became aware of BTC in 2010, and because it was introduced by an anonymous individual or group of individuals shortly after the 2008-09 market crashes (“GFC”). I was immediately interested because I, too, was concerned about the “derivative nature” of so many asset classes where (a) you really did not own them outright like you own your home, and (b) third parties are entirely responsible for documenting that ownership and gaurenteeing it, as well as ensuring the legitimacy of trading markets.

After reading Michael Lewis’s book “The Big Short” I was also troubled by the same thing that worried Dr. Michael Burry. Liquidity and valuation were set by the small group of insiders who controlled trading markets for mortgage-backed securities and collaterized loan obligations. These insiders were able to manipulate prices of both these asset classes for their own exits many trading days after insiders knew they were holding worthless positions. Dr. Burry could not get liquid until the insiders had first finished their own exits.

Another flaw in the worldwide financial system was also revealed in the aftermath of the GFC as central banks all over the world invented financial theories to justify using quantitative easing and treasury debt monetization to stimulate debt-based recoveries in almost all asset classes. In addition to their responsibility for the safety and soundness of the banking system, central banks, like the Fed, have all expanded their responsibility to insure smooth functioning of the entire financial system including money markets, and mortgage backed securities. Investors in equity markets have interpreted this expanded role as an implicit guarantee of market liquidity, and protection against market crashes. The S&P 500 has been a direct beneficiary of the so-called “Fed” put. Here is a chart of the S&P performance:

World Harmony Has Also Deteriorated

There is also unprecedented geopolitical risk with the potential for escalating worldwide conflict, capital flight restrictions, currency debasement, and asset confiscations. Most major economies are rebelling against the U.S. Dollar as the reserve currency for settling oil and other commodity trades. Increasingly, former buyers of U.S. Treasury Bills and Notes like Japan and China are not renewing funding.

Gold used to be the doomsday hedge, but in a digital world without borders how can you transfer gold to respond to currency debasement, capital flight restrictions, war, or outright confiscations? Ask billionaire Russian oligarchs which asset classes they would choose after U.S. and European central bank confiscations in response to Russia’s invasion of Ukraine.

The Oligarchs, along with drug dealers, arms dealers, human traffickers, kidnappers and extortionists, all have a common problem – incumbent financial systems are controlled by middlemen who sacrifice independence for mini monopolies that can be influenced by politicians and governments. Jamie Dimon is at the top of that food chain and for that reason protests loudest at the peer-to-peer BTC intruder at the gate of his monopoly.

I am just suggesting any proper asset allocation must have a real hedge against the failure of incumbent systems. Satoshi Nakamoto saw a near meltdown in 2008, and feared the likelihood of fiscal capitulation by central banks all over the world in its aftermath. He was right.

Think about the end of a financial system. Can you put your gold in your pocket and run for the hills? No, you will be out of breath in 20 minutes and the first time you try to use your gold to buy anything someone will steal it. An Oligarch can leave Russia with 5000 Bitcoin on a special thumb drive in his pocket, and control $300 million dollar equivalents as long as he can get an internet connection and remembers his password. No one can steal his Bitcoin without knowing (a) where it resides on the blockchain, and (b) the sending code to spend from that wallet. While he may have trouble buying pizza with Bitcoin, he would certainly be in better shape than he is now after the Russian invasion of Ukraine. Here is the likely Oligarch perspective on popular asset classes:

| US Stocks and Bonds | NYET |

| European Stocks/Bonds | NYET |

| US Real Estate | NYET |

| US Dollars | NYET |

| European Euros | NYET |

| Chinese Anything | NYET |

| European Anything | NYET |

| Bitcoin | DA |

| Physical Gold | DA but with a few hundred soldiers to protect it |

I Like Jamie Dimon

I like Jamie Diamond in the way I like pirates – as my partner based on mutually assured destruction. In every other situation I would opt for a little bit of the fraudulent Bitcoin just as a hedge against my bank’s wire transfer room being closed when I need to move money, or a calamitous event occurring when the stock and bond markets are closed (which is all weekend and Monday through Friday before 9:30am and after 4pm). BTC trades 24/7 every day of the year.

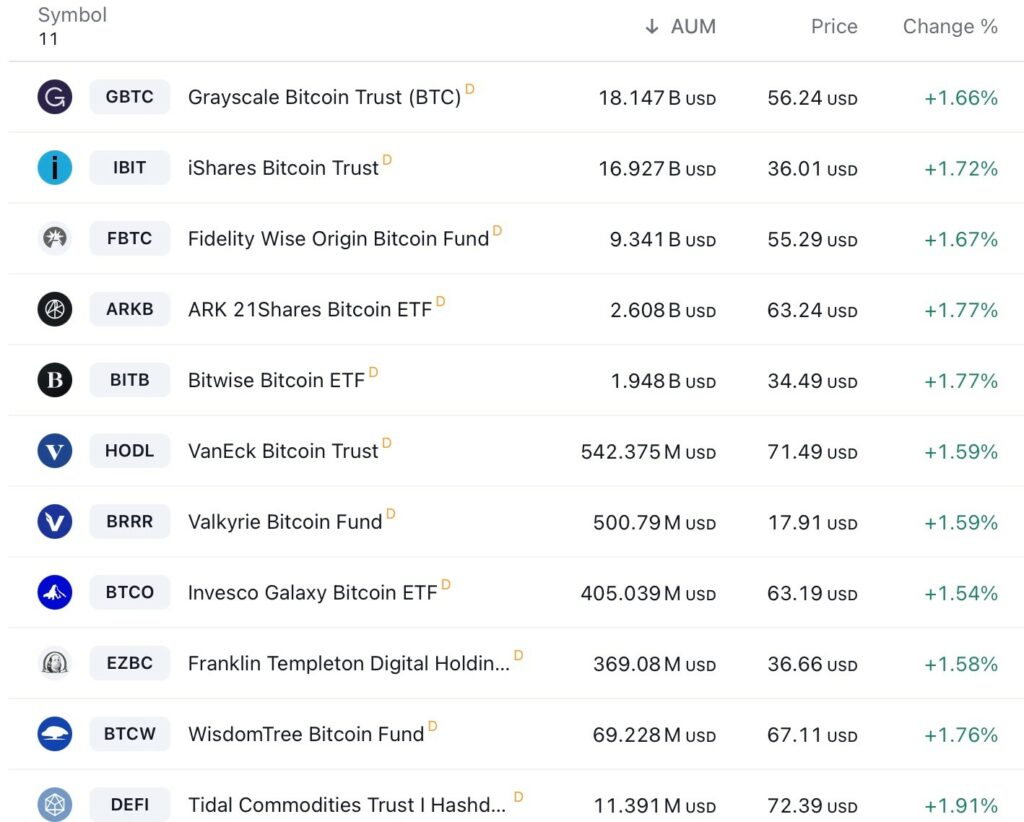

Both gold and BTC are expensive to mine. Gold is extracted by physical mining and the Bitcoin block chain is verified by “miners” who have to demonstrate enormous computing power and high expenditures of energy to validate the block chain. Gold is scarce and so is the number of Bitcoin that can be put into circulation. In addition, BTC has a small amount in circulation because many owners are “hodlers”- a term describing the inclination of many owners to “Hold On for Dear Life”. The circulating supply has also been constrained by the introduction of eleven BTC ETF’s on January 11, 2024. Those ETFs are a buyer of BTC whenever there are fund inflows of USD to buy BTC and a seller of BTC when there are fund outflows. Here is a list of the eleven approved BTC ETF’s:

Conclusion

I have a high degree of respect for many of my friends who joined Jamie Dimon in characterizing Bitcoin as a fraud. However, the decade-long irresponsibility of central bankers all over the world, and the politicization of middlemen systems does make you question whether a hedge against system failure is necessary? For now, Bitcoin is just one option, and it should be treated like the 16 year old volatile teenager it is. Many screw ups are still possible but I think this “teenager” may become increasingly popular as it ages.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.