Contrasted with the state regimen, balanced budgets based on federal tax revenues are optional for running the country. Since the four-year period 1989-2001when Bill Clinton produced budget surpluses the federal budget has run a deficit. This is not a funding problem because the Federal government can pay for its deficits by having the Treasury issue bonds to investors. If no investors want to buy low interest bonds, the Federal Reserve Bank is permitted to buy the bonds. In essence the default move is Treasury just prints money with the help of the Federal Reserve Bank.

New Expenditures Require Tax Funding

But safety net programs and cash outlays in response to Covid-19 will require new funding sources. The real competition for tax revenues will start soon. According to the Tax Foundation in a report authored by Cristina Enache in February 17, 2021 “nearly 50% of all tax revenues in the US are raised at the state and local level.”

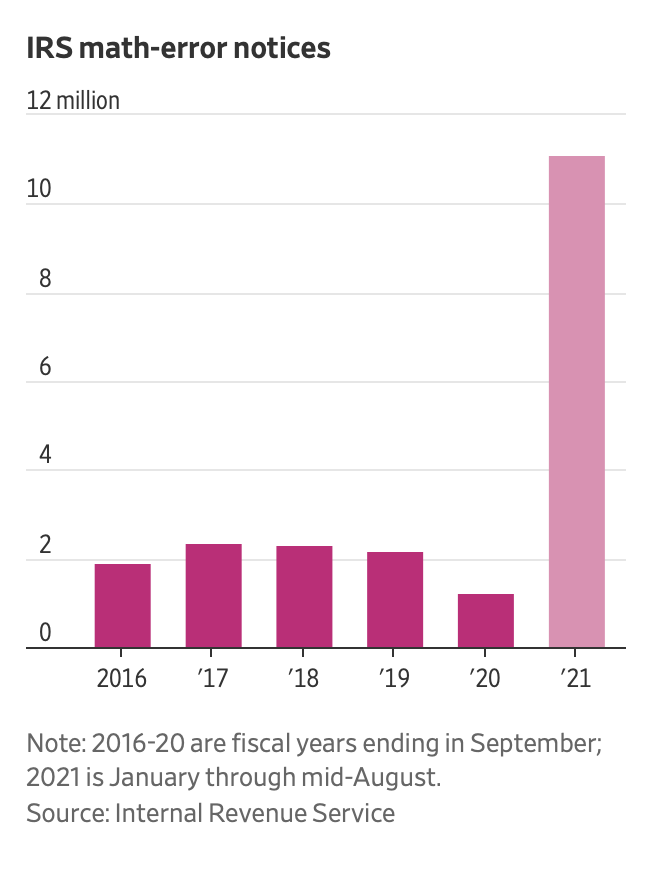

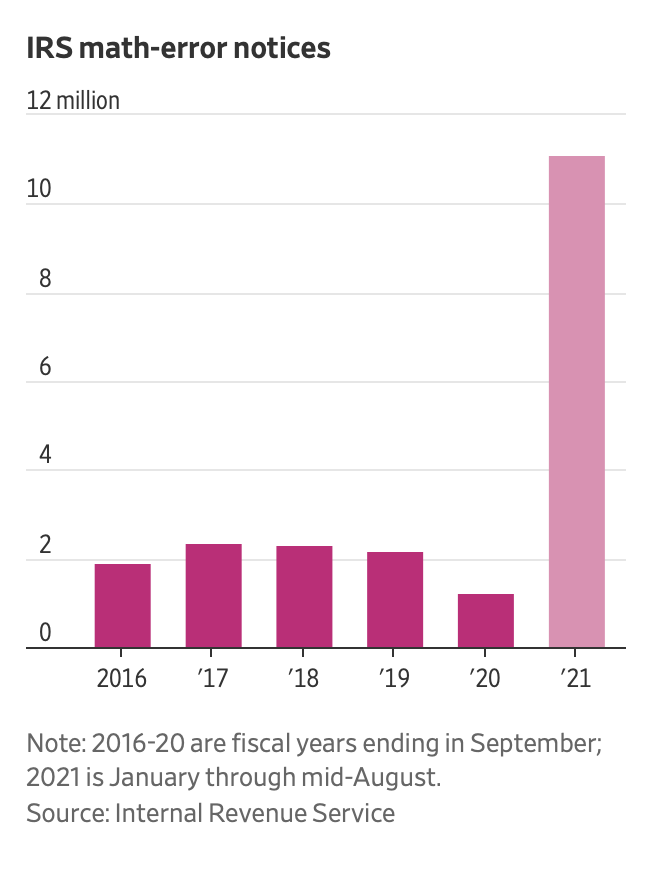

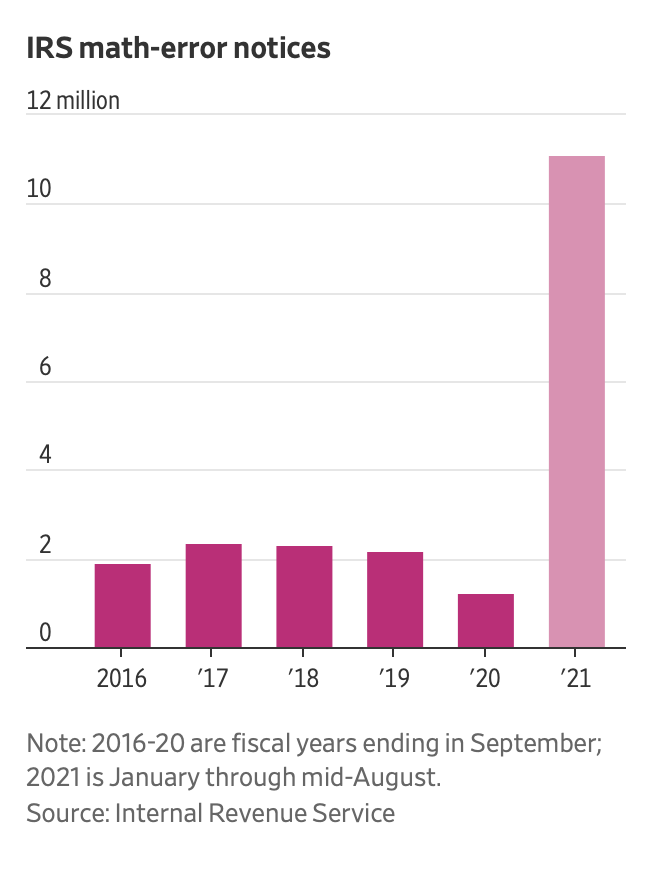

States are better prepared and incented to be efficient tax collectors because of the balanced budget requirement. I will bet on them to raise and collect taxes faster than the deficit funding federal group. The current promise of Billions in uncollected federal taxes being collected by an enlarged and reenergized IRS is a fairy tale. The IRS is under staffed and under trained and is currently struggling just to manage Covid-19 tax credits. Here is a chart from a recent article by Laura Saunders in “The Wall Street Journal” that highlights a massive goof by IRS in assessing “math error” notices without explaining why as required by laws passed by Congress in the 1970s:

The States Will Win This Race

In my opinion the race for tax revenues will be won by the states. The federal bureaucracy will not adjust fast enough to be an efficient revenue collector.

A sure winner will be a state whose citizens match their tax revenue protocols to their local infrastructure and education needs. The long-term winners, however, will be the citizens of those 9 states who don’t pay income taxes at all.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.

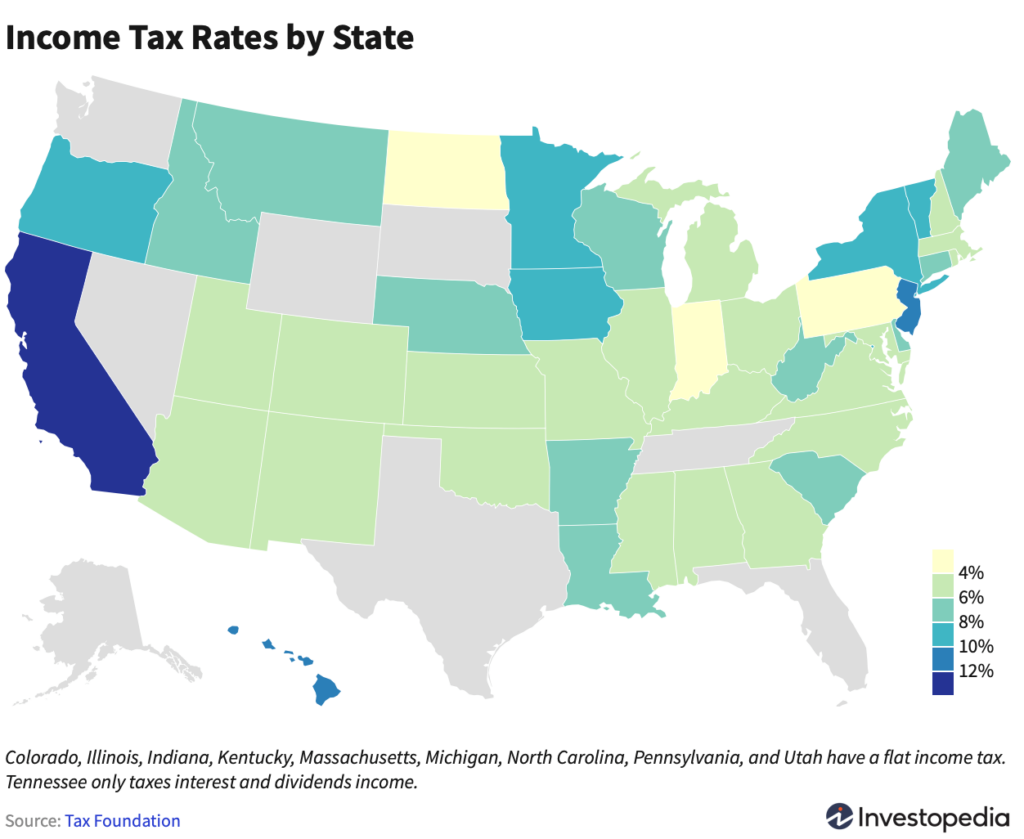

If you are intending to retire and live off your accumulated retirement savings in IRAs or 401k plans and you live in California you will have 12% less retirement cash than your friends in Texas and Florida. Percentages are benign, but retirees understand cash.

A retiree in Texas with $150,00 in her 401k who plans to withdraw $10,000/ year for 15 years can rely on gross and net being the same. In California the retiree gets $10,000 gross and $8,800 net.

Tax Migrations Are Starting

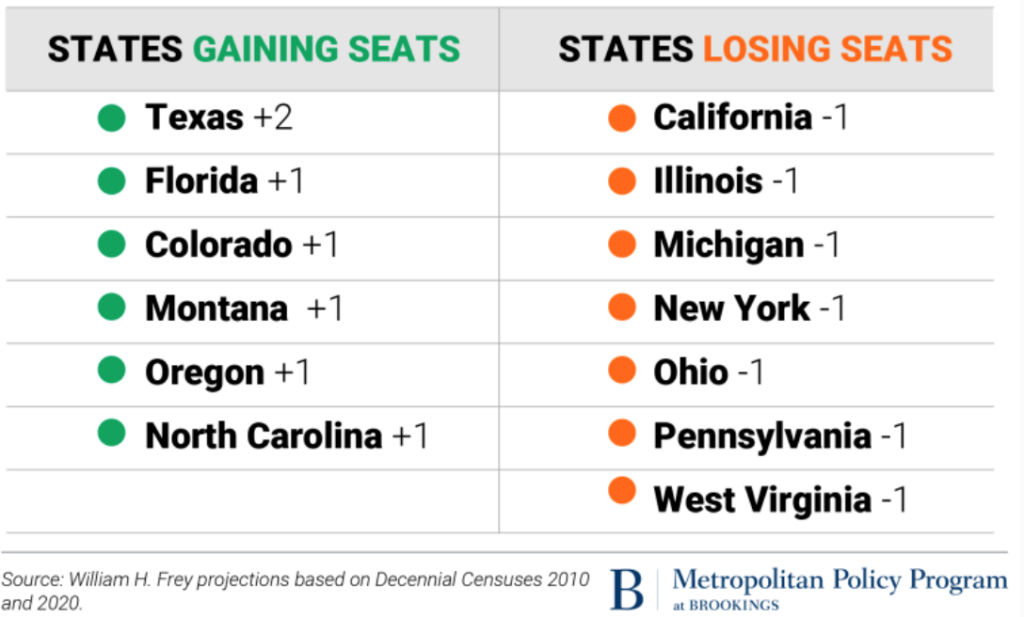

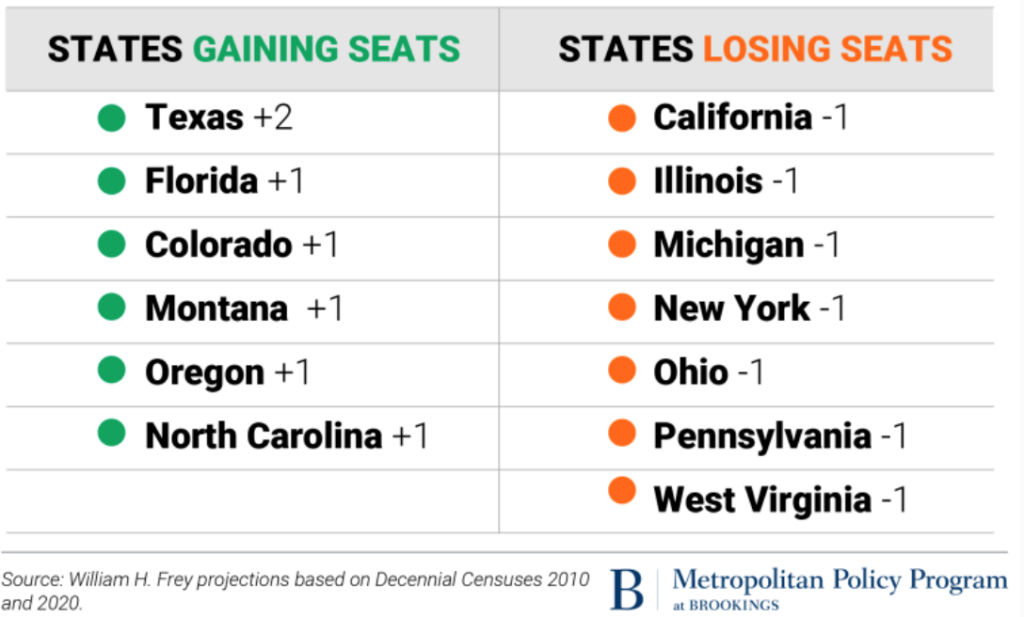

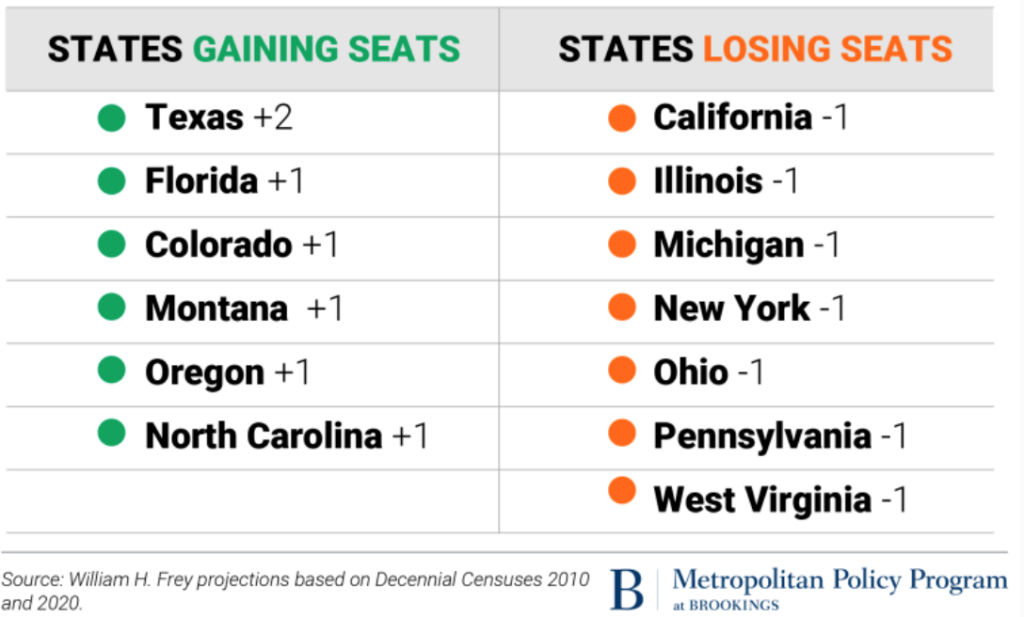

State tax regimens encourage citizens to shop around which is exactly what is happening now that the baby boomers are really retiring and planning to live off what they have. Starting each year with no state tax drag is a big reason for changing domicile. Unlike the federal scheme, almost all states must balance revenue and expense each year. There is no wiggle room for deficit spending. Here is a chart from a recent Brooking report on the 2020 Census and the reapportionment of Congressional seats. There is a clear interest in migrating from a high tax state, even if that state has great weather like California:

Contrasted with the state regimen, balanced budgets based on federal tax revenues are optional for running the country. Since the four-year period 1989-2001when Bill Clinton produced budget surpluses the federal budget has run a deficit. This is not a funding problem because the Federal government can pay for its deficits by having the Treasury issue bonds to investors. If no investors want to buy low interest bonds, the Federal Reserve Bank is permitted to buy the bonds. In essence the default move is Treasury just prints money with the help of the Federal Reserve Bank.

New Expenditures Require Tax Funding

But safety net programs and cash outlays in response to Covid-19 will require new funding sources. The real competition for tax revenues will start soon. According to the Tax Foundation in a report authored by Cristina Enache in February 17, 2021 “nearly 50% of all tax revenues in the US are raised at the state and local level.”

States are better prepared and incented to be efficient tax collectors because of the balanced budget requirement. I will bet on them to raise and collect taxes faster than the deficit funding federal group. The current promise of Billions in uncollected federal taxes being collected by an enlarged and reenergized IRS is a fairy tale. The IRS is under staffed and under trained and is currently struggling just to manage Covid-19 tax credits. Here is a chart from a recent article by Laura Saunders in “The Wall Street Journal” that highlights a massive goof by IRS in assessing “math error” notices without explaining why as required by laws passed by Congress in the 1970s:

The States Will Win This Race

In my opinion the race for tax revenues will be won by the states. The federal bureaucracy will not adjust fast enough to be an efficient revenue collector.

A sure winner will be a state whose citizens match their tax revenue protocols to their local infrastructure and education needs. The long-term winners, however, will be the citizens of those 9 states who don’t pay income taxes at all.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.

There are two essential ingredients for the cake we call the American economy- Debt and Taxes. Throughout the country’s economic timeline we have seen the recipe wander from Colonial cooking where central debt and central taxes were not even in the mix to modern days where five cups of debt for one cup of taxes is common.

There are 9 states today that impose little or no state income taxes: Alaska, Florida, Nevada, New Hampshire, Texas, Washington, and Wyoming. They often manage their economies with sales taxes, property taxes and high registration fees.

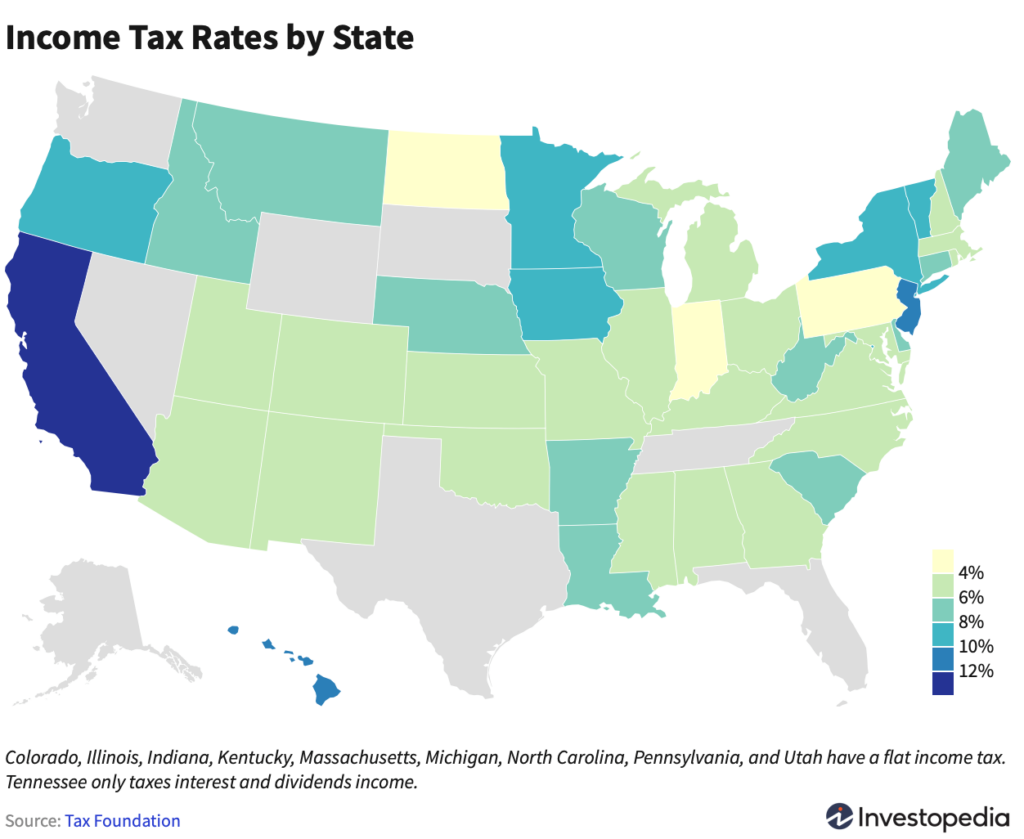

Theoretically, every state is supposed to run a balanced budget so it is hard to understand how a state like Texas can match revenue and expenses. Part of the reason is local property taxes support local needs rather than having a state impose taxes and trickle them down based on lobbying efforts. Here is a snap shot of the national state tax landscape:

If you are intending to retire and live off your accumulated retirement savings in IRAs or 401k plans and you live in California you will have 12% less retirement cash than your friends in Texas and Florida. Percentages are benign, but retirees understand cash.

A retiree in Texas with $150,00 in her 401k who plans to withdraw $10,000/ year for 15 years can rely on gross and net being the same. In California the retiree gets $10,000 gross and $8,800 net.

Tax Migrations Are Starting

State tax regimens encourage citizens to shop around which is exactly what is happening now that the baby boomers are really retiring and planning to live off what they have. Starting each year with no state tax drag is a big reason for changing domicile. Unlike the federal scheme, almost all states must balance revenue and expense each year. There is no wiggle room for deficit spending. Here is a chart from a recent Brooking report on the 2020 Census and the reapportionment of Congressional seats. There is a clear interest in migrating from a high tax state, even if that state has great weather like California:

Contrasted with the state regimen, balanced budgets based on federal tax revenues are optional for running the country. Since the four-year period 1989-2001when Bill Clinton produced budget surpluses the federal budget has run a deficit. This is not a funding problem because the Federal government can pay for its deficits by having the Treasury issue bonds to investors. If no investors want to buy low interest bonds, the Federal Reserve Bank is permitted to buy the bonds. In essence the default move is Treasury just prints money with the help of the Federal Reserve Bank.

New Expenditures Require Tax Funding

But safety net programs and cash outlays in response to Covid-19 will require new funding sources. The real competition for tax revenues will start soon. According to the Tax Foundation in a report authored by Cristina Enache in February 17, 2021 “nearly 50% of all tax revenues in the US are raised at the state and local level.”

States are better prepared and incented to be efficient tax collectors because of the balanced budget requirement. I will bet on them to raise and collect taxes faster than the deficit funding federal group. The current promise of Billions in uncollected federal taxes being collected by an enlarged and reenergized IRS is a fairy tale. The IRS is under staffed and under trained and is currently struggling just to manage Covid-19 tax credits. Here is a chart from a recent article by Laura Saunders in “The Wall Street Journal” that highlights a massive goof by IRS in assessing “math error” notices without explaining why as required by laws passed by Congress in the 1970s:

The States Will Win This Race

In my opinion the race for tax revenues will be won by the states. The federal bureaucracy will not adjust fast enough to be an efficient revenue collector.

A sure winner will be a state whose citizens match their tax revenue protocols to their local infrastructure and education needs. The long-term winners, however, will be the citizens of those 9 states who don’t pay income taxes at all.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.