Bankruptcy is a little bit like the Greeks’ vision of Hell or Hades. There is a river you have to cross called the Styx with a ferryman called Charon whom you have to pay with a coin for safe passage. If your relatives forgot to bury you with a coin, you had to swim the Styx which was much like swimming the Cuyahoga River which caught on fire in Cleveland in the 1960s.

Greek mythology offered hope for those who made a safe crossing, however. They were offered a chance for new life by inhabiting a new body.

Hertz crossed the river Styx on May 22, when it filed a petition to reorganize itself under Chapter 11 of the US Bankruptcy Laws and is waiting for a new body. Typically, secured creditors in Chapter 11 bankruptcy get cash for some of the par value of their bonds. Unsecured creditors often are left with a swap of their bonds for new equity in the reemerging enterprise. The old equity is almost always deeply impaired or completely lost.

Robin Hood Vs. Vulture Capitalists

The people who speculate about whether a company has enough coin to cross or enough credibility to get a new body are called Vulture Capitalists, and have descriptive names like “Grave Dancer”, a name given to Sam Zell who is famous for picking up real estate assets on the cheap through the bankruptcy process. These people are intimately familiar with every pothole and wrong turn in Hades. This isn’t a place for people named Friar Tuck, Maid Marian or Robin of Loxley aka “Robin Hood.”

Nonetheless, a new day trading site catering to retail investors called Robinhood with products like fractional shares, options, gold and crypto has emerged as a favorite of the younger generation. I guess the lure of no commissions matches well with investors who believe the Fed’s bailout capitalism applies to them?

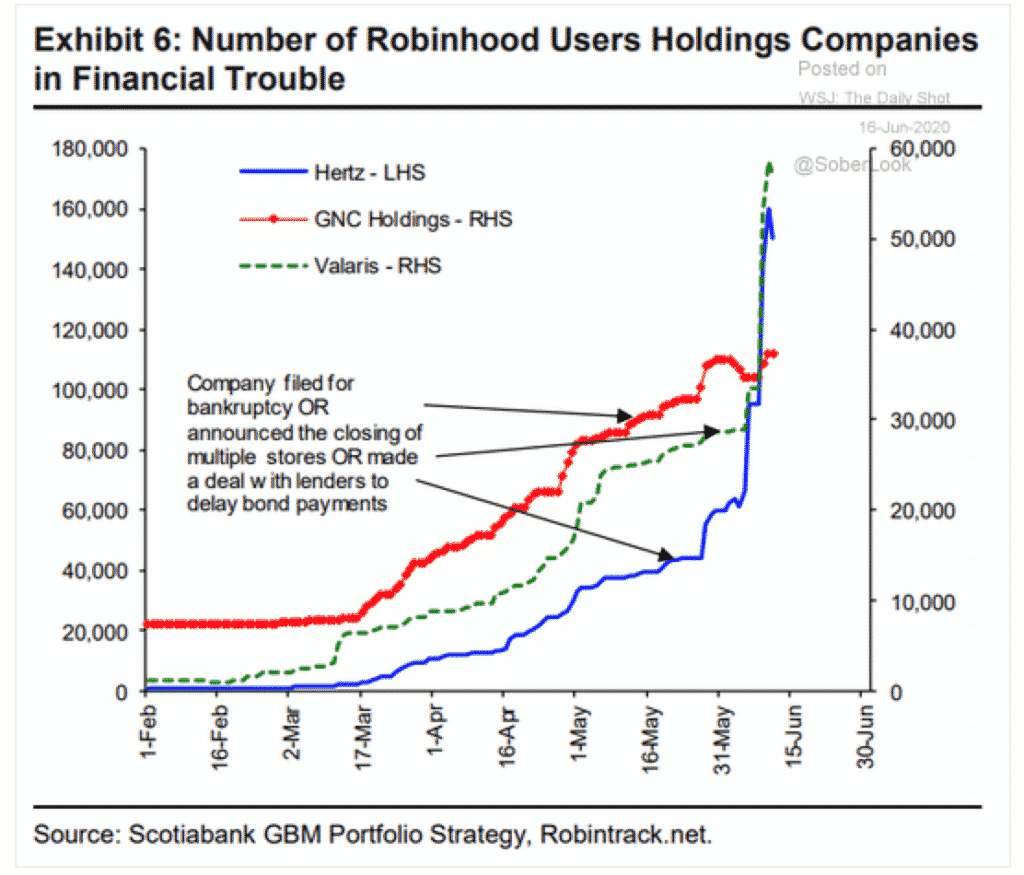

Here is a chart I saw in “The Wall Street Journal Daily Shot” from ScotiaBank about young speculators trading companies like Hertz, Valaris and GNC Holdings;

Vulture Capitalists See It Differently

The Vulture Capital community has a different opinion about the value of Hertz’s common equity. According to our friends at Wasmer Schroeder who are specialists in fixed income, the trading range for The Hertz Unsecured Bonds maturing in 2022 is currently $0.40- $0.45 which means the bondholders expect to lose 55%-60% of the par value. That does not bode well for Maid Marian and Friar Tuck’s speculative bet on the equity. The bond market is signaling the equity may be worthless.

According to Capital IQ based on Hertz’s first quarter 10Q filing, Hertz has $20.7 billion of debt, and only $1.07 billion of cash. Its net debt is 49.3x its trailing twelve-month EBITDA. Its annual capital expenditures for car fleets and facilities are more than $4.0 billion, and it competes with companies like Uber and Lyft who have minuscule capital expenditures and virtually no debt. Its biggest “real world” competitors include Avis Budget and Ryder which are highly indebted and incented to take Hertz’s market share.

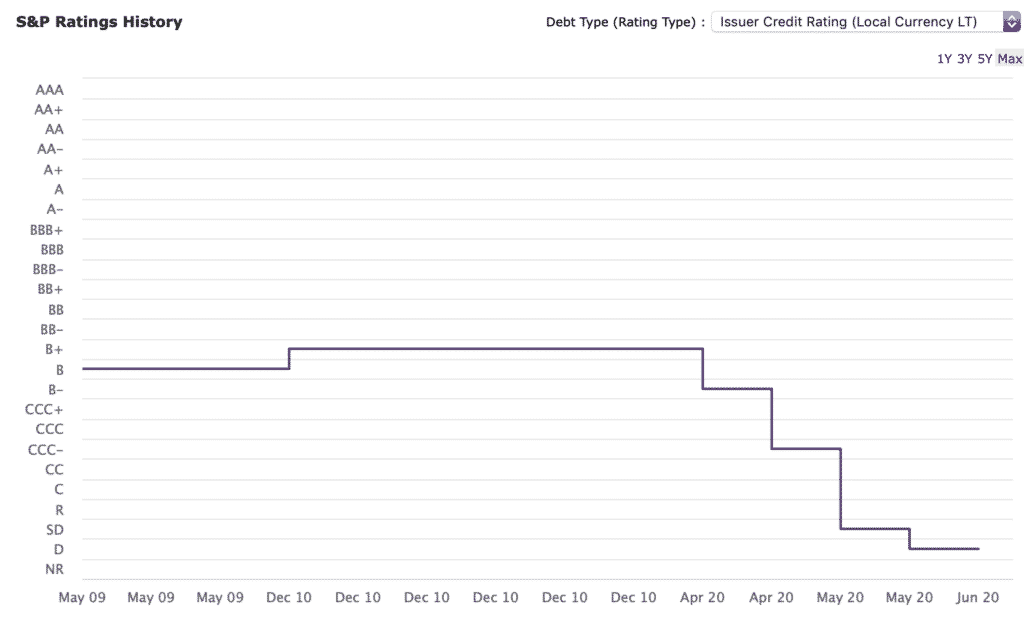

S&P Has Downgraded Hertz

Here are the S&P Credit Rating for Hertz. It is currently a “D” for default, one notch above NR which means no rating.

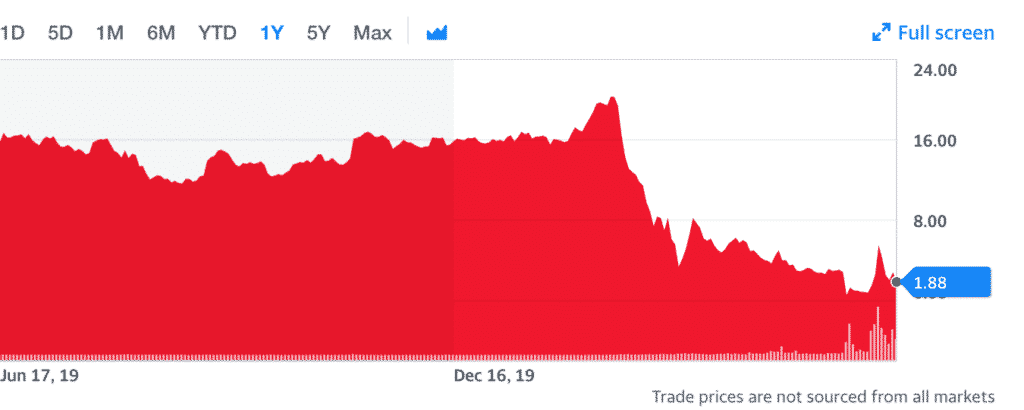

A Public Offering In Chapter 11

When Hertz announced it was going to raise up to $1 billion of equity in a public offering based on the speculative fervor in the HTZ stock, the existing equity holders sued to stop the deal for fear of being more diluted. A federal district court said the offering could proceed. Here is a chart of the HTZ stock price courtesy of Yahoo Finance. Notice that the speculative fervor has cooled in the last several trading sessions after having peaked around $6.00 per share.

There is a chance the speculators will turn out to be right. The debt that is in default is only $4.5 billion, not the full $20.0 billion. If the speculators can raise more than one billion of new equity, and other assets are sold to pare down the defaulted debt, Hertz may put the Robinhood traders “back in the driver’s seat”. They may be driving a 1968 Ford Pinto, but they will be driving.

The real danger for the speculators is those vulture capitalists who cross the Styx for a living and get names like Grave Dancer are rarely wrong about Hell.