There are only a few financial occurrences in my lifetime as confusing as negative interest rates. In September 2015, I wrote a blog about living in a Bizarro World where everything is reversed ( https://capitalworks.net/i-am-living-in-a-bizarro-world/). Negative interest rates are just the latest Bizarro example where you have to pay more for a bond or bank deposit than you get back.

What does a negative interest rate really mean, and is it based on real relationships between lender and borrower or is it just another experiment by central banks to get savers to spend? It might also have something to do with crushing national debts and trade wars. It could also be a huge source of profits for insiders who actually understand this unnatural occurrence.

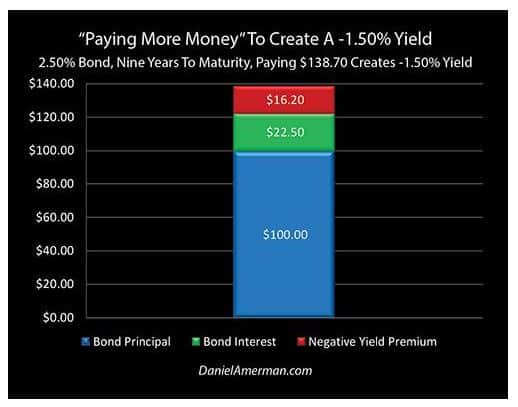

The chart below explains how debt now carries an obligation by the lender of capital to pay the borrower (negative interest) for returning par value at some future date. Under this scenario a purchaser of a $100.00 par value nine year bond bearing interest at 2.5% will have to write a check for $138.70. The blue is acquired principal. The green is acquired interest. The red is the premium (negative interest) you pay to get the bond. The 2.5% bond becomes a 1.5% bond.

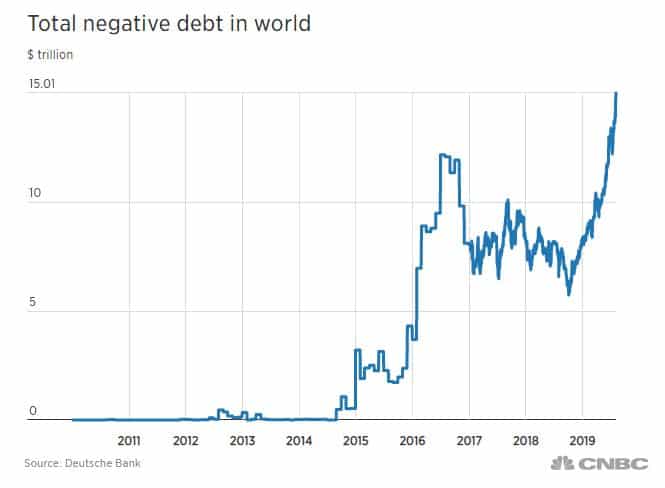

For me this is preposterous, and no individual borrower will knowingly do this, especially depositors at banks. I think the only institutions doing this kind of trade now must be sovereign central banks and their vassal commercial banks who are either buying each others negative interest bonds or, worse yet, buying their own bonds (printing money). However, there is more than $15 Trillion of negative interest debt much of which has been created in the last 5 years, so maybe Europeans and Japanese investors really are panicking?

What About Real World Transactions?

Our friends at Wasmer Schroeder who are fixed income specialists confirm the negative interest world is not market driven but rather imposed by central banks either trying to depress their currencies or stimulate their economies by forcing banks to lend at low rates. So far, savers are not paying a penalty for their deposits at banks. Wasmer Schroeder also confirms the business world is not transacting at these rates. The creation of LIBOR Floor interest rates in many loan covenants is an indication that central banks can set interest rates below zero, but lenders won’t necessarily let interest rates fall below a healthy LIBOR minimum which now stands around 50bps.

Macro Global Monitor, an investment newsletter, also sees it the same way:

“We expect Treasury auctions to get sloppier with the risk of some even failing. That will send a real wake-up call to markets and the policymakers. Zero price discovery in markets has ugly consequences, some of which, take a long time to be realized.”

Yes, Virginia, there is a debt overhang. And yes, Vice President Cheney, deficits will matter.”

“With repressed yields a sort of “rent control” problem arises, where there is a shortage of funds at the given fake or below market yield. Just as the case with a shortage of housing when rents are held below their market rates.”

The Financial Times in an article by Keith Fray dated August 13, 2019, is equally astonished by this worldwide trend but does not confirm that real world transactions are taking place at policy rates:

“Bonds have sub-zero returns out to 15 years’ maturity in Japan, France, Sweden and Belgium, out to 20 years in Denmark, 30 years in Germany and the Netherlands and an astonishing 50 years in Switzerland. In the case of Germany, it has become the largest economy where its entire yield curve is trading below zero.”

This Won’t Work For Jamie Dimon

By charging banks a fee for depositing reserves at central banks the hope is banks (the real distributors of money), will encourage borrowing and investment in slow growing economies. This is evident in a Danish Bank offering the first negative interest mortgage where the borrower will pay back less than he borrows over the life of the mortgage. While it is hard to understand, the bank is still making money (avoiding cost) because it may be charged even more to keep that capital on reserve at the Danish Central Bank.

The analogy in the industrial world would be a relationship between a manufacturer and distributor where the manufacturer persistently charged the distributor more than the distributor could resell the manufacturer’s products. The distributor would instantly look for a new relationship with a manufacturer willing to supply a similar product line at a discount. Or he would find a new line of business.

Holding Cash or Bitcoin May Be Better

The relationship between central banks and their money distributors is a closed loop. There is only one source of manufactured money (central banks) and there is a limited, chartered universe of approved money distributors (banks). Banks derive their funding from depositors and the central banks. The real test of negative interest as a central bank policy tool will come when commercial banks charge a depositor a fee to store cash. It won’t take long for that depositor to realize holding cash under the mattress is better because at least in the U.S., it always is worth at least par.

In a negative interest world Bitcoin may also become the world’s preferred currency?

Central Banks Have Failed in Europe and Japan

Japan and Europe have led the way on this failed policy. According to an August 14 article in The Japan Times on the topic, the only apparent benefit has been the devaluation of currencies against the US Dollar and even that trade benefit has eroded for Japan:

“The impact on growth and inflation has been even more mixed.”

In the eurozone, average corporate borrowing costs slipped to 1.6 percent in June from 2.8 percent at the time the ECB adopted negative rates in June 2014. Although economic growth initially boomed, it is now close to stagnating, having increased just 0.2 percent quarter on quarter from April to June. Inflation, which the ECB wants to keep below but close to 2 percent, hit a 17-month low of 1.1 percent in July, missing the target since 2013.

The benefits have also been questionable in Japan, where years of heavy money-printing had already pushed rates near zero. Bank lending rates, which were at 0.80 percent when the BOJ adopted negative rates in January 2016, stood at 0.75 percent in June.

Japan’s economy grew a meager 0.4 percent quarter-on-quarter from April to June, slower than 0.7 percent in the first quarter of 2016. Annual core consumer inflation stood at 0.6 percent in June, remaining distant from the BOJ’s 2 percent target.”

For Me Negative Rates Are Deflationary

I don’t think negative rates will work. They are so Bizarro, they would frighten me into Bitcoin, or maybe even Facebook’s Libra. One thing is for sure I am not going to buy a house because someone is paying me to borrow mortgage money. It immediately makes me think the money isn’t worth anything which suggests I will wait and see what happens. This is DEFLATIONARY and it is every politician’s worse nightmare–wrong Bizarro answer for central banks desperate for INFLATION.

When convention is flipped on its head and investors are looking for their yield in the stock market and their long term capital appreciation in the bond market you know central banks may have lost control.