Just when you are about to give up on the American people’s ability to make sound financial decisions they surprise you. Conventional wisdom suggests when you win the lottery three times in a 12-month period you buy a car, a house, and a boat. That was what the economists thought would happen when they recommended three rounds of stimulus as a financial shot in the arm of the American consumer.

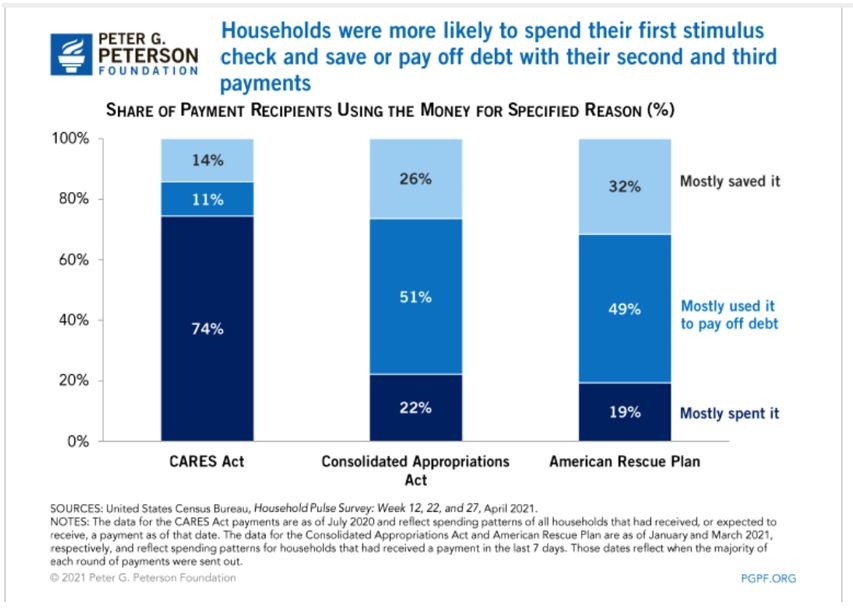

According to a recent article from Forbes in June of 2021, written by Zack Friedman “Here’s How American Spent Their Stimulus Checks” the recipients did something unexpected:

With each new influx of cash the recipients spent less, saved more and paid down debt. This is a nightmare for fiscal policy makers and reminds me of what happened in Japan after their real estate crash in the 1980s. Their whole nation became savers.

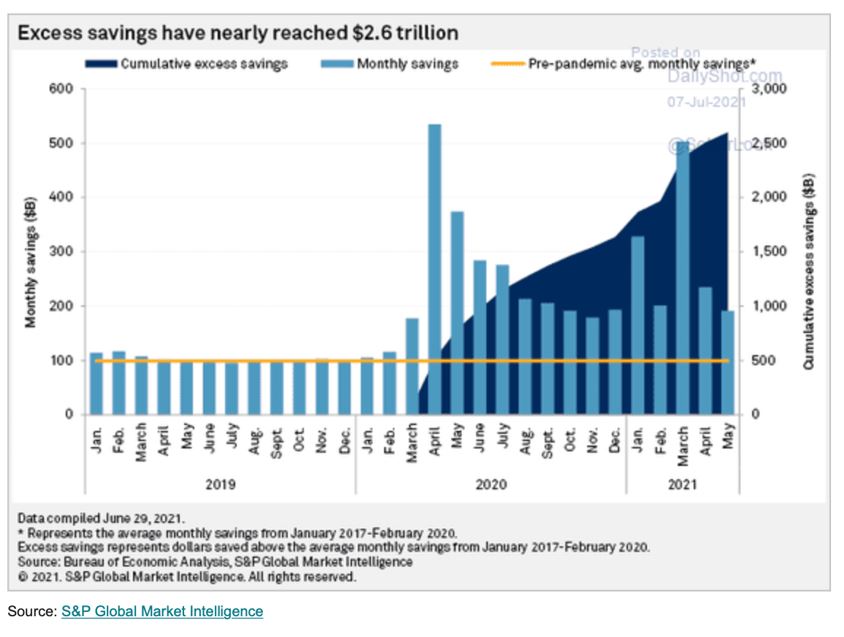

Not surprisingly, the average monthly savings rate for every month since March of 2020, has increased dramatically and the cumulative “excess” savings now stands at more than $2.5 trillion according to “The Daily Shot” and “S&P Global Market Intelligence”:

Stimulus checks don’t stimulate anything other than financial peace of mind and a good night’s sleep unless it has a “use it or lose it” conditionality. One of the reasons central banks all over the world are now considering their own digital currencies is digital accounts could evaporate if the stimulus is not spent by a certain date.

What policy makers had hoped for when they allocated more than $850 billion of stimulus was an irresponsible, financially illiterate group of recipients. Not surprisingly, the economists were out of touch with the strong survival instincts of the electorate.

If you want a barometer reading on the U.S. consumer’s outlook, I would say the barometric pressure is falling below 29.00, and the consumer is predicting rain turning stormy. Rainy day mentalities lead to rainy day savings.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.