Every year The World Series of Poker hosts the finals of the Texas hold ’em competition where the best poker players in the world compete for a multi-million-dollar purse.

Unlike most other poker hands, the players in Texas hold ’em get 2 down cards which they alone can see, and then 5 up cards, which can be used in every player’s hand. Those up cards are turned over in 3 stages with betting on each turn. The turns are named for the betting drama they create; the first turn is 3 cards and is called the “flop”, the second turn is 1 card and is called the “turn”, and the final card is called the “river”.

Everyone Is Looking For “Tells” At The Poker Table

The skill of the players is a combination of reading the ‘tells” which is poker terminology for reading signs that opponents are holding winners, or bluffing, and the ability to calculate odds in their heads. Most of the best players wear sunglasses because eyes provide the most reliable tells at the poker table.

The investment world today is like a Texas hold ’em tournament. All parties have equal and instantaneous information. Machine learning fueled by algorithms buttresses institutional traders and investors. Like the flop, the turn, and the river, almost all investment professional insiders have perfect information. Even though they see their hands and counter-parties hands as well, the very best investors still look for the markets to give them a “tell”.

My Favorite Tell

I wrote a blog (You Know It Is A Market Top When???) in October of 2018, about companies borrowing money to buy back stock, and insiders selling into that liquidity as a sure “tell”. Insiders may not be prescient all the time, but that is the way I would bet if I only had only one piece of information.

Buffet’s Favorite Tell

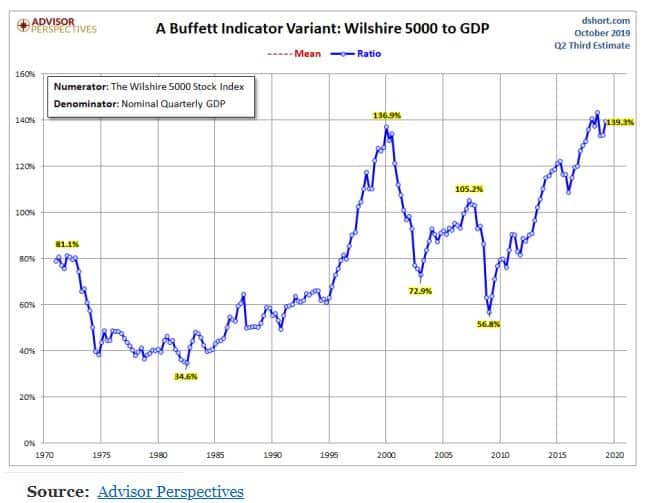

A recent article in Market Watch “One Look At This And You Can Tell Why Warren Buffett Is Siting On An Unprecedented Pile of Cash”, talks about a reliable tell for the Wizard of Omaha:

“One reason may lie in this chart, a variant to what Buffett has described as the best single measure of where valuations stand at any given moment,” which was posted by Gary Evans of the Global Macro Monitor blog this week.”

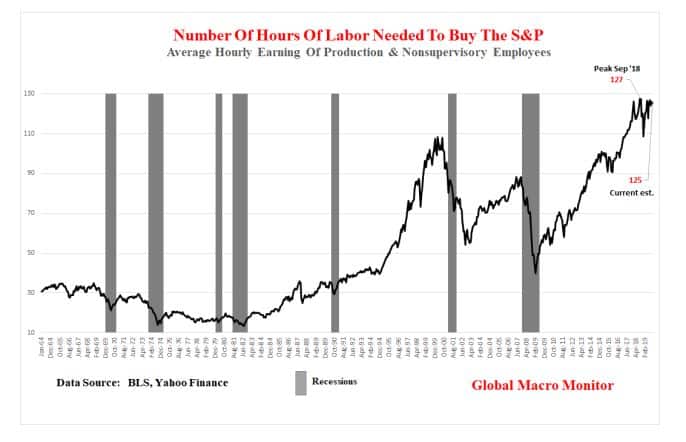

Gary Evans Favorite Tell

Mr. Evans also has his own “tell”, which is the number of hourly earnings needed to buy the S&P500:

Another tell may be what is happening with bank debt and highly leveraged loans. The debacle in 2008 should have taught us the lesson that rating agencies are profit driven, and often short on rigorous credit analysis. When you are only betting your reputation, not your wallet, your credit opinion is for hire. In fact, the real test is what owners of leveraged loans are doing.

Rating Agencies And Markets Diverge

According to a recent Article in Barron’s “The Riskiest Bank Loans Are Selling Off” by Alexandra Scaggs, the discount on leveraged bank loans (23%) is significantly higher than the 5.8% discount for the market’s lowest rated loans (CCC). The disconnect which may be another “tell”, is that at least 50% of the bank loans are supposed to have a significantly higher credit quality. Again, the market is saying something dramatically different than the rating agencies.

In any event, equity investors have seen the flop, the turn, and the river, and still are ignoring the “tells” and have pushed all their chips into the center of the poker table and declared they are “all in”, (which means they are betting it all). As Gary Evans puts it, “they are sustained by thematic delusions whether it is the magic of QE, artificial intelligence, or cessation of trade wars with China.”

Another of my favorite “tell” is when my brother, the landscape architect, starts giving me investment advice. In 2001, I sold everything when he told me a great strategy was “buy companies that have just split their stock- they always go up.” If you don’t have reliable family member or friend, you can probably count on Warren Buffet getting it mostly right.