I have not written my regular blog since January. This wasn’t a case of writer’s block, lack of time or disinterest. Rather there had been something happening on a macro level that is new and hard for me to understand.

So, in order to move forward I wanted to review the distinctive characteristics of three prior periods in American economic history, two of which I know and understand, and one period I learned about from my parents and grandparents.

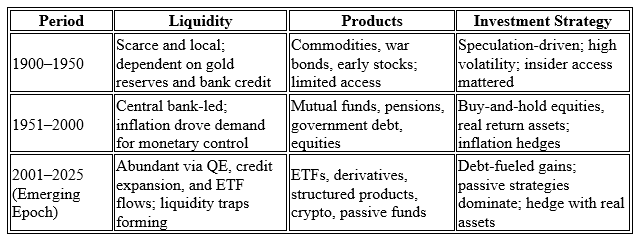

Those three periods are 1900-1930, 1931-2000, and 2001-2025. During those three periods the heartbeat of the world’s economic order was uniquely American. I feel fortunate to have experienced a large part of its evolution. Here is a summary of three those periods and the liquidity, products, and strategies characterizing each. I have had help from ChatGPT in characterizing each epoch, but the iteration of the thesis is mine:

Investment Evolution: 1900-2025

U.S. Investment Epochs Comparison

Investment Timeline Flow

1900–1950 →

• Highly volatile speculation

• Banking system collapses common

• Gold-backed currency limits liquidity

• Boom/bust cycles dominate

1951–2000 →

• USD becomes global reserve

• Inflation becomes the new constraint

• Growth of active investing culture

• Central banks begin to “manage” cycles

2000–2025 →

• Central banks expand balance sheets

• Liquidity injections drive asset prices

• Passive investing dominates

• Markets increasingly detached from fundamentals

Summary Commentary

1900–1950: Wild west finance. Cycles of credit excess and collapse with no effective lender of last resort until late.

1951–2000: Institutionalization of investments. Inflation and price discovery are central themes. Investors adapt to monetary-driven cycles but remain fundamentally focused.

2000–2025: Liquidity is king. Central banks control asset prices. Passive vehicles surge. Moral hazard and monetization redefine investment thinking. Confiscation of capital emerges as a political weapon. Investment returns are multiplied by money momentum and the Wall Street money machine prints daily billionaires.

The last two of these three periods represent the majesty of Wall Street, its command of a high functioning and universally trusted stock and bond market, its innovative and compelling products like mutual funds and exchange traded funds, and its stewardship of the system based entirely on a profit motive. It is their casino, and we are always playing with their chips in a system where we only get cashed out when they had taken care of their business first. But that has been ok for almost all of us.

For America and the rest of the world this casino was a beacon for capital because it not only provided a meaningful return ON investment in Wall Street products, but it also delivered a Return OF investment capital. Participants from all over the world spent the US Dollars they held from trading with the USA or US Dollars they obtained by converting their currencies into US Dollars by investing in the Wall Street Casino because the products were liquid and trusted.

The Great Financial Crisis Was Different

Then there was the GREAT Financial Crisis of 2008. We all know this rocked confidence in the promise of return of capital for a world trusting Wall Street mortgage-backed products. Wall Street insiders cashed out first and they even sacrificed a few of their own casinos (Bear Sterns and Lehman Bros). However, even in the aftermath of this massive predation there was no other place like the US Treasury market which Larry Summers, former Secretary of the Treasury, described as the “foundation stone of the global financial system”.

The US bond market was anchored by and priced off of the Treasury market and the implicit guarantee of the Federal Reserve Bank to print money to support both markets. Even after GFC the US was the only place to put your money with assurance it would be returned to you.

As falling interest rates were orchestrated by the Fed’s quantitative easing policy responses to Covid-19, a miracle era of debt induced world prosperity brought endless liquidity to the newly invented exchange traded products that propped up zombie companies that could not even pay interest on their leverage. Quantative easing even played a major role in making ETF momentum nearly as important as traditional valuation metrics like PE multiples.

Prosperity abounded based on public and private debt that was so casually created that no one ever asked how it could be repaid.

| Breakdown of US Federal Debt Holdings | |

| Federal Reserve | $4.6T |

| Intra-governmental holdings | $12.1T |

| Foreign Investors | $8.8T |

| Domestic Investors | $11.0T |

TOTAL$ $36.5 Trillion

| Total Private Debt | Amount |

| Household Debt | $18.04T |

| Mortgages | $12.6T |

| Auto Loans | $1.66T |

| Credit Cards | $1.21T |

| Student Loans | $1.62T |

| HELOC & Other | $1.0T |

| Non Financial Bus Debt | $21.1T |

| Corporate Bonds & Paper | $8.25T |

| Bank Loans | $2.21T |

| Non Corp & CRE Loans | $7.49T |

| Leverage Loans | $1.36T |

TOTAL $57.08

| Off Balance Sheet Liabilities | |

| Social Security | ??? |

| Medicare | ??? |

A New Investment EPOCH may have begun in the first quarter of 2025.

Economists have their own language for economic periods and the prescribed remedies. For example, most of us have recently experienced “Quantitative Easing” (money creation and falling interest rates approaching zero) and “Quantitative Tightening” (contraction of the money supply and rising interest rates), “Yield Control” (Fed sets interest rates by buying Treasury bills and bonds from the US Treasury) and “Debt Monetization” (Fed exchanges debt purchased from the Treasury to the banking system in a way that it becomes their asset).

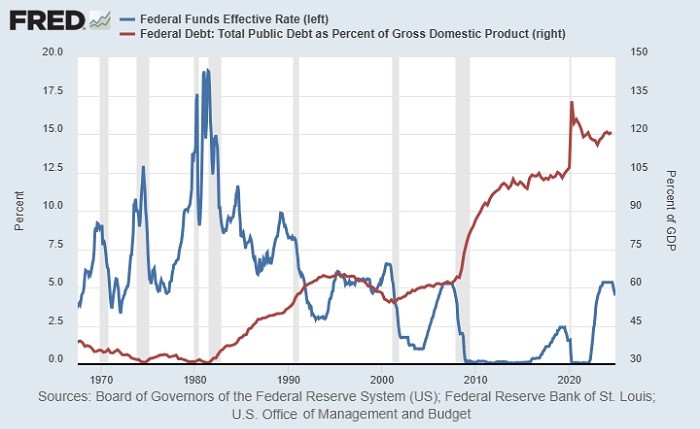

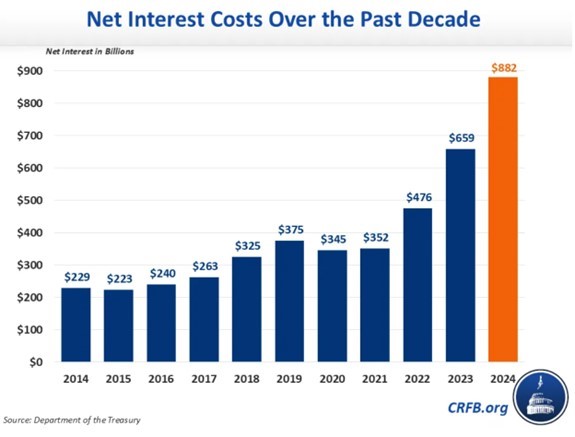

Right now we are just beginning to hear about a new era ironically labeled as “Fiscal Dominance.” It has evolved in response massive government budget deficits since 2017, and trillions of dollars of money creation. The two charts below supplied by Lyn Alden tell the story. I recommend Lyn’s free letter https://www.lynalden.com/investing-newsletter/

The simple explanation for Fiscal Dominance is the only things that matter now are the amount of federal debt, interest on that debt, and government deficits increasing that debt.

Think of it as a total eclipse of the Economic Sun, where the governors of the Federal Reserve find themselves in a windowless room with a hand grenade, dwindling oxygen, and three doors. The first door is marked “EMPLOYMENT” and it is padlocked from the outside. The second door is marked “PRICE STABILITY” and it is also padlocked from the outside. The third door is bolted on the inside, but it is UNMARKED and it leads to a dark tunnel of indeterminant length and destination.

Fiscal Dominance and the survival of the Fed only leave one choice; it won’t be the hand grenade.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.