Financial literacy is a hot topic right now. It should be.

A large swath of the younger population in the United States could not pass a basic financial literacy test, much less debate the pros and cons of capitalism. In recognition of this deficiency, Barrons devoted a Special Report, “Kids and Money” in its December 2, issue to the topic of educating your children about finances.

According to Barrons, “21% was the portion of wealth held by Baby Boomers in 1989, when their average age was 35. Millennials will control just 3% in 2023, when their average age is 35.”

No wonder Millennials are fascinated by wealth transfer promises from Bernie Sanders and Elizabeth Warren. If you haven’t learned to save by the time you are 35, your future is highly dependent on those who have. That won’t be Millennials or the Gen Z group right behind them.

Here are a few more statistics about young America’s wealth gap.

- 36% of 23-38 year olds don’t have any emergency savings

- 36% of college students have more than $1000 in credit card debt

- 45% of 18 to 29 year olds have received financial help from their parents in the last 12 months.

In a recent article for Business Insider by Hillary Hoffower, entitled “ 70% of Millennials Say They Would Vote For A Socialist” there are alarming facts about the poor financial condition of the largest population group in the United States. High interest rate credit card debt is right at the top:

“Of those who were in credit-card debt, slightly more than half (54%) said they owed less than $5,000, and 24% said they owed $5,000 to $10,000. The remaining one-fourth said they owed significantly more – 9% owe $10,000 to $20,000, 4.5% owe $20,000 to $30,000, and 4.5% owe more than $30,000. Source Business Insider– Hillary Hoffower.

With average credit card rates exceeding 15%, a $5000 card balance costs $750 interest each year. If it is not paid off or down, the principal balance will be $10,000 in 5 years. I wonder how many young Americans understand the manacles of compound interest?

Enslaved By Student Loans

The younger generation has argued that they have been enslaved by student debt. This is true and it has remained so over many generations. Many Millennials and predecessor generations without the means to repay were underwritten by a political class who made “college for all” a birthright without regard to affordability. Millennials signed up by the millions. They now can’t pay. Politicians are suggesting forgiveness.

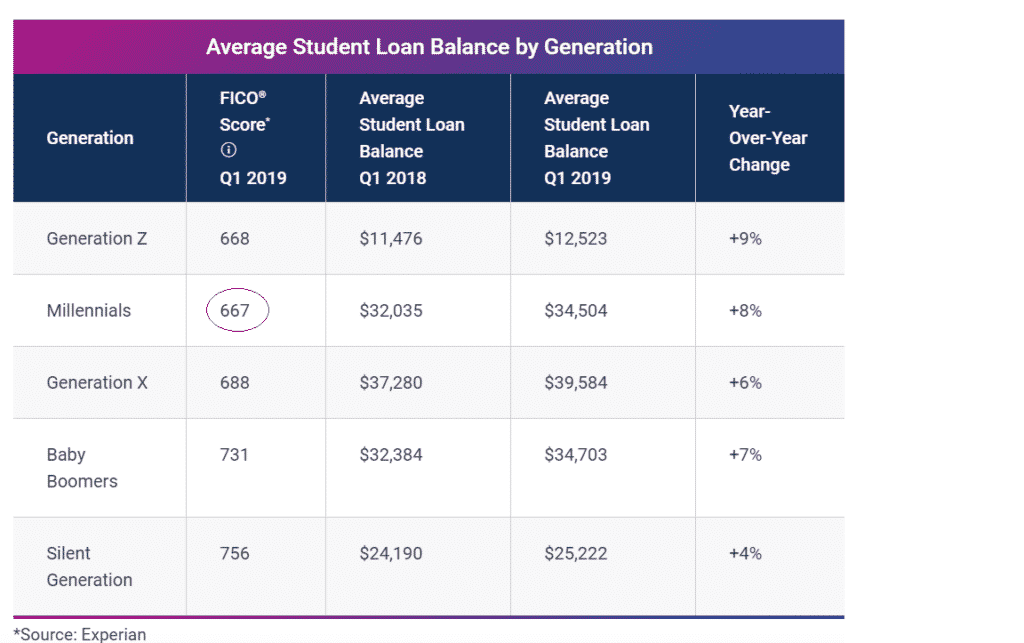

According to a 2019, study by credit agency Experian “The average student loan balance among Millennials, consumers between the ages of 23 and 38, was $34,504, an 8% increase from Q1 of 2018. Millennials are alone, however, in their ability to repay:

Capitalism is not working for the younger generation of Americans because a political class has advocated forgiveness, not accountability. To a generation that is used to participants’ trophies, safe spaces and immediate gratification, Capitalism will never be as appealing as a selfie on the beach. Mounting student loans may now be a pile of tinder for a socialist bonfire benefiting a permanent ruling political class.

Capitalism Must Be Taught

Capitalism has not been taught as an economic theory for a long time. As governments provide an ever greater share of life, capitalism will fade as an abstraction. The cornucopia will stop providing.

Financial literacy is needed. Like all good habits, saving and frugality must be taught. The destructive inevitability of debt needs to be understood. Foremost, socialism as failed political and economic theory is a now muzzled by colleges and teachers, many of which owe their own existence to the student loan program. Free speech must return to college campuses.

I taught my children capitalism. They are teaching their children, and I am cheerleading. There are too few parents who understand the economic and political underpinning of a system that has made the USA unique in the history of the economic and political world. For the Holidays, buy a copy of Neale Godfrey’s 1996 book “Money Doesn’t Grow On Trees” and read it to your children or grandchildren.

Millennials won’t miss capitalism until they have a ruthless socialist master like Nicholas Madura in Venezuela. By then compound interest and student loans will be the least of their worries.