You have to be at least 70 years old to have any recollection of the economic environment of the late 70’s and early 80’s, when inflation grew from 3% to 15% and interest rates grew from 6% to 16%.

I am also absolutely positive that very few of us are really prepared for the possibility of real inflation in 2022 and 2023, or appreciate its destructive and paralyzing effects. While many of the experts think inflation is short lived, someone at the Social Security Administration thinks it is real and has set the 2022 cost of living adjustment at 5.9% for social security recipients.

Here is a simple hypothetical to illustrate the reasons for concern about inflation.

Assume you bought a $1000, 10 Year Treasury bond on January 1, 2021, with a 1.5 % coupon and are expecting a real return (net of taxes and inflation), of slightly less than 0%. That would have been a pretty safe assumption in 2020, when the inflation rate was well under 2%, but in 2021 the inflation rate is almost 6% , and fed, state and local taxes now average 33% and going higher.

Our bond buyer’s nominal rate of interest is 1.5%. The after-tax rate is 1%, and the real rate after subtracting 6% inflation is negative 5%. If you are a “under the mattress” hoarder of cash you netted 0%, as your nominal after tax return so your real return is negative 6%, and your bond only has a buying power of $940. If inflation stays at 6% through 2023, the bond’s buying power will have fallen to $820.

The Fed Will Accept Inflation

Unlike 1980, the whole world, including the U.S., is now badly hooked on leverage. While inflation is wonderful for debtors by allowing them to pay back with inflated dollars, rising interest rates, inflation’s historic twin, are simply not affordable. A 3% interest cost on the US public debt would translate to almost $1 trillion annually.

But The Fed Has Monetized So Much of It

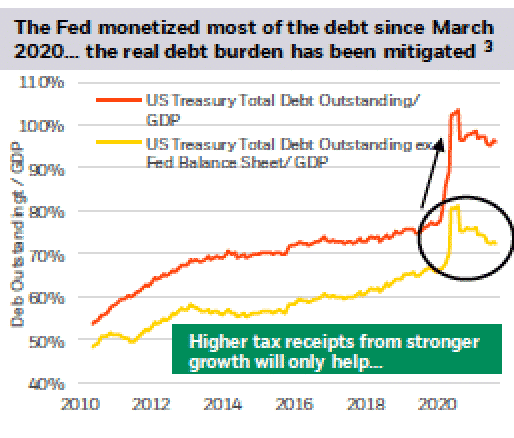

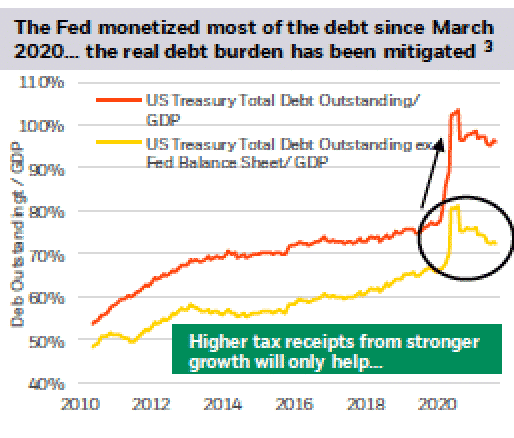

However, there is an interesting systemic change from the late 1970s and early 1980’s. The Federal Reserve Bank now “buys” low yielding, original issuance government debt from The U.S. Treasury such that the real interest burden from public debt only applies to approximately 75% of the nominal debt. In fact, the Federal Reserve Bank has monetized almost all of the debt created since March 2020 to pay for the $5.5 trillion of Covid-19 response. Here is a chart that illustrates the significant difference between U.S. Treasury Total Debt and Total Debt Ex Treasury Debt On Fed’s Balance Sheet (source: 9/30/21 Bloomberg Barclays US Aggregates):

The Plan Works, If Inflation Stays In Check

Milton Friedman is right about inflation being a monetary problem leading to rising prices for all goods and services, but policy makers have to choose it because all other remedies involve a potential rise in interest rates.

Pundits have to bet the Fed can minimize the risk of inflation taking hold and ushering in a persistent stagflation. Remember it took a gutsy Paul Volker and a 15% yield on the 10-year Treasury Note to whip inflation in the mid 1980s. A 21st Century world of debtors cannot even imagine the carnage from that austerity and are happily rooting for inflation as an acceptable alternative.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.

Have you noticed an old financial prophet is now being quoted all the time by “The Wall Street Journal”, “Barrons”, “Bloomberg” and “The Financial Times”? Milton Friedman, a Nobel Prize-winning economist who died in 2006, has been exhumed and his monetary wisdom once more is flourishing at the first significant inflation point in the U.S. economy in 40 years.

Milton Friedman Was A Rock Star

Mr. Freidman was a leading economist in the 1950s in America. He was from the University of Chicago School of economic theory which means he directly challenged many of John Maynard Keynes’s ideas about economics. Keynes believed in a central government’s ability to control outcomes in the private markets through fiscal policy. Here is how Investopedia described Keynes theory:

“Keynesian economics was used to refer to the concept that optimal economic performance could be achieved—and economic slumps prevented—by influencing aggregate demand through activist stabilization and economic intervention policies by the government.”

Milton Frieidman thought otherwise. He decried many governmental programs as lacking accountability. He wished governmental program outcomes were measured rather than the political intentions anchoring them. He also believed that monetary policies are “always and everywhere” directly responsible for inflation. This translates into a theory that a dramatic increase in the money supply, like we have witnessed in the last 18 months, eventually leads to inflation in prices of all goods and services.

He also espoused a unique theory about unemployment that may help us understand why no one wants to react to all the “help wanted” signs you see everywhere. Here is a quote from Friedman about unemployment:

“If you pay people not to work and tax them when they do, don’t be surprised if you get unemployment.”

Friedman Is Discredited By ESG Proponents

As I researched Friedman, I realized he is largely discredited today for his central proposition that the sole responsibility of business is to maximize profits for its shareholders. The whole ESG movement suggests that businesses have an equally important environmental, social and governance responsibility.

Instead of exhuming a prophet with an ESG deficiency, I am asking the readers to explore with me why inflation is bad for savers and even worse for those who put cash under the mattress, and why it is good for debtors including debtor nations, but only if it doesn’t increase interest rates.

Only Baby Boomers Remember Stagflation

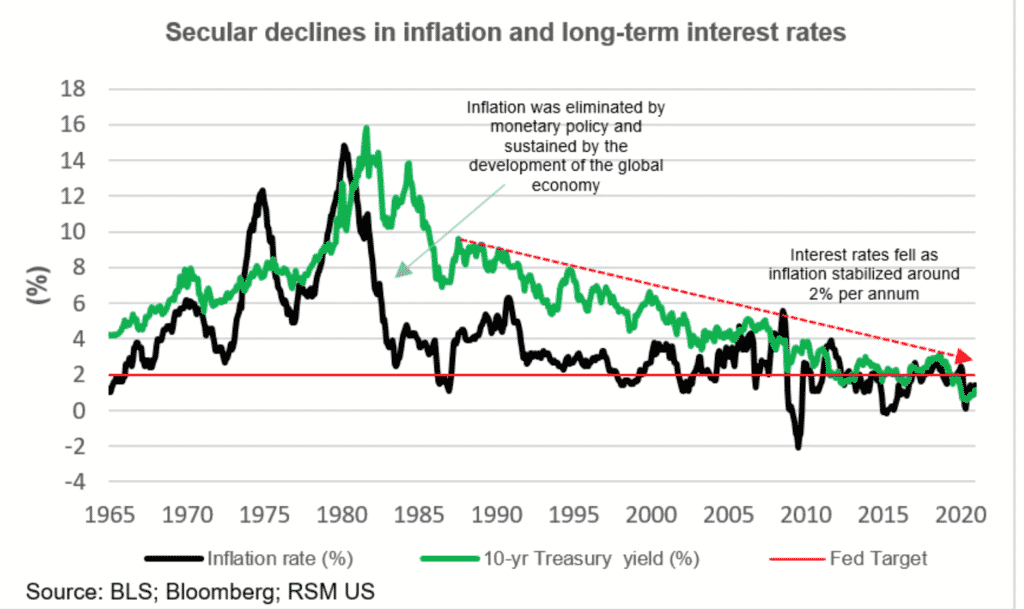

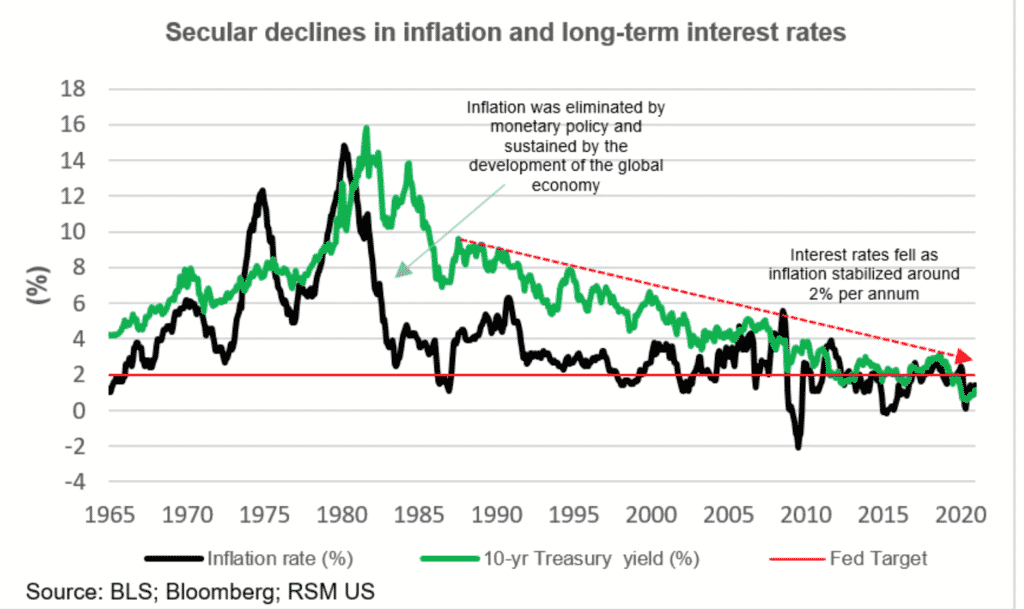

We have lived for the last 40 years in an unusually low inflation environment. Here is a chart from Bloomberg showing the decline. Notice how inflation and interest rates have been highly correlated:

You have to be at least 70 years old to have any recollection of the economic environment of the late 70’s and early 80’s, when inflation grew from 3% to 15% and interest rates grew from 6% to 16%.

I am also absolutely positive that very few of us are really prepared for the possibility of real inflation in 2022 and 2023, or appreciate its destructive and paralyzing effects. While many of the experts think inflation is short lived, someone at the Social Security Administration thinks it is real and has set the 2022 cost of living adjustment at 5.9% for social security recipients.

Here is a simple hypothetical to illustrate the reasons for concern about inflation.

Assume you bought a $1000, 10 Year Treasury bond on January 1, 2021, with a 1.5 % coupon and are expecting a real return (net of taxes and inflation), of slightly less than 0%. That would have been a pretty safe assumption in 2020, when the inflation rate was well under 2%, but in 2021 the inflation rate is almost 6% , and fed, state and local taxes now average 33% and going higher.

Our bond buyer’s nominal rate of interest is 1.5%. The after-tax rate is 1%, and the real rate after subtracting 6% inflation is negative 5%. If you are a “under the mattress” hoarder of cash you netted 0%, as your nominal after tax return so your real return is negative 6%, and your bond only has a buying power of $940. If inflation stays at 6% through 2023, the bond’s buying power will have fallen to $820.

The Fed Will Accept Inflation

Unlike 1980, the whole world, including the U.S., is now badly hooked on leverage. While inflation is wonderful for debtors by allowing them to pay back with inflated dollars, rising interest rates, inflation’s historic twin, are simply not affordable. A 3% interest cost on the US public debt would translate to almost $1 trillion annually.

But The Fed Has Monetized So Much of It

However, there is an interesting systemic change from the late 1970s and early 1980’s. The Federal Reserve Bank now “buys” low yielding, original issuance government debt from The U.S. Treasury such that the real interest burden from public debt only applies to approximately 75% of the nominal debt. In fact, the Federal Reserve Bank has monetized almost all of the debt created since March 2020 to pay for the $5.5 trillion of Covid-19 response. Here is a chart that illustrates the significant difference between U.S. Treasury Total Debt and Total Debt Ex Treasury Debt On Fed’s Balance Sheet (source: 9/30/21 Bloomberg Barclays US Aggregates):

The Plan Works, If Inflation Stays In Check

Milton Friedman is right about inflation being a monetary problem leading to rising prices for all goods and services, but policy makers have to choose it because all other remedies involve a potential rise in interest rates.

Pundits have to bet the Fed can minimize the risk of inflation taking hold and ushering in a persistent stagflation. Remember it took a gutsy Paul Volker and a 15% yield on the 10-year Treasury Note to whip inflation in the mid 1980s. A 21st Century world of debtors cannot even imagine the carnage from that austerity and are happily rooting for inflation as an acceptable alternative.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.