I remember the Over-The-Counter Trading Desk at a regional securities firm called Prescott, Ball& Turben (PBT) where I was employed in the Mergers & Acquisitions group from 1987-92. Trading small stocks was an art with high commissions and limited liquidity. Good trading desks did not “position” securities by holding them in inventory, rather they preferred making markets in securities where they could know they had a buyer for every seller. They strongly preferred “round lots” of 100 shares [1].

There was nothing worse than a customer who wanted to sell an “odd-lot” of 73 shares of General Electric. Matching an odd-lot book was hard work. Ending up with those shares on your balance sheet was not unusual and quite disturbing if your trading desk, like PBT, had limited capital.

As a consequence, odd-lot trading was quite expensive and the odd-lot seller or buyer often paid 2x the trading commission or more.

Forty years later the marvels of electronic trading and apps that put a trading desk on your mobile device have changed the reputation of odd-lots. A retail investor who wants to own Amazon or Berkshire Hathaway cannot afford a round lot of 100 shares because the cost would exceed $100,000, but a one share slice of Amazon or Berkshire Hathaway is more affordable at $1000.

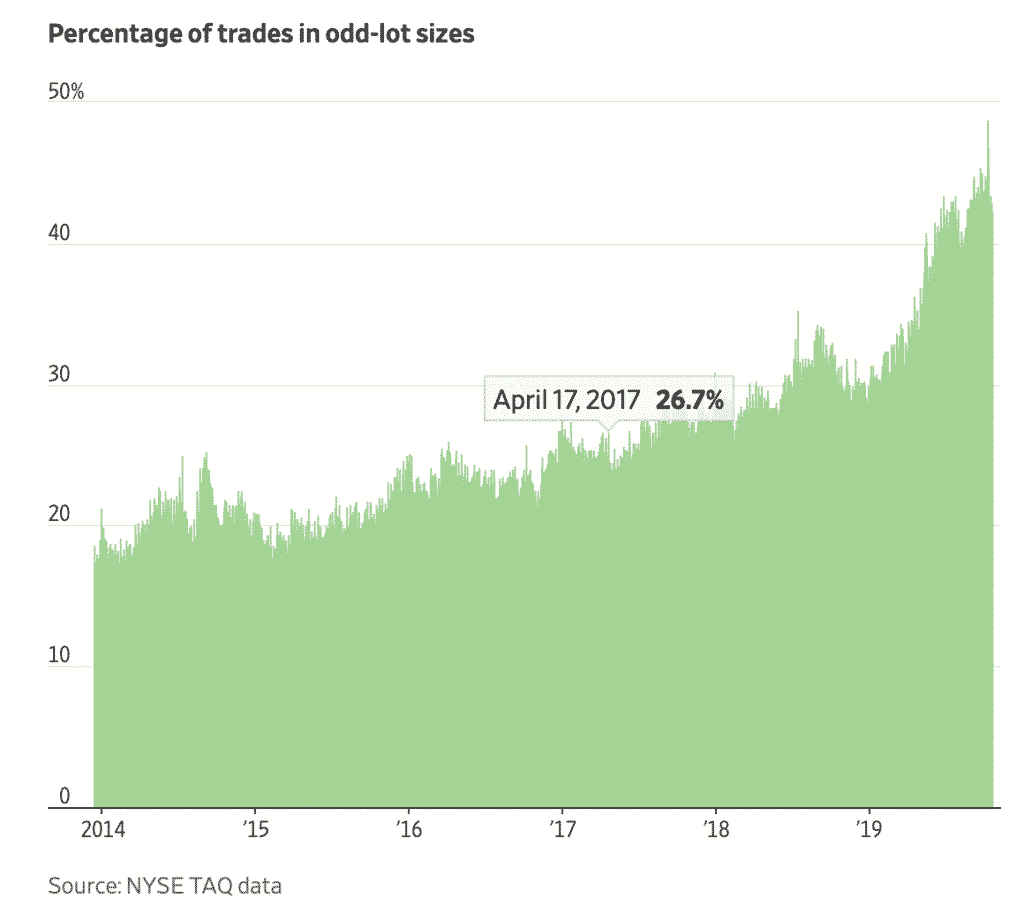

The major custodians like Fidelity, Schwab, and E Trade, now offer stock trading without any commissions. A whole new industry of phone trading has also been enabled by new entrants like Robinhood who have created trading desks on individual phones. As a consequence, the odd-lot, once a pariah, is back in the highlights as demonstrated below: [2]

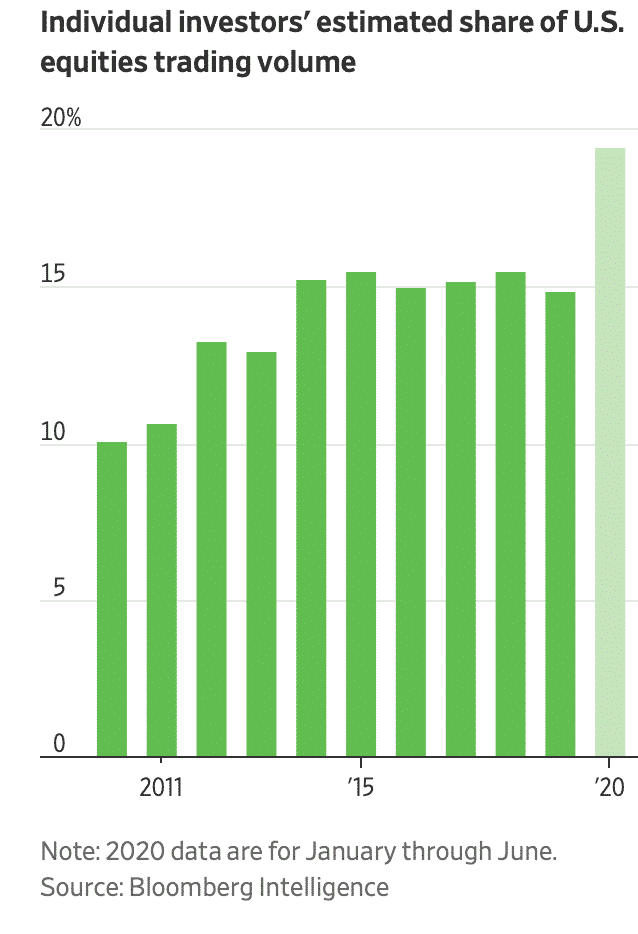

Part of the reason is electronic trading can easily bundle odd-lot trades and then unbundle proceeds. A large position can be sliced and traded in small increments to disguise the size of the party seeking liquidity. This is especially helpful for small capitalization stocks with limited trading volumes. As a consequence, the individual investor has returned to the trading markets:

I am not sure what this change portends? In my past experience, whenever large swaths of individual investors started day trading it was a sure sign of the coming apocalypse. If you look at the crowd favorites you see a mixed bag of sexy tech stocks like Apple, Amazon and Google, disruptors like Tesla and, more concerningly, complete moon shots like Hertz and Kodak where the results are binary. The good news for these individual traders is the trading cost of winning and losing is no longer a deterrent.

The movement for slices doesn’t stop with stocks. A recent New York Times article published on July 31, 2020, written by Paul Sullivan titled “Can’t Afford A Birkin Bag or a Racehorse? You Can Invest in One”, explores the fractional ownership of otherwise unaffordable assets or goods. Most investor’s experience with fractional ownership harkens back to condominium time shares where the monthly fees continue to escalate but valuations have cratered. The promoters and managers made all the money in fractional ownership of condos.

However, the Securities & Exchange Commission must feel differently about fractional ownership of start-ups, Birkin bags and racehorses, because it has relaxed the rules on small securities offerings. Some of the riskiest investments are now affordable. Here is how Mr. Sullivan describes the opportunity:

“The market for investing in fractions of items otherwise seen as collectibles — and largely reserved for the wealthiest people — has seen an uptick in interest during the pandemic as people spend more time at home. Rally Rd. began by selling shares in exotic cars several years ago but has expanded to art, books, wine and whiskey, memorabilia and Birkin bags.”

This slicing up of everything is a trend that will probably continue until the fractional owners who often have neither possession nor liquidity, decide it may be they who are experiencing financial death by a thousand slices.

[1] References herein to a specific company or its securities do not constitute investment advice with regard to such security and no implication of a recommendation to buy, sell or hold any such security should be attributed to such reference.

[2] References herein to brokerage firms do not imply a recommendation of any such brokerage firm. References to commission charges are based on publicly available data and are subject to change.