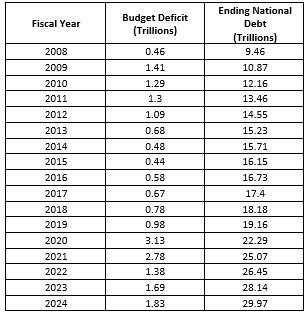

My inbox has been exploding with reactions to the DOGE onslaught on good governance and good financial stewardship. This is another tribal exercise meant to take our eye off the elephant in the room which is the $36 Trillion and growing National Debt. Here is a table showing the growth of our national debt since the Great Financial Crisis in 2008.

The howling and growling from my divided friends is telling me the DOGE exercise is having its intended polarizing effect. Of course, Elon Musk is going to find payments that shock and offend his tribe and further tether his truth to followers on X. This paralyzing emotional response is exactly what enslaves us and keeps us from unifying around an obvious question: “How Did We Lose Control Of Our National Debt?”

Personally, I have been writing about this for 5 years and people much smarter than I have been warning about this for much longer. The existential question is how can you pay back $36 Trillion. The simple answer from an English major with a liberal arts background is you cannot pay back $36 Trillion.

The next question then should be if you cannot pay it back, how can you refund it? What I mean by refunding is finding someone holding U.S. dollars to buy newly issued Treasury Bonds or Notes to refund U.S. dollars to holders of the maturing U.S. Treasury Debt – Bills or Bonds. This universe of funders has changed since the GFC and it will continue to shrink as protectionism strategies make worldwide funders nervous.

Refundings Don’t Matter If You Have The US Bond Market

Again, I was educated about the divergence between the obviously unpayable amount of Treasury Debt and the miracle of instant liquidity at incredible size (many millions) in the U.S. Bond market. This is one reason that market has been labeled “The Eighth Wonder of the Modern World.” So, I was naively asking the wrong question. Traders in the U.S. Bond Market will buy Treasuries of every kind and maturity as long as there is instant liquidity without risk of loss.

The mechanism for keeping the money flowing is interest rates, and the bond market just did a major reset by pushing down prices at which you could get liquidity, but in so doing raised the yield on the 10-year treasury. Liquidity might mean loss of principal so accept a longer duration at a higher interest rate. This insight came from a recent article written by Sam Goldfarb writing for the “Wall Street Journal” on July 16, 2024, in “How Wall Street Keeps Absorbing America’s Borrowing Binge”.

Here is how Mr. Goldfarb explained the bond market paradox where the huge amount of total debt is irrelevant if traders seeking liquidity and safety meet second to second in a completely liquid trading market where they can deploy U.S. dollars. So, I have learned that it does not matter if the U.S. is bankrupt as long as the plumbing supplied by Wall Street works without flaws and can be relied upon by buyers and sellers. No one worries about payment at maturity if you can liquidate your entire position right now; and if your fear of loss is handled by instant liquidity, the greed instinct of getting paid interest to wait until maturity kicks in and there is a quite orderly and vibrant miracle happening every second of the trading day.

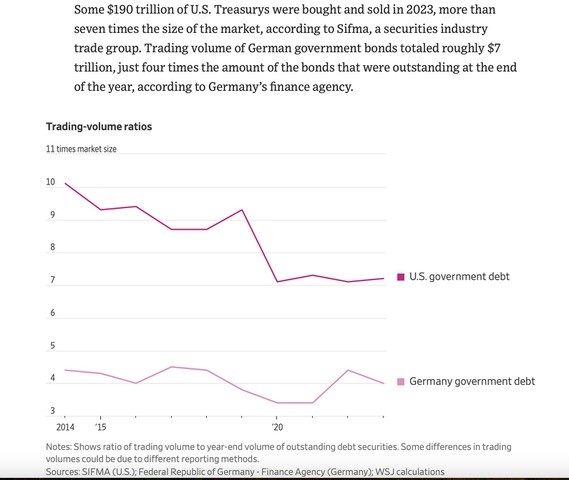

Below is a comparison of liquidity in the US bond market and the German Bond market. Germany is always considered to be one of the best capitalized countries in the world. While its relative liquidity has slipped since 2014, the U.S. bond market still is the dominant source of liquidity for dollars by a wide margin.

I guess this is where the Fed, the Treasury and the world all meet. As long as the Fed can print money to buy new Treasury securities or make open market purchases to stabilize markets there is no other credible competitor. China? Russia? Europe? United Kingdom? There is just no other way for a world to trade and there is no other system that can become the eighth wonder of the world, that I can see anywhere.

The U.S. may be broke, but Wall Street’s bond market always promises you are not insolvent and that is all that matters after you have reached a point where you have liquidity at a price and no competition offering a better deal.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.