I wish I could join the throng of euphoric pundits who are now advocating Modern Monetary Theory (“MMT”). Most of them equate MMT with the ascendancy of central banks and their invincibility procuring worldwide prosperity even in the face of one of the swiftest business reversals in my lifetime. Politicians also see it as a pathway for transformational social programs like a guaranteed national income, cancellation of student loans, and the new Green Deal. Thoughtful economists are now conceding money printing is OK as long as it does not become inflationary.

Another Expert With A New Paradigm

Unfortunately, I have been around long enough to have witnessed too many “it is different this time” moments spanning multiple decades. First it was Michael Milken and Drexel Burnham and a seminal white paper from an expert about junk bonds being completely safe. Next it was the dot com bubble where any business plan with a modem could raise public capital. Soon thereafter it was the Big Recession where real estate mortgages on poor properties issued to people with substandard credit were transfigured, like the Wedding Feast at Cana, from jug water to fine wine.

Now you have another white paper episode from a professor at Stony Brook University, Stephanie Kelton who says Federal debt creation does not matter as long as you are issuing debt in your own currency and you are managing inflation. I have not read anything from Ms. Kelton on the question of whether a profit seeking enterprise actually has to be buying that debt for it to be benign instead of the current practice of the Treasury issuing bills, and notes at artificially low interest rates and the Federal Reserve Bank “buying” them. It is estimated that $2.3 Trillion of the Federal debt issued to provide Covid response stimulus is just book entries from the Treasury to the Fed with no third party price discovery.

Janet Yellen is now telling us that stimulus has to “go big or go home”, suggesting that the paltry “stimulus response” to the Big Recession slowed the return of prosperity.

Respected Investors Are Cautious

How about a few contrary theories from respected investors who are seeking profits without speculation, and are smart enough to understand these modern theories? Seth Klarman, James Grant and Jeremy Grantham are three such giants.

Seth Klarman, the founder of Boston based Baupost Group, a hedge fund with $30 billion under management sees it as a competition between the private sector and the public sector. Here is a summary of his recent letter to his own investors created by The Financial Times on the consequences of money printing:

“Mr Klarman referred to the Fed as an “800-pound gorilla” that has priced out investors who typically provide liquidity in moments of distress. The biggest problem with these unprecedented and sustained government and central bank interventions is that risks to capital become masked even as they mount,” he said.

James Grant in his January 22, 2021 Interest Rate Observer newsletter also questions the central bank playbook: “Prices convey information; artificial prices convey misinformation; interest rates are prices. Ergo suppressed interest rates misinform. They inflate asset values, misallocate capital and fill some pocketbooks while emptying others”.

Jeremy Grantham in his most recent newsletter “Waiting For The Last Dance” also spots a bubble and writes about the herd psychology that underpins the frantic dash to the cliffs:

“This time, more than in any previous bubble, investors are relying on accommodative monetary conditions and zero real rates extrapolated indefinitely. This has in theory a similar effect to assuming peak economic performance forever: it can be used to justify much lower yields on all assets and therefore correspondingly higher asset prices. But neither perfect economic conditions nor perfect financial conditions can last forever, and there’s the rub.”

I have seen a similar competition between governmental stimulus like unemployment insurance and moratoriums on mortgage defaults and rent evictions. The government is making it difficult to find employees and, inadvertently, is inducing businesses to invest in technologies to replace workers. By delaying or suspending creditors rights to keep people housed and fed, the government is making certain parts of the real estate investment landscape highly unattractive. Who wants to build multi-family housing where rents are controlled by the public sector? But if the interest rate for that loan is the lowest ever and I can pass the credit test…well maybe I will give it a try!!!

A recent example is a company we know that manufactures windows. It cannot find enough employees to meet the unexpected high demand for new housing and repair and remodel projects. Its competition for employees is partly a few new employers entering the local economy, but it is also the stimulus programs that incent not working like direct payments, unemployment insurance, mortgage default and rent eviction moratoriums.

The government has no cost of capital as long as the Treasury can issue bills and notes that are purchased by The Federal Reserve Bank at a rate set by The Fed. In essence, the risk free interest rate is zero. That is not true for private sector debt, all of our creditors are quite focused on monthly payments of principal and interest, and while the interest rates are low and the advance rates are aggressive, the debt must be repaid.

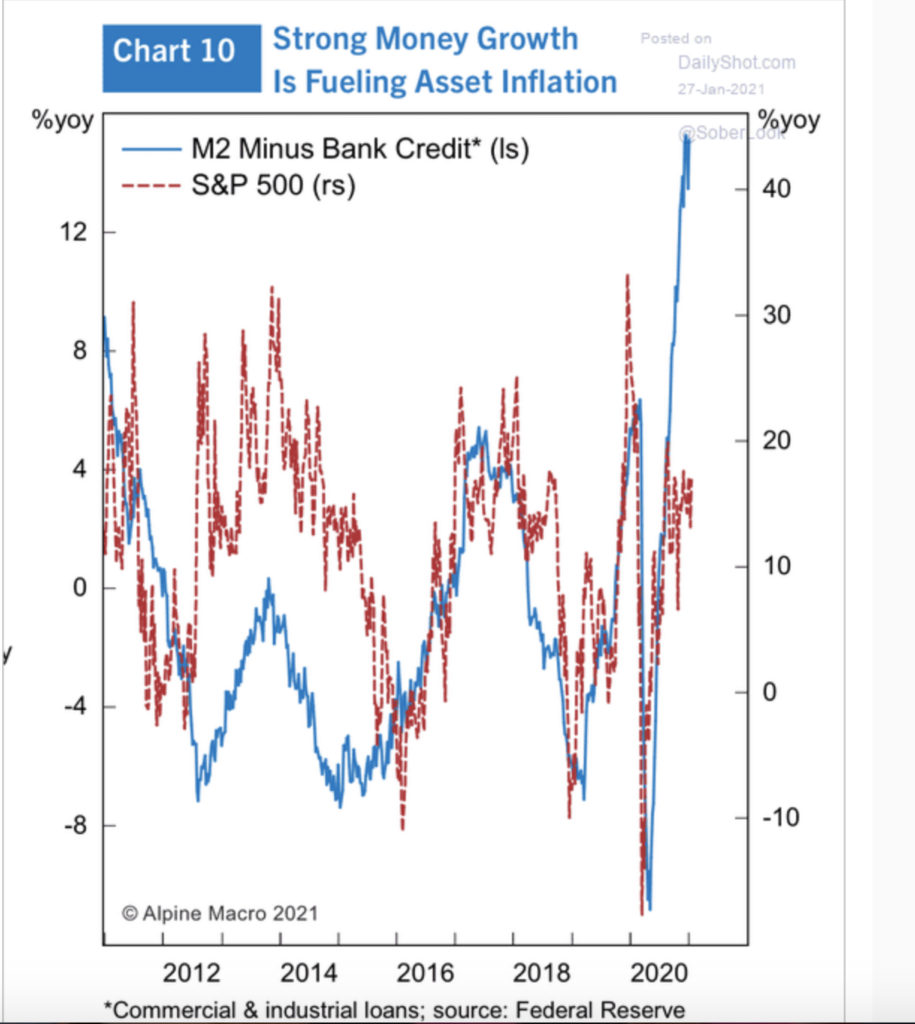

So far, I have not read anything from any economist examining the MMT experiment about the crowding out of productive business, but I see it as a significant risk. Here is a chart from The Daily Shot showing the correlation between money supply and stock prices:

Looking at the stock market, the bond market, the proliferation of SPACS, the housing market, Bitcoin and other crypto as validations of money printing presupposes, someone is actually thinking that deeply. Most investors are simply assuming the FED can control interest rates and, implicitly, will underwrite all markets like it just did in March of 2020. There is evidence of the same frantic fear of missing out on the next wave that I have witnessed in every one of the prior bubbles. But I will leave you with Grantham’s assessment from his recent newsletter. He is the expert. He has been wrong, but convicted, for more than a decade. That is courage:

“However, for any manager willing to take on that career risk – or more likely for the individual investor – requiring that you get the timing right is overreach. If the hurdle for calling a bubble is set too high, so that you must call the top precisely, you will never try. And that condemns you to ride over the cliff every cycle, along with the great majority of investors and managers.”

Who knows when but I am in the camp that it won’t be different this time. This is just an amateur’s opinion, but so far I have always had to repay my debts one way or the other.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.