Someone’s investment gyroscope is completely out of whack. For most of my investment life I have tried to discover unseen gems among the trash heap of abandoned stocks. These might be stocks with good revenue growth, low debt, high cash flows, a defensible position relative to other competitors and few financial analysts following their story.

However, nothing in my experience prepared me for the “pump and pump” crowd that creates fools gold from spinning straw like Hertz, Game Stop and AMC. The business model is also unique. Find a lousy company with a massive short position and coordinate a “short squeeze” by convincing thousands of followers to buy call options on the stock or the stock itself on margin. As the short seller is squeezed by the rising prices it must buy stock to cover its margin account deficit positions or add new capital to a trade going awry. Because the short sellers in Game Stop (GME, NYSE) had sold 110% of the outstanding stock they were actually creating a “naked short” position making them vulnerable to the Captain Crunch of All Squeezes.

I had two immediate questions about Game Stop. What are its fundamentals? If its fundamentals are bad, how will the legion of retail investors ever get out of their position?

Fundamentals Are Poor

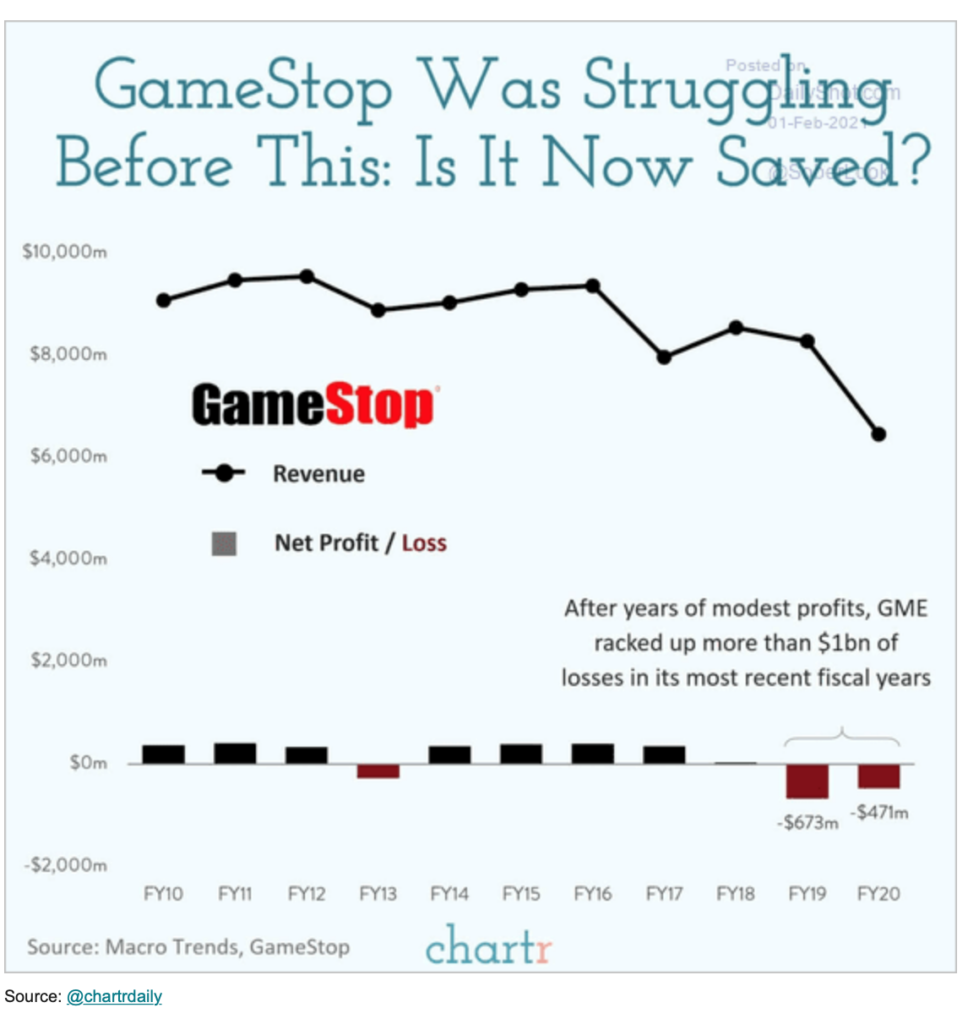

Game Stop (GME, NYSE) had a $30 billion market capitalization as of January 28, 2021. Looking over the last 4 years, its fundamentals are bad. It has declining revenues, declining earnings, declining free cash flow, declining dividends and insistent creditors who have removed more than $1.0 billion of capital, but are still owed $1.5 billion. Net debt to EBITDA is now 6.2x. It has had 5 CEOs in 4 years, and it restated its audited financials for 2018 and 2019. Here is a chart from “The Daily Shot” on February 1, 2021 showing historical sales and earnings:

A Pump and Dump Strategy For Sure

A “pump and dump” strategy makes sense if you can organize a “Captain Crunch” wolf pack of concerted day traders who buy, squeeze, inflate the stock price and then sell to a greater fool. But a “pump and pump” strategy, where you become a long term holder only makes sense if you can sustain the new valuation and then do a public offering or another capital raise at the new, nosebleed market cap. In 2020 I wrote about Hertz (HTZ, NYSE) demonstrating that a bad company cannot access the public markets https://capitalworks.net/hertz-bankruptcy-whos-in-the-drivers-seat/. Why would Game Stop be different?

Remember Who Owns The Casino

Major Wall Street firms own the Depositary Trust & Clearing Corp (DTCC). This is a private monopoly on the capital requirements, trading restrictions, clearing and custody of almost all the stocks and bonds in the world. It monitors all brokerage firms, including firms like Robinhood, for activity injurious to the safety and soundness of the capital markets. After all this is their casino.

The DTCC stepped into the GME manipulation and said Robinhood was insufficiently capitalized to underwrite the thousands of retail investors who were buying GME call options and stock on margin.

When you buy stock on margin and the stock goes up, there is no problem. But if the stock declines, you must have collateral worth $2X the margin debt. If a retail investor gets a margin call, she must add new capital to maintain the $2X ratio or Robinhood must sell her stock position. The problem with a retail investor base like Robinhood is insufficient outside capital to handle a margin call and the market interest in buying GME quickly evaporated. Robinhood and its capital providers had to absorb the losses in the short term and pray it can liquidate its GME position to pay back its banks. Robinhood may be caught with a large GME position at a high valuation and no counter party to buy on fundamentals. It had to suspend trading to try to save its franchise.

As a consequence, Robinhood has been forced to raise $3.4 billion of new capital which it will deposit with DTCC to allow it to continue in business. I guess Robinhood now understands it is a minor brokerage firm serving at the pleasure of the best firms on Wall Street and the video game trading it promotes just got toxic.

However, it may still own way too much GME from defaulted retail accounts and the price is falling. There is no way out of the squeeze and it may end up just like Lehman Bros.

So the damage from a video game trading foray is massive. The hedge funds who had the naked short position got wiped out, Robinhood and other accommodative online brokers that permitted margin trading in GME are facing massive capital calls, most of the retail investors will lose their investment, and the ownership in GME has come full circle. The short position is now back to 40%.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.