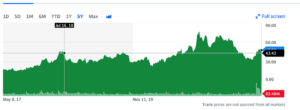

Elon Musk shocked many private equity firms when he proposed acquiring Twitter in a going private transaction for $44 billion plus fees. Twitter had struggled after the recent departure of its bearded co-founder and CEO/messiah, Jack Dorsey. Here is a chart of Twitters stock price since April 2017 courtesy of Yahoo Finance. It shows that prior to Musk’s takeover activity the stock traded in the low $30’s. The announced buy out price was $54.20 per share.

From a pure deal metrics standpoint this transaction is an incredible outlier. The median range of EBITDA multiples for large company transactions is currently 11x-13x Enterprise Value to EBITDA.

At a take private price of $54.20 per share, Mr. Musk is proposing to pay 6.5x 2022 estimated revenues of $5.98 billion and 30x projected EBITDA of $1.443 billion for 2022, and 61x projected net income for that period. Twitter is trading at 4x the EBITDA multiple for Meta and 3.0x the EBITDA multiple for GOOGL.

The capital structure for the transaction has not been disclosed but there is speculation that Mr. Musk will have to capitalize Private Twitter with as much as $20 billion of equity. “Fortune” has also reported that Musk has given his personal guarantee for a $12.5 billion loan to finance the transaction.

The “Financial Times “also reported on May 5, in an article “Larry Ellison, Binance, Sequoia Venture Capital Back Elon Musk’s $44BN Twitter Bid” that a number of private equity firms have looked at the going private deal but not a single one has said they want to be Mr. Musk’s partner.

Other Billionaires Paid Peanuts For Media Properties

Musk must see value in the Twitter franchise beyond deal math. Compared to what Jeff Bezos paid to control “The Washington Post “($250 million), what John Henry paid for “The Boston Globe “($90 million), what Patrick Soon-Shiong paid for “The Los Angeles Times” and other Southern California newspapers ($500 million), this deal cannot be benchmarked to other media transactions.

Musk Deal Is #3 Technology Deal

The only larger deals on record were public acquisitions of other technology companies. Microsoft bought Activision Blizzard for $68.7 billion and Dell bought EMC for $67 billion. However, in both of those transactions, there were proven synergies and oligopoly positions in their aftermath. Twitter just has opportunity for improvement.

What’s The Rest of the Story

So, the proposed third largest tech deal and the proposed largest media deal must be motivated by something other than high finance or return on equity? According to Musk himself, the acquisition of Twitter is about restoring free speech. An early investor in Tesla, James Anderson, one of the founders of Scottish investment firm Baillie Gifford had this opinion in a recent interview by Barrons on April 29, 2022:

“Many years ago, we were shareholders of Twitter, and were frustrated by management changes and the apparent inability to turn this powerful platform into a machine. I don’t think Musk’s investment is about that, though. He takes his interpretation of the moral tasks of our time around free speech incredibly seriously. So, am I shocked that he would do this? No. Do I know where it goes? No.”

A week ago, in a tweet that he later deleted, Musk also claimed that its reliance on an advertising business model had exposed Twitter to the “power of corporations to dictate policy.” But experts warn that relying on other business models such as subscriptions for its income could reduce the reach of the service. “There would be much less conversation if it was a paid platform,” said Rich Greenfield, a consultant with Light Shed.

One thing almost everyone agrees on is Musk intends to openly revamp the algorithms that decide who gets heard on Twitter. I just wonder whether his emphasis on returning to “First Principles”, which propelled the simplification of the rocket technology for SpaceX and put a computer on wheels for Tesla is really at work in the Twitter logic.

Could it be that the forum for non-tribal, free speech will double the audience for Twitter followers and spawn a business model where subscribers pay for well informed, yet contradictory, points of view?

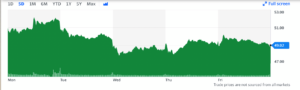

It is hard to be against Elon Musk, but many detractors suggest he really does not understand the complex choices you make when you are deciding the rules for a social media platform. With time and due diligence, he may decide to let the Private Twitter deal drop. He apparently has a walk away right for $1 billion. Only he can decide if he has a formula for success, but the merger arbitrageurs still have some doubts as is shown in the following chart of trading prices courtesy of Yahoo Finance for Tesla for the week of April 25, 2022. Notice that the stock sold off after initially trading slightly below the take-out price:

The recent sell off in technology stocks has not helped the deal math either. With the TWTR stock trading at 47.48 on May 10 (a 14% discount to announced price), the arbs are signaling this transaction may not happen.