One of the challenges of having a rowboat is learning to navigate forward by constantly looking backward. This is unique. No other mode of transportation has your future course decided by a point behind you— a rock, a buoy, shoreline trees or a mooring. Unless your head can spin on your shoulders like Linda Blair in “The Exorcist”, your ability to keep a straight line to your target relies on constantly reassessing your relationship to the reference point behind you.

Investing is usually considered a forward-looking activity— remember past performance does not guarantee future results. The investment process is fixated on predicting future earnings, events, or trends. Rarely does a reference point in the past matter as much as what is likely to happen ahead.

Right now, the future of almost all investments and asset classes, public or private, is unknowable. However, the past is certain. There are at least 4 forces established many years ago that have dictated performance in all asset classes since 2008. They have been dependable markers for almost 15 years:

- LIQUIDITY

- LOW INTEREST RATES

- CONSUMER PARTICIPATION

- DEBT BASED MULTIPLIERS

I ask whether you have confidence today rowing forward with any one of these 4 forces being your fixed navigation point?

Liquidity

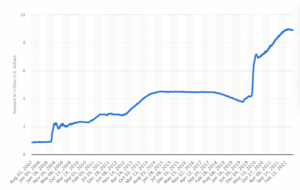

Let’s start with LIQUIDITY. How can liquidity in future markets equal or exceed the last decade? Central banks have created prosperity and inflation by providing too much liquidity through a program called “quantitative easing.” That program saw the Fed creating money to buy and hold on its balance sheet many assets, but its principal market activity was the Treasury market, and its secondary activity was mortgage-backed securities. A third and more recent activity is shoring up money market instruments by providing nightly liquidity at a small yield through a Fed subsidized repo facility. Together these persistent injections of liquidity have increased the Fed’s balance sheet from just under $1.0 Trillion in 2008 to $8.89 Trillion in 2022. Here is a chart from Statista showing the growth of the Fed’s balance sheet:

These governmental, non-market-based liquidity measures used to be 100% private market activities where banks, brokerage firms, foreign investors and private domestic retail and wealth funds supplied liquidity to the Treasury, Mortgage-backed and Money markets. These private markets were choppy and at times highly illiquid just like you saw in 2000. You had to ride out the tempests of illiquidity which meant being quite certain about the survivability of what you owned.

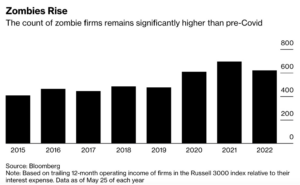

Since 2008 there has been non-market-based liquidity for even the riskiest assets as shown by the performance of Zombie corporations. Zombies are public companies whose net income is insufficient to cover interest expense. It is surprising that they represent just about 20% of all publicly traded companies. It is also true that they are represented in micro cap, small cap and some mid cap exchange traded funds.

Low Interest Rates

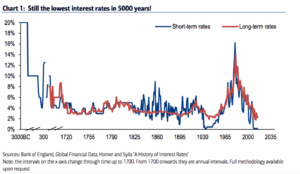

How about LOW INTEREST RATES? With a long period where the cost of debt was under 2% comes a “risk on” mentality of incurring debt to buy back stock. Almost all real assets from real estate to private companies and every asset class in the capital markets have depended on this marker as well. The Fed may not have the gumption to raise rates quickly, but the private sector will likely reprice risk when it perceives liquidity is reversing and inflation is sticky.

Here is a 5000-year chart of interest rates. We have experienced the lowest rates in history:

Consumer Participation

Liquidity and low interest rates allowed the US consumer to buy almost any asset, especially since 2008. The “risk on” party was irrepressible and anyone who was unable to participate fell way behind in terms of wealth creation. You failed the IQ test if you sat on cash. Here is a chart showing the return of “risk on”:

Debt Multiplying Demand

Risk on mentalities alone are not as dependable as risk on plus an almost unlimited supply of debt. Any asset class that could access debt markets could leverage equity from 4:1 to 10:1. That trend has now ended and there is a noticeable contraction in the ratios of debt to equity.

New Markers for The Next Phase

So, if interest rates are no longer the lowest in recorded history and debt is no longer plentiful, I am looking behind me and asking which of these formerly reliable, unwavering points of investment reference are still suitable for the thousands of oar strokes I still am going to take? I think I am going to look for new fixed points of reference:

Cash Flow – Liquidity must be generated by the business model itself. If a public company wants to pay dividends or buy back its stock it will have to generate the free cash flow to do so or borrow at low fixed rates.

Rising Interest Rates – As companies meet their wall of debt maturity a whole swath of the US economy will be rendered insolvent. The so-called Zombie companies will perish if they have not combined with others before they hit the wall. Variable rate debt will replace low-cost fixed rates as asset classes are revalued and loan-to-value ratios fall.

Real Markets – The Fed will slowly withdraw as a market maker. This will mean a long period of reestablishing functioning markets. Risk will be over-priced at the start and smooth functioning will be restored only when the risks are, like a casino, mathematically in favor of the operators.

Inflation – Inflation is like Lyme Disease. It is unpredictable and chronic if not treated immediately with powerful antibiotics. The highly indebted Fed can only prescribe baby aspirin in its approach of Quantitative Tightening and Limited Rate Increases (“QTLRI”). Anything else and either the Fed will be unable to service the interest on its debt or it will simply write-off the $3 Trillion it is owed by the US Treasury.

Right now, I am still thinking through what QTLRI will mean for all investment classes and zig zagging all over the harbor in my investment row boat trying to set a straight course for the next 15 years. Looking backward to move forward is awkward, but once you have confidence in your markers everything improves. Try it yourself.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.