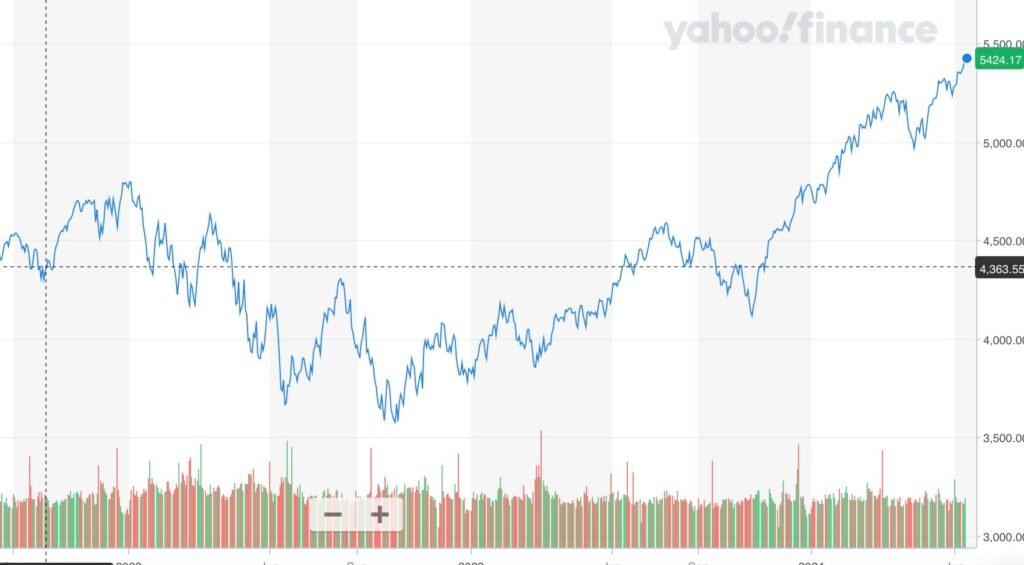

I have been monitoring many of the favorite investment names in the U.S. stock market like Eli Lilly (NYSE: LLY), Progressive (NYSE: PGR), Facebook (NASDAQ: META) and Alphabet/Google (NASDAQ: GOOG). After a significant downturn in 2021 these stocks and many others have rebounded and, in many cases, have exceeded the giddy highs set in October 2021. A few of them like Eli Lilly (3.3x), Progressive (2.2x), Dick’s (1.8x) and Parker Hannifin (1.7x) are pretty basic companies and not helped by any AI tailwinds. Their recovery from the trading price on October 21, 2021, when investors sold out of the S&P500 after discovering that inflation was persistent, and the Fed was not going to abandon quantitative tightening (selling down its balance sheet) was pretty remarkable. Here is a chart of the S&P 500 from January 1, 2021, to June 12, 2024.

The resilience of the top stocks in the S&P 500 is almost magical, rivaling the momentum of the buying frenzy in GameStop (NASDAQ: GME) after Keith Gill, aka “Roaring Kitty”, invited his Reddit followers to buy the stock again after a 3-year hiatus. Here is a chart of GameStop from January 1, 2021, to June 12, 2024.

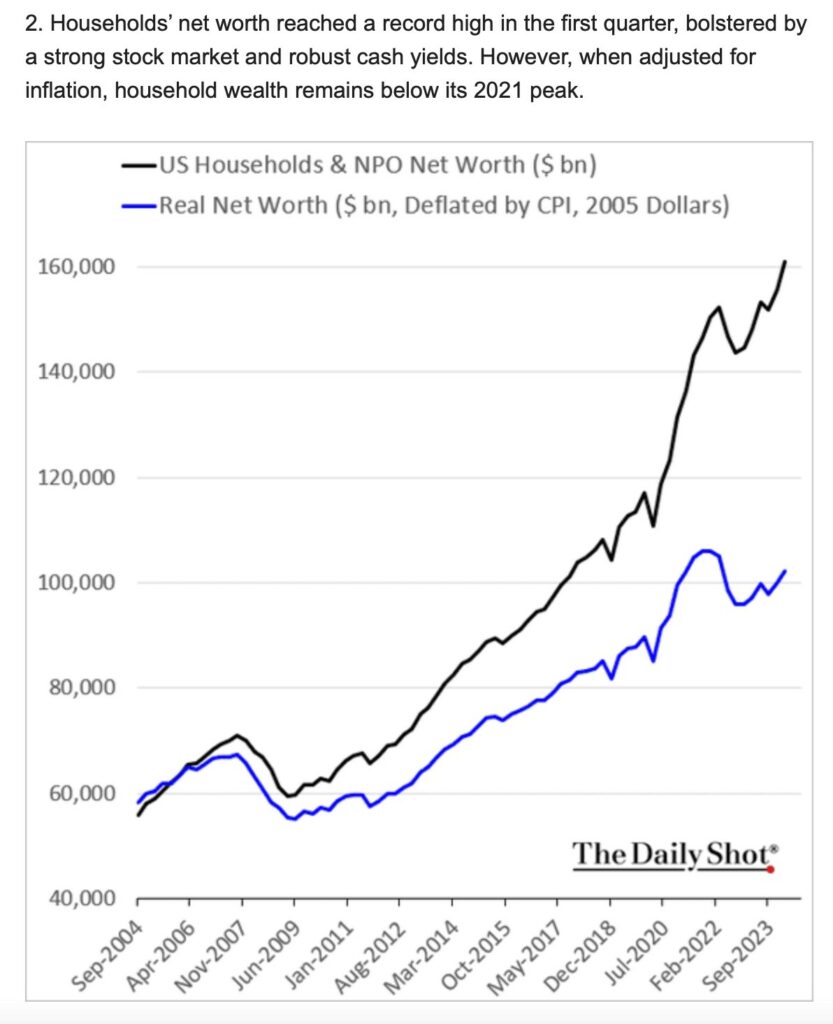

These momentum stocks are moving at dizzying speeds, and it looks like they are great wealth creators for their holders, but it is easy to forget about how inflation confuses nominal and real returns. It is like a sailboat named “Market Momentum” making 5 knots of forward progress against receding tide called “Inflation” travelling at 6 knots. Get ready for 6 hours of frustration with no progress at all. Market Momentum would be better off dropping an anchor and waiting for the tide to turn.

Here is a chart from The Daily Shot that shows for all the “Roaring Kitty” like momentum of the stock market — especially the S&P 500 market cap weighted index — these dramatic changes in net worth are not enough to compensate for how inflation has eroded purchasing power below 2021 levels. By my calculation the cumulative hit has been 35%:

In stark contrast is the dismal relative performance of the S&P 500 Equal Weight Index which according to “The Daily Shot” is now trading at the largest discount to the S&P500 Market Cap Weighted Index since 2008. Inflation mitigation has only been successful if you own those few stocks benefiting from investor momentum or the index funds they comprise. If you are just buying stocks, equal weighted large or small caps, or any other genre of equities you are in a dingy rowing against a 6-knot tide and going backward fast.

You are also seeing a new sign of flagging “nominal” profits as the price of some of your retail or services experience is now being increased by a “reimbursement charge” for the transaction fee the credit card companies charge the retailer.

I could not believe my auto repair dealer asked me to pay cash or use a debit card to reimburse that 2 1/2% credit card charge for an oil change and a tire rotation. This suggests to me that inflation is making that transaction fee large enough to matter. It is also an indication that retailers are losing pricing power to combat inflation and need an expense reduction subsidy by the consumer to maintain current profitability.

While all the financial news in an election year is as cheery as a 70-degree day in April, I am wary about the rest of the story we may hear in December.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.