Over the last several decades a profound shift has occurred in the world of investments and responsibility for investment risk.

Once upon a time when I started my career in the 1970’s, the risks associated with investment decisions were squarely shouldered by investors themselves. In this traditional model which had existed from the beginning of investing, investors made decisions, accepted the potential for both gains and losses, and were rewarded or punished based on the performance of their investments.

This model led to successive boom and bust cycles highlighted by predictable and ruinous bank failures the most damaging of which was the 1929 stock market crash and the ensuing depression lasting from 1929 to 1940 in the United States. But there were many other calamities pre-dating the Great Depression, the most significant of which were the Panic of 1893 and the Panic of 1907.

The Federal Reserve System was introduced in 1910 at a secret gathering of leading businessmen in Jekyll Island, Florida. That lightly publicized planning session is the subject of an interesting financial book written by G. Edward Griffin titled “The Creature From Jekyll Island”. That creature was The Federal Reserve System, and its goals were documented as providing stability and preventing financial panics and stabilizing the banking system through supervision and regulation.

In its early iteration the Federal Reserve System worked as planned by providing liquidity in times of bank crisis. However, in recent years, a growing trend has seen the Federal government increasingly stepping in to manage and underwrite risks outside the purview of its creation.

This shift has significant implications for the financial system, the economy, and the future of capitalism itself.

The Traditional Model: Investors Bear the Risk

Historically, investment risk was a private matter. Investors, whether individuals or institutions, understood that they were putting their capital on the line. If a company failed, or a market collapsed, those who had invested in those entities bore the brunt of the loss. This model encouraged prudent decision-making, thorough research, and a cautious approach to investing. The potential for loss was a natural check on reckless behavior. This risk-bearing structure was fundamental to the functioning of free markets. It aligned incentives: investors who took on more risk in search of higher returns were rewarded when their bets paid off, but they also faced the possibility of losing their entire investment. This model fostered a sense of responsibility and accountability.

A shift to “Government as the Underwriter of Risk “has recently emerged as another mandate. In recent years, The Federal government has increasingly taken on the role of risk manager and underwriter for the investment community. This shift can be traced back to several key events and trends summarized below.

The 2008 Financial Crisis

The global financial crisis was a watershed moment in the transfer of risk from private investors to the public sector. When major financial institutions faced collapse, the Federal government intervened with massive bailouts. This set a precedent that some institutions were “too big to fail,” effectively guaranteeing that the government would step in to prevent catastrophic losses, even at the expense of taxpayers. Here are charts prepared by ChatGPT that shows investment volatility before and after the GFC:

Quantitative Easing and Low-Interest Rates

In response to the financial crisis and subsequent economic challenges, central banks, particularly the Federal Reserve, implemented policies such as quantitative easing (QE) and maintained historically low-interest rates. These measures have distorted risk pricing in financial markets, encouraging investors to take on more risk, knowing that the Federal Reserve would likely intervene to stabilize markets if necessary.

The COVID-19 Pandemic

The government’s response to the economic fallout from the COVID-19 pandemic further entrenched its role as the underwriter of last resort. Trillions of dollars in stimulus measures, including direct payments to individuals, expanded unemployment benefits, and unprecedented support for businesses, demonstrated the government’s willingness to absorb economic shocks that might otherwise have led to widespread financial losses. Notice the smooth red line below showing market stabilization.

Moral Hazard

As the government continues to absorb risk, the concept of moral hazard becomes more pronounced. Investors, knowing that the government is likely to step in during a crisis, may engage in riskier behavior than they otherwise would, expecting that any significant downturn will be mitigated by federal intervention. This dynamic distorts market behavior and erodes the fundamental principles of risk and reward.

The Implications And Where Are We Headed?

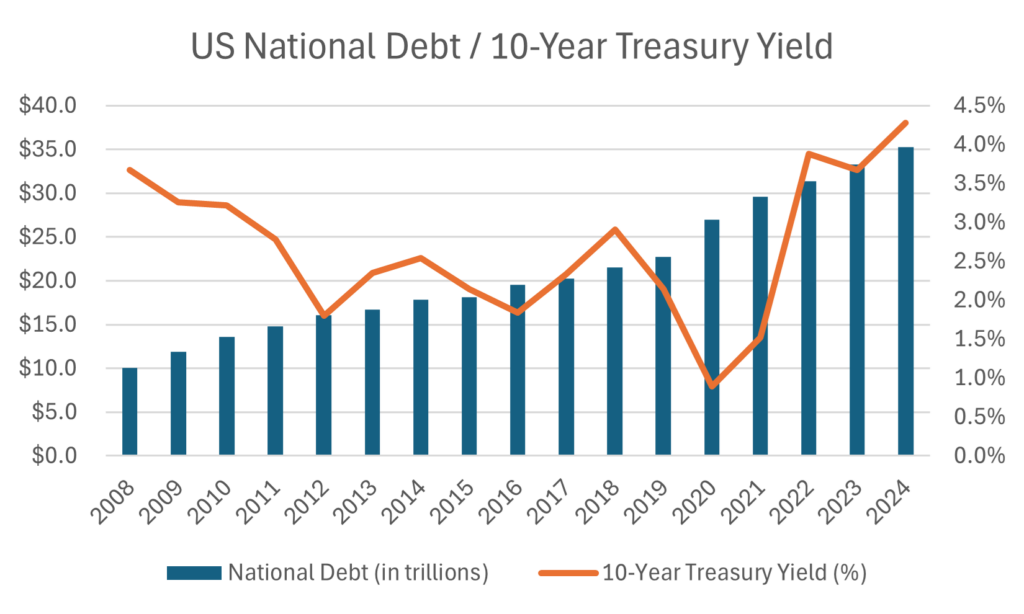

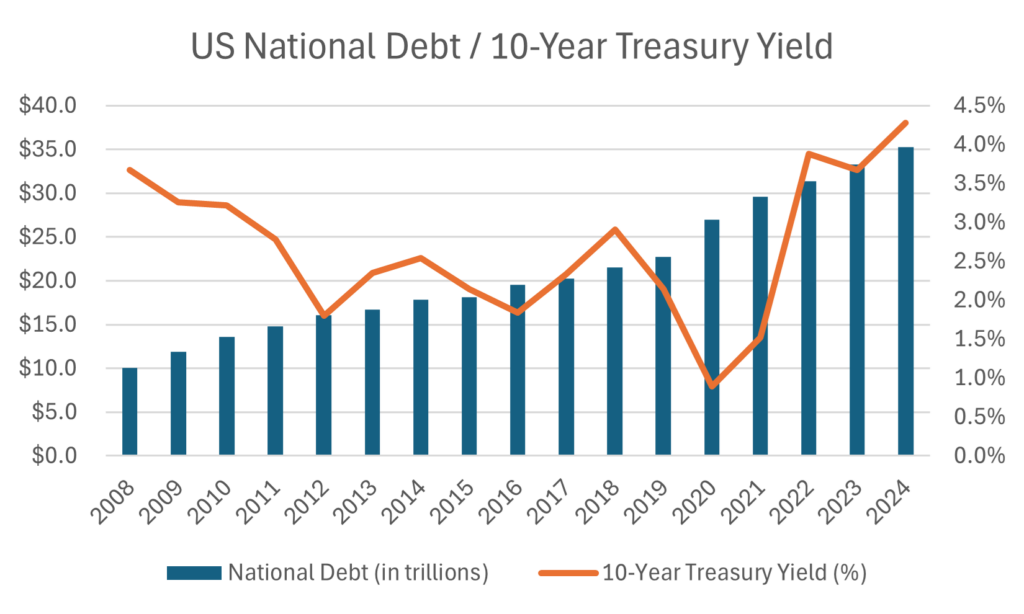

The consequences of this shift are far-reaching and multifaceted. While government intervention can stabilize markets and prevent economic collapse in the short term, it raises critical questions about the long-term. Foremost among those future risks are misplaced comfort with using debt to purchase assts, or spur growth. A handmaiden of the debt creation incentive is the expectation of low interest rates. Here is a chart showing a recent history of government debt levels and interest rates:

The Fed’s Fiscal Dominance Dilemma

If you have ever experienced a toothache, you know how it dominates and controls your life until you can get to the dentist. In 2024 the Fed has its own toothache, and it is blocking out all other considerations. The implicit “Fed Put” promise of market liquidity and stabilization with printed money flowing like a river from 2008 is now competing with a new pain called “fiscal dominance”.

This means monetary policy decisions are heavily influenced or constrained by keeping interest rates low to support required Treasury debt refinancings as well as new debt creations. Many investors don’t realize the Fed has a toothache and continue to invest as though the Fed will honor its traditional goal of controlling inflation and stabilizing the economy, inflation, and maximizing employment

Trump’s promised legislative agenda of cutting taxes and increasing spending is only going to make the pain worse. What is now a $35 Trillion toothache could be a $42 Trillion trip to the dentist without Novocain at the end of his term. Restraint and consistency are needed and threatening to fire the Fed Chairman in the midst of this crisis of fiscal dominance begs the question of what is next?

Fans of Bitcoin are voting with their wallets.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.