In 1971 I was married while in college. I distinctly remember inflation in gasoline and food prices. I also remember wage and price controls because our landlord made us “rent to buy” furniture from his cousin as a way of increasing our rents. I have no recollection of what was happening with wages, but my research shows there was a huge surge in labor costs.

In all these cases, scarcity created inflation.

Like many of you, I am confused about the inflation we are experiencing in 2021, especially wage inflation. With 9 million job openings, and 9 million unemployed workers there appears to be balance and no possibility of labor scarcity.

I can see why many Fed watchers buy into the temporary nature of the workforce imbalance. All will be well in September when unemployment subsidies expire and kids go back to school.

I am less sanguine about central banks’ ability to control outcomes given so many known labor variables, and at least three or four that could arrive as surprises. I also have absolutely no confidence the Fed really has the chops, like Volker in the 1980s, to fight wage inflation by persistently raising interest rates.

Population Growth, Aging Boomers and Generation Z

The current Pandemic and its first variant come at a time when there are meaningful demographic, societal and lifestyle changes in the United States.

A July 31 article in “Barron’s” by Lisa Beilfuss entitled “The Labor Shortage Is Worse Than It Looks, and Help Isn’t on the Way”, questions the soft landing and predicts high wages for the foreseeable future. Her thesis is wage inflation from labor scarcity will be pernicious because of these trends:

- Baby Boomers are retiring

- Birthrates in the U.S. are falling

- Stay at Home Parenting may not end

- Entry Wages have already moved up

- Safety Net Programs, Like Child Care Credit, will persist

- Resurgence of Infections will discourage physical work

On top of these trends we will all probably agree the world is no longer our back-up employment pool. Tariffs, immigration policies, nationalism, re-shoring and trade wars will limit the amount of goods and services that can be outsourced for cheap labor.

There is also a fear Generation Z will not work in lower paying jobs like restaurants, hospitality and manufacturing.

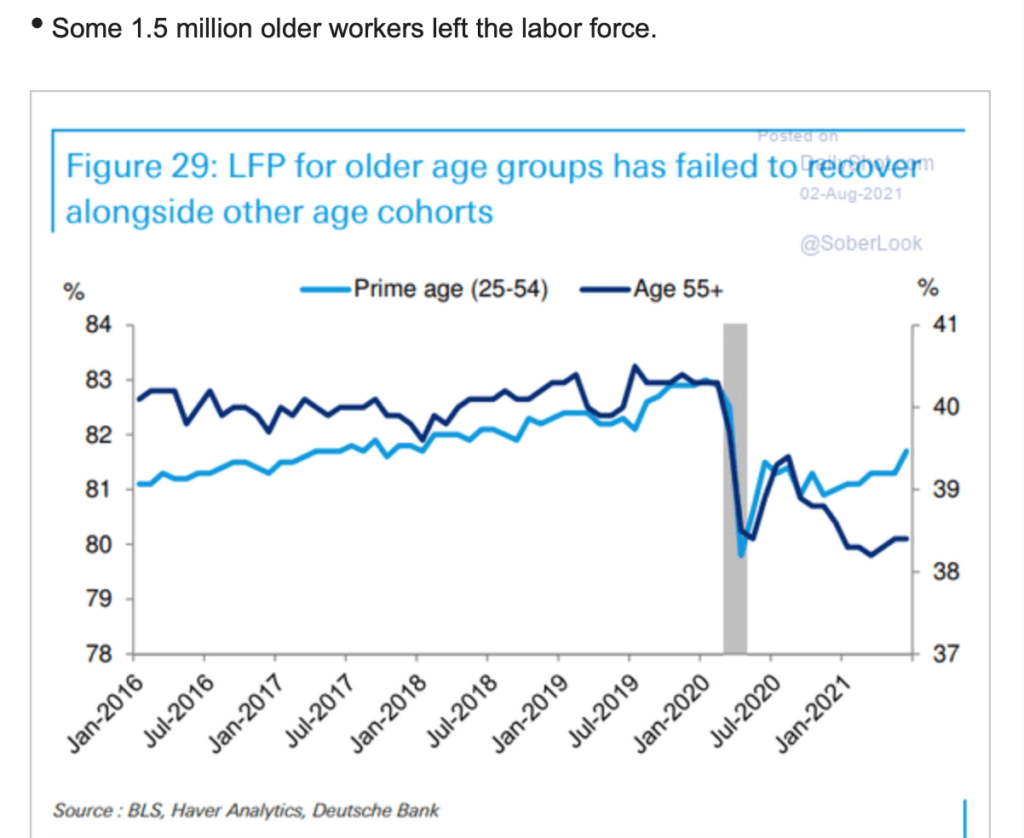

Baby Boomers Are Not Coming Back To Work

The Baby Boomers are retiring. The Pandemic accelerated the trend, and now they are no longer a dependable replacement for the 9 million unfilled jobs. The oldest boomer is now 75 years old. That cohort was attentive to the dangers of the first round of infections and they already have credible fears about the delta variant. I would be surprised if they are a pool from which unfilled jobs can be had at any price.

Here is early confirmation of that trend from “The Daily Shot” on August 2:

A Second Wave May Bring Children Home

The second wave risk also impacts children, schools and daycare. From everything I have read this second wave is much more contagious than Covid-19, and is making younger people sicker than the first wave. Why would we expect a return to normal schooling when the infection rates are likely to sky rocket in September? Stay at home parenting (mostly Mom’s) is unlikely to go away and that means fewer workers.

Automation Is Coming, But Short Term Will Not Help

There is a whole swath of GDP like hospitality and industrial that requires physical presence and physical work. The hybrid work model doesn’t wash dishes, make beds or run production equipment. According to the National Restaurant Association the restaurant segment alone accounted for 10% of the US workforce in 2019. It relies on lower wages to make its business model work. Short term, automation will not fill the gaps.

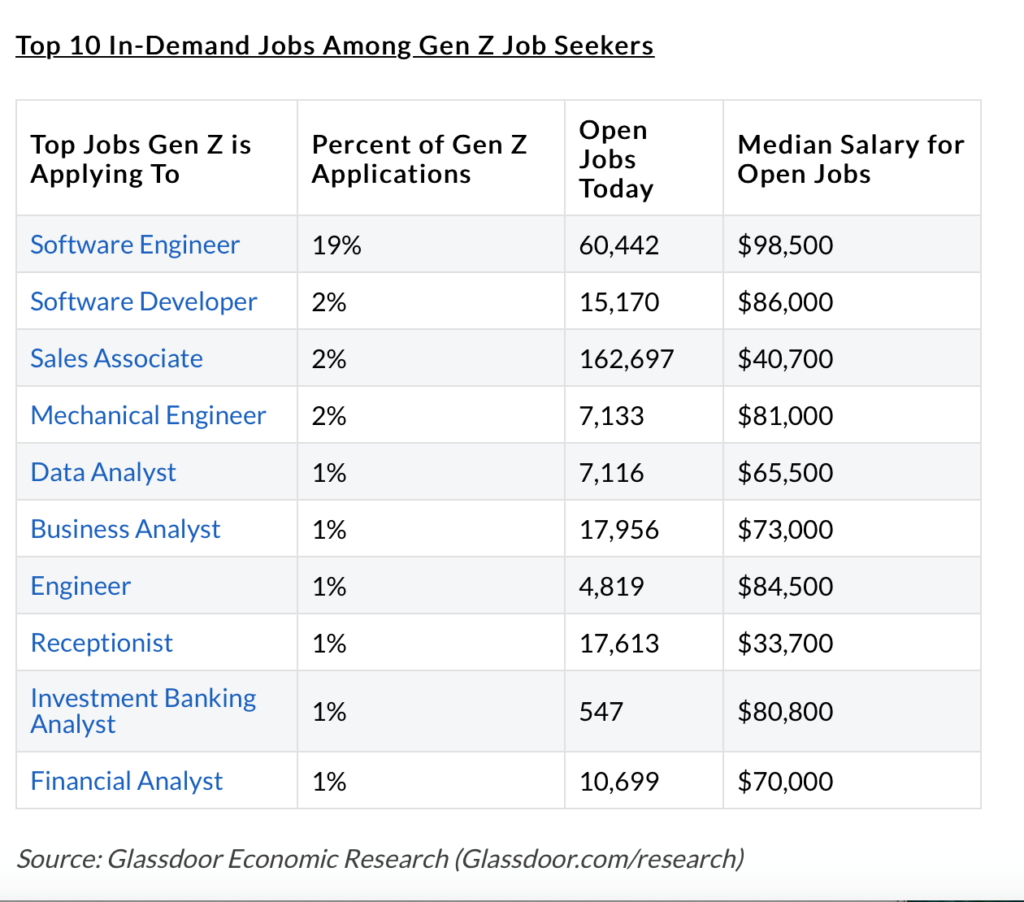

Will Gen Z Go To Work For Minimum Wages?

There is a fear Generation Z will simply not work in many of the industries where jobs are plentiful like retail, manufacturing, or hospitality. This cohort is estimated at 90 million people under age 25. When McDonald’s is advertising $15.00/ hour plus benefits and the 18-20 year olds are not showing up there is a problem.

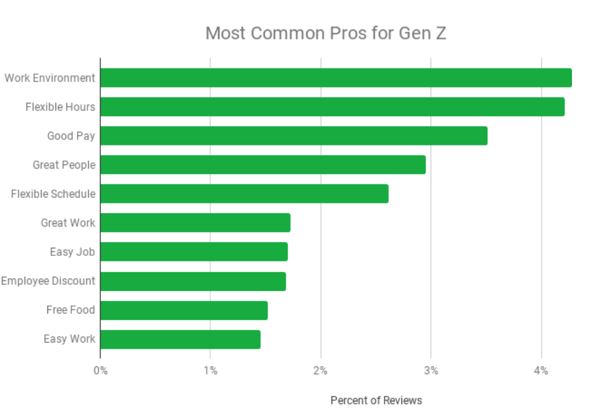

Ms. Beilfuss says the job switching reservation price now exceeds $70,000. This would suggest the entry level wage and benefits for 2000 hours is no longer $30,000. The inflation in rents, food, and homes may compel a much higher entry wage. Is it also possible the Gen Z pool won’t budge for less than $20.00/hour wages and benefits? Here is research from Glass Door about Gen Z’s top ten job interests and positive attributes (“Pros”) they seek in employment:

One thing is certain about Gen Z, they don’t want most of the entry level jobs that are available in hospitality and manufacturing.

Worldwide Cheap Labor Interruptions

Covid-19 has muted immigration, and tariffs have ignited a re-shoring rhetoric. Whether labor demand follows the rhetoric is still to be seen, but it is just one more variable impacting possible wage inflation.

Wages have already increased by 10-20% for most of the manufacturing companies in our portfolio. Scarcity in the workforce and a mismatch of skills and interests puts any business with a production model in an impossible labor situation where the only long-term solution will be higher wages.

The Fed says it has a firm grasp on the tiller, but I don’t think they are prepared for a few rogue waves like a massive gap in skills matching and the number of workers who can or will show up in person. The only way to get them to work is to raise wages and wage inflation is the hardest kind to cure.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.