It is with a massive dose of humility that I am attempting to divine why Warren Buffett has sold down his large ownership position in Apple stock and how he accomplished it without affecting the trading prices. Here is a 5 year chart of Apple’s performance. It has risen from around $68 per share in 2020 to $248 per share for a compound growth rate of 29.5%.

Apple Inc Five-Year Stock Price Chart. Source: StockCharts

According to “Forbes” magazine, Mr. Buffett has sold 605 million shares or almost 70% of his Apple position:

Starting Value= $175 Billion

- *Q4 2023 10 million shares sold

- *Q1 2024 116 million shares sold

- *Q2 2024 390 million shares sold

- *Q3 2024 100 million shares sold

Ending Value= $70 Billion

During the period where, in a quite public way, one of the smartest investors on the planet was exiting AAPL, exchange traded funds, institutional investors, index funds tracking the S&P 500 and mutual funds were all buying or holding on to their positions in AAPL.

Index funds had no choice. During the two year period Buffet was selling, AAPL continued to represent a 6.5- 7.5% weighting in the S&P 500 as investors continued to demonstrate confidence in the U.S. equity markets. AAPL also was included in just about every conversation about artificial intelligence. If you asked informed investors whether they would buy a stock Warren Buffet was selling I think the more astute among them would want to know why he was so quickly and aggressively changing his asset allocation.

This also illustrates two lessons for all of us amateur investors. The first is Mr. Buffet was counting on momentum to provide liquidity for his exit. That momentum during his selling period came from bullish net inflows to equity funds concentrated on the AI trade, Apple’s own $110 Billion buyback program, and index funds required to buy what Buffet is selling to mimic the weightings of the S&P 500 constituents. When institutional money is only flowing one way, there are rarely adjustments in the weightings unless there is some stock specific bad news. During the period Buffet was selling there was mostly good news for Apple.

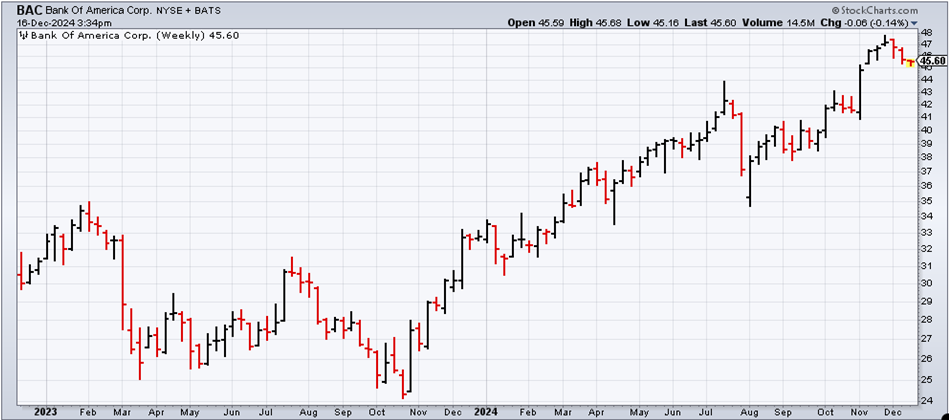

I also checked the stock prices for Bank of America. Buffet divested $10 Billion worth of stock with only a small decrement in trading value. Here is a chart for BAC for the two-year period ending September 2024, when Berkshire Hathaway was a seller.

Bank of America Corp Two-Year Stock Price Chart. Source: StockCharts

I am the last person who would suggest you should not hold Apple or Bank of America just because Mr. Buffet is selling down his position in a major way. But if you forget motive and you just look at what has happened over the last 4 quarters Mr. Buffet is signaling that he prefers cash, even though both AAPL and BAC pay dividends, and have quite large stock buyback programs. He may also be signaling that when you have large concentrated positions you need to find liquidity when you can safely exit without depressing the share price. It might be fair to conclude that Mr. Buffet wanted to safely change his asset allocation at Berkshire Hathaway by selling down his most liquid and momentum driven publicly traded assets.

Berkshire’s Resulting Asset Allocation Model

Maybe the other lesson for all of us who are amateur investors is to understand the skill it takes to hold a portfolio of highly concentrated publicly traded stock and still achieve complete liquidity without any portfolio decline. In the case of Apple at one point in the period 2023-24 Berkshire Hathaway’s Apple holdings reflected 915 million shares, worth over $715 Billion and 50% of the market value of Berkshire’s entire equity portfolio. After selling shares of AAPL and shares of BAC Berkshire’s total public equity exposure is now $266 Billion against total assets of $1.114 Trillion or slightly more than 23%. His cash position is $325 Billion against a total asset base of 1.114 Trillion or 29.2%

So, as an asset allocator Mr. Buffet is currently positioned 29% in cash, 23% in publicly traded stocks, and 48% in other assets, the largest of which are Geico and BNSF Railroad. He is also signaling that even in his 90’s he still loves pizza (Dominos), ice cream (Dairy Queen), candy and chocolate (Sees Candies), and Coca Cola.

That probably is not the recommended diet for a 2025 New Year’s resolution, but it certainly is an appealing food group for the holidays.

Merry Christmas and Happy Holidays. Hope 2025 Is Your Best Ever.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.