Detective Harry Callahan, Dirty Harry, was played by Clint Eastwood in a series of movies beginning in the 1970’s. As a detective for the SFPD Dirty Harry was highly unconventional in his approach to policing. For example, he did not carry the standard issue police revolver, preferring instead a Smith and Wesson 29 that housed a .44 magnum bullet.

He often reminded his captor that it was the most powerful handgun in the world. Harry was also famous for having steely resolve and certainty, especially about whether he still had a bullet in his gun: “I know what you’re thinking, ‘Did he fire six shots or only five?’ Well, to tell you the truth, in all this excitement, I’ve kinda lost track myself.” Harry was rarely confused even when he was wrong because he had confidence in himself. And he knew how to count.

Once In A Millenia Munificence

The abundances bestowed on the American people by governmental aid responses to multiple versions of the current pandemic have made many ordinary people wealthy or wealthier. Public retirement plan deficits have been reduced; the IRS has sent millions of Americans extra cash. Defaulting debtors have been given time to repair their balance sheets as governmental edicts handcuff creditors with moratoriums on student loans, rent defaults, and missed mortgage payments. Small businesses and their employees have a second life because of payroll protection programs and credit programs. Municipalities with bad balance sheets can now borrow with investment grade balance sheets. Home ownership has become available to a whole group of young people forced to live with their parents through ultra-low mortgage rates and accommodative lenders. Stock markets rose like the sun and never set.

Most importantly, the recipients have been acting like Dirty Harry. They have been counting properly and have certainty and resolve about not giving it all back:

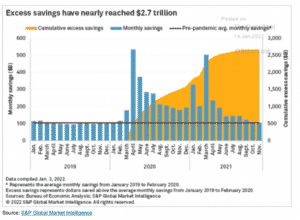

Notice that through November 2021, the savers have never wavered in their certainty the fairy tale will end and their resolve not to shoot their last bullet. This kind of savings response with 22 months at or above the pre-pandemic savings rate gives me hope for the quality of a recovery.

The Training Wheels Are Coming Off

The Federal Reserve has announced that it will slowly begin to remove training wheels from just about every asset class. Americans young and old will be facing a hard fall on the sidewalk if they cannot keep moving with confidence and speed. The big question is what to do?

Maybe the question they should be asking, instead, is what not to do. Like Dirty Harry or the new two-wheeler experience the best advice is don’t lose count, don’t make any quick changes of direction, and believe in yourself.

If you have been a saver don’t let inflation scare you into an uncomfortable position. After all, inflation is only temporarily taking away buying power on lots of money you never had in the first place. Make sure your savings are guaranteed by the US government. Some money market plans have a guaranty. The governmental plans are probably less likely to “break the buck,” which means falling below a $1.00 par value.

If you have debt, try to make the interest rate fixed, not variable. Credit cards have variable rates, but most home mortgages have fixed rates. If you have been counting like Dirty Harry, you realize these rates are low now but likely to rise as the training wheels come off and the Fed stops buying mortgages. Ask your bank if you can switch variable rate credit card debt into a fixed rate mortgage on your home which has likely appreciated in value.

More Sophisticated Asset Classes Need Simplification

If you have been lucky enough to have invested in the stock market, the private equity market or the multi-family or commercial real estate markets and those investments have worked out, they are unlikely to simply crater when the Fed stops accommodating. But this is where resolve comes in. Like a good detective you better ask yourself how much risk you have been taking in those investments.

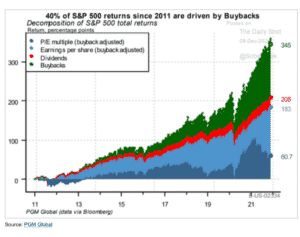

You are probably the best judge of how likely that investment will preserve what you have gained. Again, if it loses just a little you still have the sixth shot. A good barometer of risk is how much of your gain was totally unexpected. If it was a big number, then you probably were swept along by a huge tide of money and will give it all back once the money stops flowing.

One example of that money tide was stock buy backs. Even poor corporate credits were able to get capital to buy their stock back. If your investments rely on buy backs continuing or having creditors take an enforcement holiday, common sense suggests the fairy tale may be ending soon with a face plant on the sidewalk.

Advisors Can Help, But You Need Certainty and Resolve

The pandemic has been horrible for our society, but often good for your pocketbook and your financial well-being. If you are uncomfortable about making decisions alone, there is a lot of help available but good outcomes rely on your certainty and resolve. Be a counter like Dirty Harry but foremost don’t be afraid to make decisions for yourself.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.