The wealth management industry has a prediction dilemma. Like environmentalists trying to predict where you could safely preserve five trillion gallons of newly created fresh water, crafting an asset allocation strategy for 2022 is complicated.

$5 Trillion is slightly more than the gallon volume of water in Seneca Lake which is the largest of the Finger Lakes in New York State. Where could you safely dump that volume without some weird results?

If Preservation Is the Goal, Choices Are Few

You could dump it in the Great Salt Lake or the Mojave Desert but that would probably make it undrinkable. You could dump it in the Mississippi River, but you would probably flood most of the adjacent towns. You could dump it in the oceans but that would squander fresh water. My only suggestion would be Lake Superior. It could handle 5.0 trillion gallons and its water level would only rise a few inches.

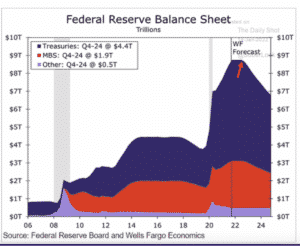

The Fed has dumped the equivalent of Seneca Lake into the US economy in the last 24 months by buying treasuries, mortgages, and other assets without regard to value. Here is a chart from The Federal Reserve and Wells Fargo economics showing how dramatic this infusion really is:

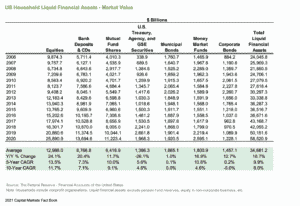

The two asset classes available to investors in the United States to handle Trillions of new moneys have historically been the US Bond Market and the major US Stock Markets. So the logical thing to ask is how attractive are these two markets if I want, just like the fresh water, to preserve money for the long term.

This question was asked and answered by Julie Beillfuss writing for “Barrons” on January 9th, in an article entitled “ “Forget Rate Hikes. How The Fed Handles Its $9 Trillion In Assets Is What Really Matters.” Julie thinks we should be asking how the Fed can safely dispose of $5 Trillion in assets it has accumulated since 2019. Here is how she asks the question:

“The idea: The Fed owns about a third of the Treasury and mortgage markets and long-term rates won’t really rise until the Fed’s footprint diminishes. Rate increases on their own would thus be ineffective if bond markets aren’t speaking for themselves and adjusting accordingly.”

So, Julie is making an interesting point. Your wealth advisor is not going to recommend a two-year US treasury bond yielding 1.0% when inflation is running at 6.0%. Your real return would be minus 5.0%. Instead, you would want 7.0% so you could get a safe 1.0% real return. This isn’t like buying War Bonds below market value after World War II as a patriotic duty.

A rational buyer of the Fed’s balance sheet will want a big price discount from carrying value to give him a positive real return. A big discount to carrying value might make the Fed look dumb, and the political repercussions for incumbents in an election year would be unthinkable. In addition, trading volatility as the markets return to real actors will certainly scare away cautious investors.

A whole group of retirement savers are also beginning to question how long they can live off a negative real return on safe investments. If they are losing 5% each year and inflation persists for 3 years, a $350,000 nest egg has a 2025 purchasing power of $300,000. Here are the latest statistics about US Household savings:

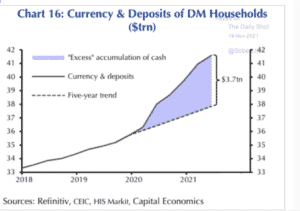

Without a normally functioning bond market and a real estate market clearly influenced by massive central bank mortgage-backed positioning- in essence two markets no longer controlled by capitalists- where can US Households safely preserve $3.7Trillion of excess cash? Research from The Federal Reserve Bank shows the migration from 2019 to 2020 was into equities, banks, and money markets. I would not be surprised if similar data for 2021 shows a large lake getting deposited mostly in the US stock markets:

Inflation May Make Households Dump Another Lake

With inflation running at 7% and money market funds generating no nominal returns, the real return is negative 7.0%. A drumbeat may soon sound out a retreat from cash. That would discourage investment in banks and money markets. Whether real estate is a viable option will probably turn on the extent to which the Fed continues providing liquidity through its purchases of mortgages.

In essence, there is great market risk in the Fed unwinding its balance sheet positions but there may be greater risk in continuing to disrupt normally functioning markets.

In the transition the only Lake Superior left is the US Stock market. Until real markets return and set prices, money, like water, will likely flow to a place it can seek equilibrium.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.