Everyone likes momentum, especially mountain climbers. 2022 will present a” Seven Summits “challenge for US and world economies. That challenge was popularized by Richard Bass in 1985 who set out to summit the highest peaks on all seven continents. He was successful and his exploits demonstrate how connected and accessible world economies have become.

Of course, like all international challenges, this one comes with controversy. Just like today, the Russians and Europeans could not agree on boundaries and that determines whose peak is larger.

Most climbers default to the venerable Reinhold Messner whose summit selections mean Russia and Australia peaked just below the top seven.

In any event, a review of the world economies shows some interesting momentum shifts in 2021. Foremost among them are: the rise of crypto, pervasive inflation, supply chain dysfunction, the great resignation, worldwide central bank accommodation, negative yields, and demographics predicting prosperity.

Asia: North Face of Mt Everest

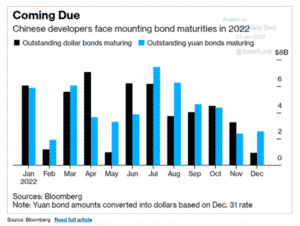

China is determined to control all outcomes. It certainly looked good until its property sector cratered in the 4th quarter of 2021 amid one of the greatest Ponzi schemes of all time. Its currency has wobbled a little bit, but is significantly stronger than the USD, perhaps portending a switch from supplying the world with cheap goods to developing an indigenous consumer economy? Demographics don’t favor that transformation, however. The one-child rule has left China with lots of old people, just like all the other developed world. Its belt and road strategy has put its facial recognition software in countries on 3 continents, so control should not be an issue. It is hard to bet against it in 2022 but I predict you will not see worldwide capital flowing to it. There are still too many questions about transparency and manipulation and there is a mountain of debt coming due for Chinese property developers:

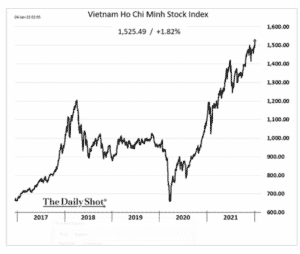

Perhaps the Asian countries to watch in 2022 are South Korea, and Vietnam. Vietnam’s stock market reminds me of Tesla’s share price. Here are momentum charts supporting South Korea and Vietnam for 2022, courtesy of “The Daily Shot”:

Oceana: Carstensz Pyramid

Australia lost out on the other highest peak controversy with Kosciuszko coming in just short of Carstensz Pyramid in Indonesia. These two countries are both asset rich and net exporters of important commodities like coal, palm oil, and natural gas. Indonesia has a young population compared to Australia and its prospects for growth in 2022 are high. Its currency and stock markets both recovered in 2021 even though it was hit hard by the three strains of Covid-19.

Here is a chart from “The Financial Times” showing the 10-year performance of the HSBC MCSI Indonesia ETF:

Africa: Kilimanjaro

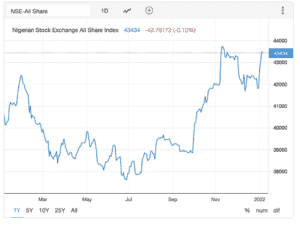

Africa has the youngest cohort on the planet. Those demographics should give it phenomenal momentum in 2022 and beyond but persistent tribalism and regime change limit the upside. Within Africa there are a few established democracies like Botswana and emerging economic engines like Nigeria. Africa is also rich in natural resources like petroleum, iron ore, and copper all of which should do well with supply chain scarcity of natural resources. Here is a chart of the Nigerian stock market in 2021 courtesy of Trading Economics:

South America: Aconcagua

The news from South America has been pretty bleak in 2021. Venezuela has the most oil in the world, but it is ruled by a dictator and its stock market is more trashed than the face of Everest. It lost 99% of its market value in March of 2021. Chile just elected a leftist, and its currency is falling but its economy is booming. Brazil was hit hard by Covid-19 and its economy is shaky. Peru has slipped from open borders to insular nationalism. Its currency has faded.

The only good news is north in Central America where Mexico’s economy has rebounded notwithstanding a drug cartel that is almost as controlling as China’s communist party.

Europe: Mont Blanc

Europe is a tapestry of contrasts. Germany’s manufacturing economy is strong, and it comes as no surprise that it wants the EU to pursue austerity as a solution for inflation. The other members of the EU are more interested in governmental stimulus. The UK is now on its own and is digesting its Brexit trading alternatives. Its stock markets are trading at significant discounts to US markets. The Scandinavian currencies are strong and the economies in Denmark, Norway and Sweden are recovering nicely. Europe’s appeal in 2022 turns on the outcome of the Russian threat to invade the Ukraine. That uncertainty and trillions of negative yielding debts make European asset classes temporarily uninvestable.

North America: Denali

What a year for the US and Canada. Both economies came roaring back from the Pandemic and both stock markets exploded, notwithstanding inflation, labor shortages, and supply chain disruption. The amount of new money put in circulation in the United States alone is multiples higher than the elevation of the Seven Summits combined. The US dollar has remained pretty strong, and the Federal Reserve seems to have complete control of the economic landscape. It has even found a way to prop up money market accounts through its overnight repo facility.

The bad news for North America is the market systems- the bond market, stock market, commodities markets, and currency markets- don’t appear to act like real markets where investors determine outcomes. They are stepchildren of the Federal Reserve Bank policy and action, and their outcomes are influenced first and forever by the Board of Governors of the Federal Reserve.

One thing is common to all seven continents—they all have chosen stimulus over austerity in dealing with the Pandemic. They have created too much cheap debt and inflation is the result. The story of 2022 will be inflation and how to tame it.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.