I am always keeping an eye on a backwater of the U.S. financial system called Zombie Companies. There is a general consensus that “Zombies” are businesses that do not have the cash flow to service the interest on their debt. For example, the biggest zombies in the world right now would probably be Chinese property developers. Historically the longest-lived Zombies are Japanese businesses which have been functionally insolvent since the 1980’s, but survive under an “amend and pretend” regulatory scheme in Japan.

Clearly central finance systems worldwide are highly tolerant of “too big” or “too many” to fail regulatory approaches when it comes to zombie businesses. I was curious when I began to research this topic last week if there is any angst about rising interest rates, inflation pass through or swap expirations.

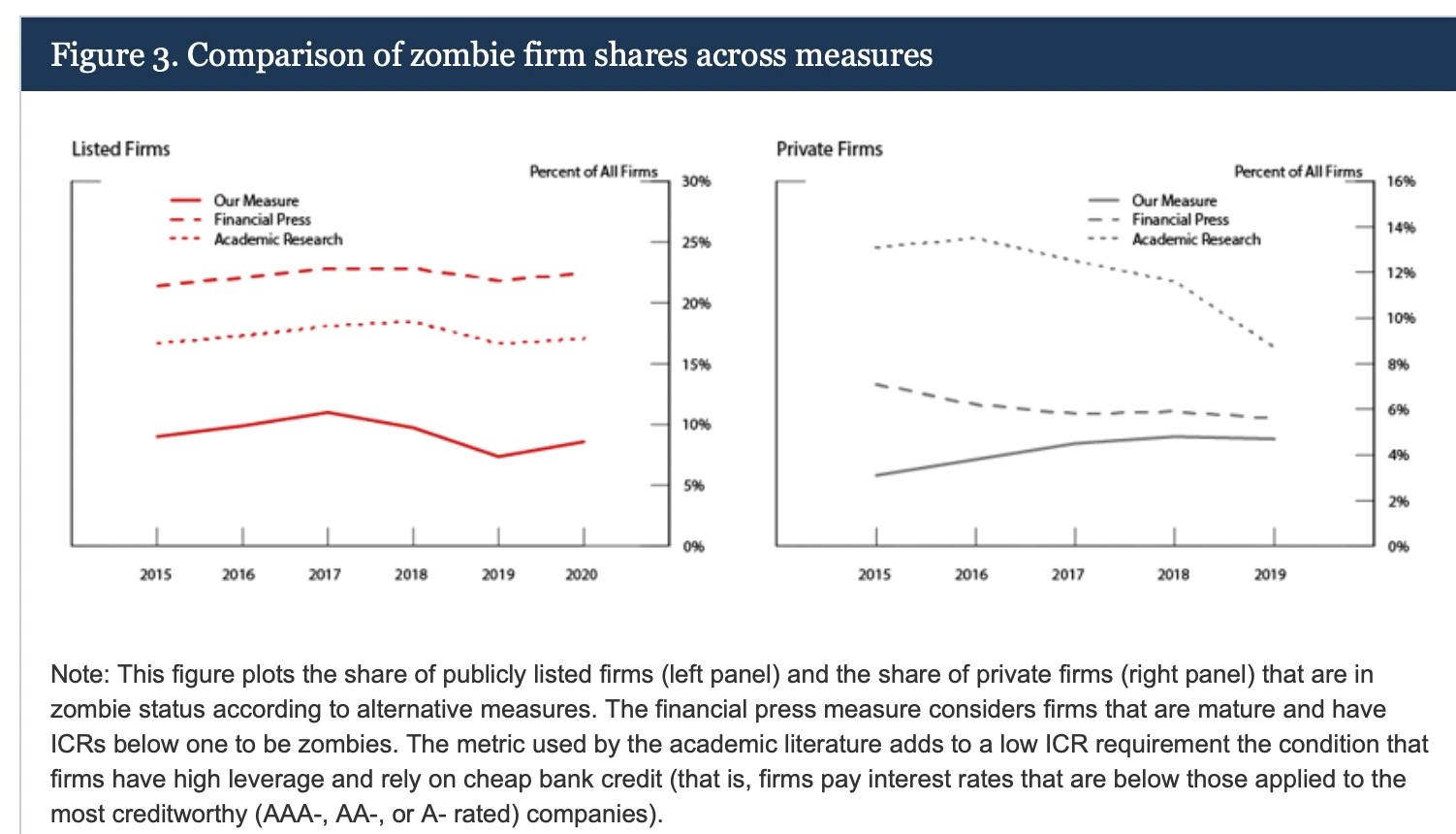

The Fed was once again way ahead of me when it commissioned a study of Zombie Companies in late 2021, responding to Washington Post concerns that Covid-19 relief measures were keeping this asset class alive and crowding out capital available to healthy companies. Of course, the Fed study concluded that the popular press and academic literature had exaggerated the risks of the zombie nation. Here is a chart from the Fed study showing that all is well:

When the Fed is taking the “over/under” on matters affecting the safety and soundness of the U.S. Banking System it usually will take the Under and remain several standard deviations below what is being reported by the press and academics. The central flaw in their studies’ data set, however, is the Fed defined the Zombie universe as having BOTH “bleak growth prospects” as well as interest coverage problems, while academics and press just looked at current and historic inability to cover interest payments. I am wondering whether this is something we can wager on FanDuel?

Banking World Metrics

I reached out to my industry contacts to see if this kind of test is used by the real-world lending community. What I found is the banking system uses a quite more stringent interest coverage ratio test where it starts with earnings before interest and taxes as a proxy for operating cash flow, subtracts capital expenditures and then divides by the sum of interest and required debt amortization. There is nothing futuristic or subjective about the banks’ requirement that the ratio exceed 1.0x and in the case of smaller credits, 1.2x.

Having taken small comfort in the Fed’s research, I then did my own checking in the popular press and academic literature for 2023. I was particularly interested in the effects of “swap expirations” and sudden reset of interest rates to account for the reset of deposit funding.

What I found was the Fed knew something about the future I did not expect. While many of these Zombies have significant debt stacks, it turns out that many of them have also replaced banks with unregulated covenant-lite unsecured senior notes as their source of debt funding. They also have significant availability on undrawn bank lines of credit.

Not All Zombies Have Debt Pressures

AMC, the owner and operator of movie theaters is a perfect example. It has $9.15 Billion of debt against 62.5 million of LTM EBITDA but only 21% of that debt stack is bank debt. Beyond Meat (Nasdaq, BYND) has $925 million of total debt against negative EBITDA of $257 million but 95.0% of that debt is Zero coupon notes. This is contrasted with Sun Run (“Run”, NASDAQ) a residential solar panel system manufacturer that has negative EBITDA of $201 million against a debt stack of 9.335 Billion, of which $6.0 Billion is bank debt and Kennedy-Williams, an owner of multi-family and office real estate with $208 million of EBITDA to service $5.21 Billion of debt of which $3.3 Billion is bank debt.

I am somewhat confounded by Sun Run and Kennedy-Williams. They have stratospheric equity market capitalizations of $3.5 Billion and $2.15 Billion respectively, for what used to be considered functionally insolvent enterprises. For example, Sun Run has $6.0 Billion in bank debt all of which carries variable interest in excess of 8% and has an interest coverage ratio of less than 1.0x.

New Normal For Banks?

Having itself mastered the art of refinancing and monetization of debt, maybe the Fed is signaling the new normal will be “amend and pretend” for banks? Say “sayonara” to worries about swap expirations, variable interest rates, inflation pass throughs and actual bankruptcies and follow the 40 year old Japanese playbook.? I am sure a large cohort of the Zombie nation will reply “Domo Arigato”.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.