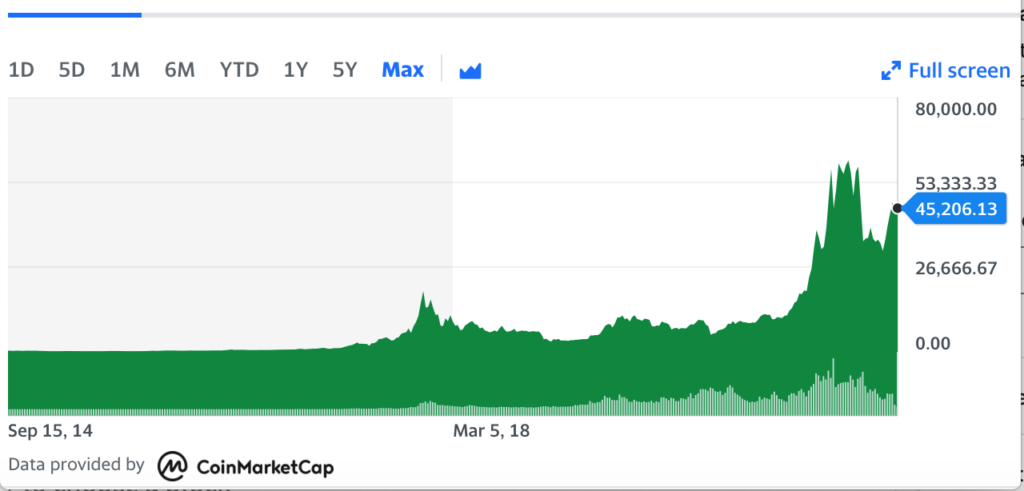

Bitcoin gets all the attention because it is the rock on which all other cryptocurrencies are made possible. Supporters believe BTC will always have value because it is like collectible art. It has attracted intelligent investors who are willing to buy and hold a decentralized digital currency not backed by anything other than its compelling scarcity model and an immutable blockchain. It also has done quite well for an asset class that does not pay interest or a dividend.

Proof of Work Has Been the Model

At the heart of the BTC business model is security. Its blockchain is validated by an open source peer review of every transaction. That process of validation requires massive investments in computing power and is called “PROOF OF WORK” (PoW). Independent miners all over the world compete for the right to validate a block of transactions and they are paid in Bitcoin. That is how the supply is increased slowly over time.

But security comes with a cost of speed. It can take as long as 10 minutes for a block of transactions to be confirmed. It is also expensive to transfer small amounts of BTC. Think about standing in a busy grocery line for 10 minutes while your Bitcoin payment is validated, and also paying a 2% transaction fee.

Mastercard and Visa have programmed us to expect “tap and go” payment systems, where fraud is underwritten by the credit card companies. This is quite compelling.

The BTC trade-off of security for speed makes it a lousy currency, but a pretty dynamic substitute for physical gold. Bitcoin’s junior partner, Ethereum, hopes to speed things up with a new approach to security and an interesting opportunity to receive annual returns for putting it into a staking pool.

Ethereum Is Adopting a New Security Protocol

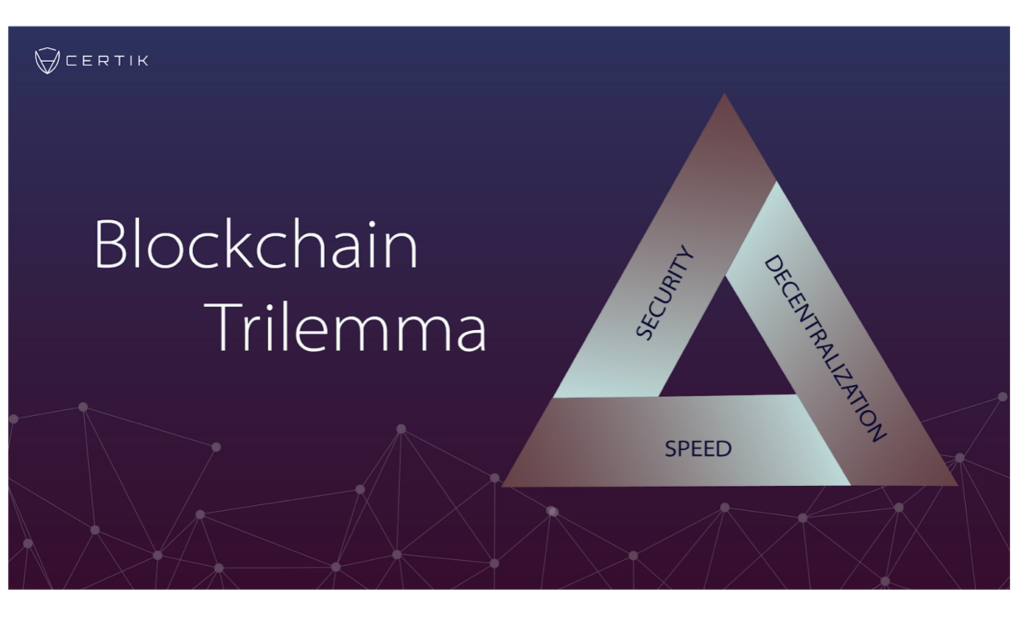

On August 8th the second most popular cryptocurrency, Ethereum, took a first step to adopting Ethereum2 (“ETH2”). The switch is intended to address three significant and sometimes competing objectives for any cryptocurrency, even Bitcoin. That dilemma is illustrated in the Blockchain Trilemma shown below:

Proof of Work has been Ethereum’s security system since inception. PoW means the validators have a massive investment in the computing power that allows them to accurately validate a blockchain.

New Security Will Rely on Staked Capital

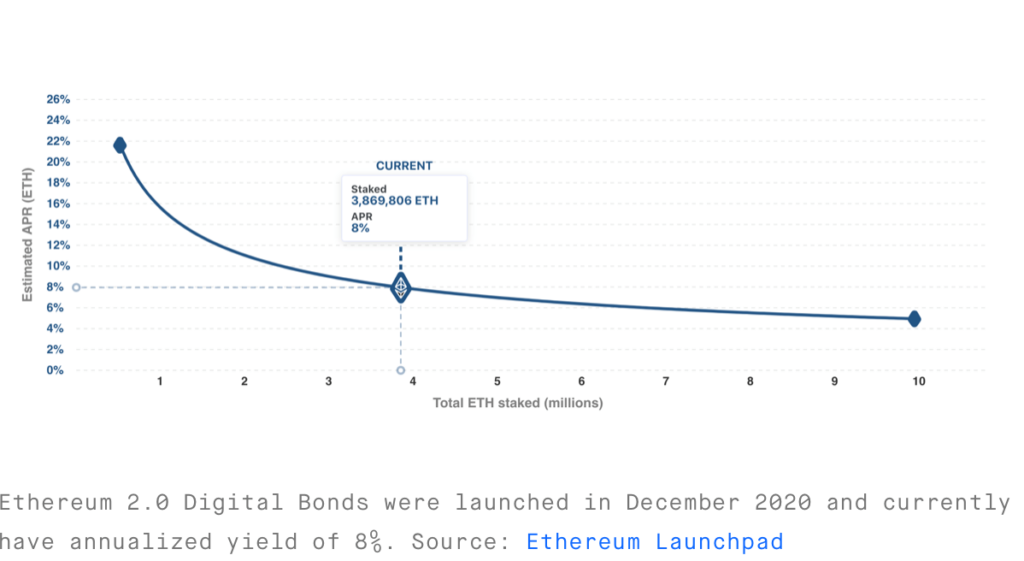

Proof of Stake (“PoS”) means the peer validation system is based on validators staking a minimum of 32 ETH (about $100,000 now), to unlock the ETH2 source code and stand ready to validate transactions. The ‘stakers” receive interest on their stake payable in ETH2 as well as eligibility to be selected at random to validate pieces of the ETH2 blockchain called “shards”. The objective is to democratize the nodes by allowing anyone anywhere in the world with $100,000 and a smart phone or laptop to be eligible to participate in a validation for a fee and the token will pay you interest as long as it is staked. Here is the history of interest paid to stakers. Notice it began at 22% in December 2020 and is currently around 8%:

A side benefit of preparation for the conversion to the staking system is it removes ETH from circulation, thus creating scarcity and driving up the price. Here is a chart of ETH from Yahoo Finance over the last month as the first step to ETH2 became a reality. Right now the price of ETH is about $3,000.00 USD.

What Is Ethereum

Ethereum is a cryptocurrency just like Bitcoin, but its blockchain is programmable. It is the most popular token for decentralized finance applications and its market capitalization stands at $370 billion making it second only to BTC which has a market cap of $875 billion.

ETH2 Will Compete With Incumbent Finance Systems

An example of a decentralized finance application (“Dapp”) would be a loan to buy a house. Right now, the traditional path would be to get a FICO score, go to several banks, apply for a loan and provide employment verifications, secure a mortgage, and begin monthly payments. If you own Ethereum2, you can get a loan by putting up the ETH2 as collateral and get the loan approved in one minute. The Dapp lender would get interest from you but it could also “stake” that ETH2 for double digit real annual returns.

A bank might gross 4% annually but the Dapp lender might gross 15%. There is also a side benefit from the absence of expensive middlemen like appraisers, title examiners, lawyers and accountants.

The ETH2 token that supports the Dapp loan in the previous example has programmable features. It is decentralized meaning a central authority cannot steal it or render it worthless through currency debasement. It is secure because peers with financial stakes have validated its authenticity as loan collateral. Stakers will lose all or part of their staked ETH if it turns out the ETH collateral was fraudulent.

ETH2 should be speedier because the new examination and validation process will eventually work on “shards”, meaning more recent, transactions rather than going all the way back to the first transaction. It would be like checking the most recent lineage in the family tree, not the lineage already validated under the ETH1 system which was based on slow, but secure, PoW.

Whether the ETH2 system can compete with processing times for established payment systems like Visa and Mastercard is still in doubt, but the switch should remove speed as a detriment to mass adoption. A nice yield in a negative interest world may also ease the pain of having to wait a few more seconds than it takes to authorize a credit card.

What Is the Transition Timetable

The switch from the ETH1 blockchain (“Mainnet”) to the ETH2 blockchain (“Beacon”) is predicted for the first quarter 2022. Like an ERP conversion, the Mainnet and Beacon chains are now running side-by-side. There are many complexities and risks with a premature switch, and I would not be surprised if ETH1 and ETH2 run as redundant systems for much longer than predicted.

Why Is Proof of Stake Better for Ethereum?

As cryptocurrencies become more commonplace there has to be a token that can compete with traditional assets classes like the bond market, where there is a proliferation of negative interest loans all over the world. Ethereum is offering 5-20% real annual returns (net of inflation), for owners of ETH2 to pledge it as security for the legitimacy of the new PoS system. As more ETH2 is pledged, its scarcity as a trading asset rises. Long term scarcity could mean price appreciation even though the journey could be quite volatile.

*A special thank you to Will Mason for contributing to the content of this blog.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.