The world has 10 major stock exchanges, three of which are either controlled or influenced by China. Here are those exchanges:

| Exchange | Established | Mkt. Cap |

| New York Stock Exchange | May 1792 | $19.3T |

| NASDAQ | February 1971 | $13.8T |

| Tokyo Stock Exchange | January 2003 | $5.7T |

| Shanghai Stock Exchange | November 1990 | $4.9T |

| Hong King Stock Exchange | February 1891 | $4.4T |

| Euronext | September 2000 | $3.9T |

| Shenzhen Stock Exchange | December 1990 | $3.5T |

| London Stock Exchange | January 1571 | $3.2T |

| Toronto Stock Exchange | October 1861 | $2.1T |

| Bombay Stock Exchange | December 1990 | $1.7T |

Source: “Business Insider” article by Ben Wick dated June 19, 2020

The three Chinese markets are poised to grow dramatically as prosperity in the south China region of the world becomes reflected in ownership of listed stocks. There is a fourth trading market linked to the Shanghai Exchange and patterned after the NASDAQ called the China Star Equity Market, which is also known as Shanghai Stock Exchange Science and Technology Innovation Board (the “Star Market”). It is a market for early stage technology companies.

Trade War May Be An Accelerant

The current trade war between the United States and China may also hasten the rise of the south China region exchanges, especially if the U. S. forces smaller Chinese public companies with inadequate financial disclosures off its domestic exchanges like the NASDAQ. Evidence of this trend is shown by the U.S. Senate voting by unanimous consent in May 2020, to curtail access to U.S. stock exchanges for Chinese companies unable or unwilling to make financial and other disclosures required of U.S. companies.

Jack Ma Is Betting on Chinese Capital

A real test for capital formation will come when Ant Financial Services Group Co., Ltd ,a Chinese financial platform, goes public later this month. With the world’s largest mobile payments platform called “Alipay”, and Asian dominance in retail credit rating, online banking, insurance, and wealth management, Ant could be the largest IPO in history. Today it is 33% owned by Alibaba (Baba, NASDAQ) from which it was spun out as an independent private company. Alibaba’s founder, Jack Ma, has influenced Ant’s meteoric growth.

Unlike the previous biggest IPO in history (Saudi Aramco), Ant will only raise capital in its IPO from the three south China region exchanges. This will mean institutional capital from all over the world will have invest in “H” shares through The Hong Kong Stock Exchange, and then through a conduit called Stock Connect to Ant. Domestic retail capital and mainland China institutional capital will be allowed to invest in “A” shares trading on the Shanghai Stock Exchange as well as The Star Market.

The interesting question for the Hong Kong Exchange will be whether institutional investors will be content to own “H” shares in Ant trading on the Hong Kong Exchange when direct ownership through the “A” shares is allowed only on Shenzhen, Shanghai and Star Exchanges? Current mainland China capital flight rules prohibit mainland capital from “travelling south” to the Hong Kong Exchange so any mainland retail or institutional investors interested in Ant must purchase on one of the two mainland exchanges. The “H” shares have always traded at a discount to the “A” shares because their trading market is tethered to China and its capital restrictions.

Conventional Approaches May Be Challenged

For investors outside mainland China the conventional way to invest in mainland China for most institutional investors has been “northward” from Hong Kong through “Stock Connect”, or through approved dealers like Qualified Foreign Institutional Investor (“QFII”)or, Renimbi Qualified Foreign Institutional Investor (“RQFII”) entities.

With the recent mainland “thumbprint” for Hong Kong under the National Security Act there is increasing concern about Honk Kong’s long-term role in Chinese capital formation. I know I would be concerned if my ownership of Ant was through H shares and not the pure “A” shares available to mainland citizens. What do you really own if mainland company dividends can be restricted by capital flight laws or if H shares trade at ever steeper discounts to the “A” shares? The Security Act may portend a slow decline in the Hong Kong Exchange as the preferred institutional trading exchange for the south China region. This will come at a time when institutional capital relies on the rigor and transparency of the Hong Kong Exchange to winnow out fraudulent mainland companies.

Chinese Stocks Have Been Under Represented in World Stock Indexes

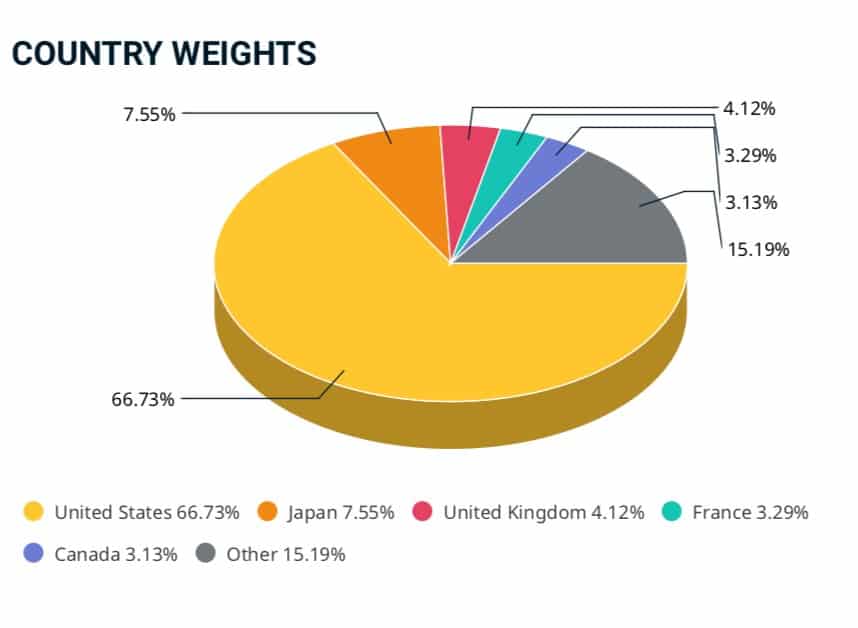

Morgan Stanley Capital International World Index (MSCI) seeks to represent a balanced approach to owning the “investable” (my emphasis) world through one index. Until June 2018, however, the MCSI had no weighting for Chinese A shares presumably because A shares were largely owned by Chinese retail investors and the A shares market was thinly traded and quite volatile. Beginning in June 2018, the A shares were included in the MSCI index for the first time. It is not clear, however, whether this index is still reluctant to include “A” shares as a more important market cap weighted component because of the fear they are not safely investable due to skimpy disclosures, thin trading and market manipulation? Here are a couple of charts from the MSCI website(https://www.msci.com) that show the MSCI index does not reflect China shares as a separate component. Only its MSCI ACWII Index which includes emerging markets has a 5% China allocation:

MSCI INDEX COMPONENTS

MSCI ACWII COMPONENTS

It will be interesting to see how the south China markets evolve over the next five years. Clearly, Chinese public companies are underrepresented in major world indices like MSCI relative to their GDP contribution. Attaining a level of transparency, liquidity and security found in the NYSE and NASDAQ will be a daunting task, but the Ant IPO will be a first step and a telling adolescent breakout.