Few people really understand how currencies work. It requires math to figure out how much more or less a cup of coffee (Starbucks), or a hamburger (Big Mac), costs in Boston versus the same products in Moscow, Shanghai or Hamburg. If we had a universal currency like Bitcoin or Libra (Facebook), the currency math would be done for us. You could simply compare the relative prices in Bitcoin or Libra of the same product around the world.

The Big Mac Index

Lacking a world currency, the next best thing is the Big Mac Index which is something The Economist invented in 1998 to compare the relative purchasing power of each country’s currency in USD based on the price of Big Macs.

For example, according to Statistica (https://www.statista.com/statistics/274326/big-mac-index-global-prices-for-a-big-mac/) in July 2020, the average price for a Big Mac in the USA cost $5.71, but the USD price for the same product was wildly different depending on the country you were visiting and the currency you were exchanging. The chart below shows the Big Mac Index for the top twenty strongest currencies. You will see that a holder of US Dollars, the world’s reserve currency, can buy almost twice as many Big Macs in South Korea as he can in Switzerland.

So, if your local business is manufacturing and exporting a commodity like Big Mac’s in competition with the rest of the world, you want the relative purchasing power of your currency to be as low as possible compared to your worldwide market. Their stronger currencies will mean they can buy more of your Big Macs than others and they become your natural trading partners.

Take the example of Brazil and Canada above. Both export commodities. If they are both trying to sell commodities to Switzerland, based on the Big Mac Index, Brazil can sell 29% more than Canada for the same exchange price in USD.

The currency markets are a little bit more sophisticated than the Big Mac Index, and they consider many local factors. The Statistica survey shown above explains the more sophisticated approach as follows:

“Purchasing power parity (PPP) is the idea that items should cost the same in different countries, based on the exchange rate at that time. This relationship does not hold in practice. Factors like tax rates, wage regulations, whether components need to be imported, and the level of market competition all contribute to price variations between countries. The Big Mac index does measure this basic point – that one U.S. dollar can buy more in some countries than others.

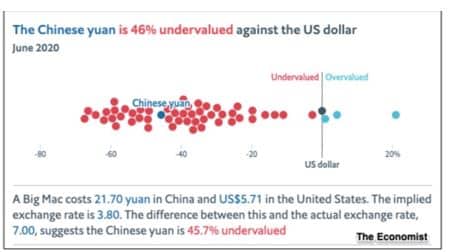

To see what the real currency markets think of the Big Mac Index, you have to look at the purchasing power parity index for July 2020. Econlife did just that in an article dated August 13, 2020 by Elaine Schwartz titled “What We Can Learn From A Big Mac”. They cited a chart from The Economist that corroborated the Big Mac Index ranking above and then showed how undervalued the Chinese Yuan is relative to the US Dollar:

The currency markets seem to agree with The Economist’s conclusion because the Chinese Yuan has appreciated from August 2020 by almost 4.5%, versus the USD. Here is a one-year chart from XE.com that shows the sprint to the bottom from May 2020 by the USD versus the Chinese Yuan (CNY). Based on the Big Mac index , though, the Yuan still has a long way up.

Desired Policy Objective

Normally, you would think this is bad for America, but because our economy (like almost all the other economies in the world) is propped up by mountains of debt, it is actually a desired policy objective. The Chinese hold more than $2.0Trillion in USD debt. If the U.S. can get the purchasing parity index to move closer to the Big Mac Index, repaying Chinese creditors in USD at a $3.80 exchange rate versus a $7.00 exchange rate is almost 46% less dollars. This is how a weaker currency helps an indebted nation.

So, like many things in this Bizzaro world, having the weakest, least desirable currency – having the lowest Big Mac score – is really the best debt policy objective. I am confident the rest of the world wants the same thing and we will see an amazing race to the bottom. However, the rest of the contestants don’t have to worry about losing the status of being the world’s reserve currency. The U.S. can’t win it all.