The investment world loves acronyms especially ones that help them sell products. The great revival that began in 2010 and ran unchecked until October 2021 had some really catchy ones like “FAANG” (Facebook, Amazon, Apple, Netflix, Google) “FOMO” (Fear of Missing Out). “TINA” (There is No Alternative) and “YOLO” (You Only Live Once). YOLO was the rally slogan for the Robinhood/Reddit investment cabal that promoted group buying of stocks like Tesla, GameStop and Hertz.

The momentum in these investment philosophies ended abruptly in October of 2021 and since that time the investment strategy powered by these acronyms has produced a “LOSER” (Lots Of Surprised Enterprisers and Redditors).

Here is a scorecard showing market values of the FAANGs and two of the Redditt favorites from October 4, 2021 to end of February 2023:

- Facebook -47%

- Amazon -43.5%

- Apple +6.08%

- Netflix -53.0%

- Google -38.5%

- GameStop -64%

- Tesla -46.7%

With the Fed shrinking its balance sheet and looking like it will have to go 12 rounds with former heavyweight boxing champion Sonny Liston to whip inflation, the “sure thing” investment strategy must be grounded in yield but flexible enough to reverse course if there is a “TKO” (Technical Knockout) in the sixth round and the Fed wins the fight early and immediately begins to lower rates.

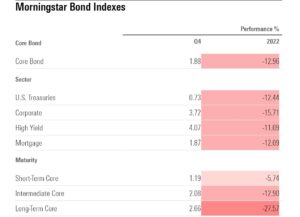

In 2022 investors found that bond funds can be tricky because the market value of the portfolio rises only as long as interest rates fall or are perceived to be ready to fall. As the Fed began its first interest rate increases and took a hawkish tone about beating inflation with interest rate increases and quantitative easing by removing Fed liquidity, interest rates began to rise quickly, and the value of bond portfolios cratered. 2022 is said to be the worst year for the bond market in history.Here is a table from Morningstar showing major losses in every category of fixed income:

The unexpected losses in fixed income have generated fear and loathing among retail investors, but their reaction should be aimed at the vehicle not the strategy. Think about what the Fed is signaling as its long-term strategy. It is funding its operation with short duration securities. Here are the spreads as of March 8:

| 1 month | 3 months | 4 months | 6 months | 1 year | 2 years |

| 4.77% | 4.88% | 5.01% | 5.21% | 5.25% | 5.04% |

This is exactly what I would be doing if I had a short-term problem like inflation but a balance sheet with Trillions of Dollars of Debt and I could hardly afford the interest, much less pay back the principal. I would borrow as much money as possible at a rate that attracts funding, but for the shortest duration possible. I would then reduce the interest rates on longer maturities like 4.31% for a 5-year treasury note and 4.17% for a 10 year note and remind investors who just got clobbered in longer duration bond funds about how rising interest rates cause longer term bond values to decline.

Maybe A KISS Strategy Is Something To Think About?

So maybe a good approach is not to overthink the opportunity. “KISS” may be the right acronym (Keep It Simple Stupid) for a ladder of Treasury securities right up to the point where the current yield begins to decline (2 years). As long as the spacing of the maturities will create enough cash flow to pay your bills you won’t be forced to sell your longer dated notes as the Fed keeps returning to the ring for round after round of inflation fighting and the market value (not the face value) of your longer maturities may have declined. As long as you can wait until the next maturity, you will get your 5% interest and you will get 100% of your principal back.

This strategy is tax effective because interest on Treasury securities is exempt from state and local taxes.

You Can Also Speculate With This Strategy

There is also something in this strategy for the Redditors and speculators. You can decide when you think the Fed will be perceived to be winning the inflation fight against Sonny Liston and buy the 10 year Treasury Note at the peak of its yield and then get a capital gain as the value of your high interest bonds increases. This is exactly what happened for the period from 1987 to 2021 and it made many holders of longer dated Treasury notes a handsome profit.

But this is just like gambling on the Fed’s fight with Sonny Liston and I can’t even win my March Madness pool. There is no sure thing in investing but if you are a saver facing retirement you want to get as close as you can.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.