When I got my first job in 1976 going out for dinner was a new experience. As associates in a law firm you were asked to help recruit summer interns who might be candidates for a permanent job. The big problem was none of us had any credit and our law firm was not ready to trust us with a corporate credit card which was an indication adults were running the finances. The solution was to get a cash advance from the accounting department.

By today’s engorged credit standards, the idea that you could entertain prospective hires for under $100 seems absurd. But this was before the American wine revolution and the necessity of ordering from a Reserved List. Two gin & tonics were no more than $10 and a big ribeye and a Caesar salad might have been $12.00. Two associates and a recruit could eat and drink like frat boys, pay a big tip and still have $20 left over.

The real beauty of cash, however, was you could not expand it. You were forced to live within your Recruiting Budget.

The Envelope System of Budgeting

The other benefit of no credit was you had to save before you spent. Unlike Popeye’s friend Wimpy you could not “gladly pay Tuesday for a hamburger today” so we all learned the envelope system of budgeting where you created a paper envelope for rent, food, gasoline, clothing, furniture, Christmas and entertainment. From each paycheck you would allocate cash to those envelopes in order of priority.

TikTok The Rescue

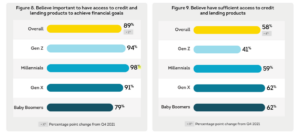

To my knowledge Gen Z and Millennials have always had a fascination with credit and their credit score was something to be managed and improved. A recent TransUnion Study in March 2022 confirms that the younger generation considers access to credit indispensable for reaching their financial goals:

The buy-now, immediate gratification urges often became a serious financial problem. The concept of saving before you spent was swept away by an appealing, yet predatory credit climate where you were always encouraged to buy in advance of what you could afford.

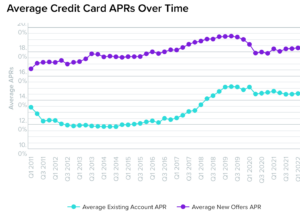

When I write blogs about financial literacy, I always get supportive notes from my readers whose children or grandchildren are hooked on credit card debt and paying exorbitant and confiscatory interest between 14% and 18% applied daily. It seems like all the literacy in the world cannot combat the peer pressure to live beyond your means at nosebleed rates.

Just recently I stumbled into a new investment paradigm spawned by TikTok called “cash stuffing.” These are videos of attractive and intelligent young women stuffing cash in ornately decorated envelopes with categories like food, rent, car and entertainment. Here is a link to one of the most popular videos. Notice the hypnotic sound of the cash money sounding out a beat while money is filling up all the envelopes. I also started to see ads for certificates of deposit from Chase and Marcus pop up whenever I searched the subject online. One final observation: no young men were featured in the most popular videos, but they were usually credited with contributing to the effort.

Unpacking The Discovery of Savings

I was so amazed by these compelling videos that I dug deeper. There is a pretty serious debate online between the younger cohort that likes the analog approach of touching the money and stuffing the envelopes and a whole other group who longs for a digital alternative. They are also enamored of a completely new approach to savings called “100 Envelopes.”

It is almost like our generation eagerly participating in a bank or savings and loan “Christmas Club” where you could make deposits designated as your Christmas gift sinking fund.

A path to financial freedom, it appears, is as simple as following the 100 envelopes path to riches. Adherents buy 100 plain envelopes and number them 1 to 100. Every day you select 1 envelope and remove it. You then put in cash corresponding to the number on the envelope. So, if you pull envelope marked 87 you have to deposit $87.00 in cash. Should you be unlucky enough to pull 99 the next day, you need cash reserves to stay true to your financial commitment.

The bottom line on the 100 Envelopes exercise is $5005 in savings in less than 4 months. More importantly, you cannot commit to it unless you are funding with reserves above the “stuffing cash” envelopes. One video showed a woman who committed to deposit $2×100 envelopes. It showed her going to her credit union and unpacking $10,000 for deposit.

While this commitment is clearly tactile, not digital and not associated with any backbeat TikTok teenage video I could find, it does suggest its proponents are sick of being manipulated by the endless dissatisfaction of financing immediate gratification on a credit card with average interest rates at 14-18%. Here is a chart from Wallet Hub in an article by Adam McCann dated April 14, 2022, showing new and existing credit card accounts. Notice existing accounts paid more than 15% from 2017 forward at a time when the 3 month Treasury was yielding less than ½ of 1%:

I am no expert on TikTok popularity metrics but some of these videos have more than 1.0 million views and many of them have more than 500,000 views. Obviously, there is something bigger going on than just watching people stuff envelopes.

Inflation is making everything more expensive. Cheap goods from China and Southeast Asia are disappearing. If you are financing a meaningful part of your budget at 15% interest rates and costs are compounding at 7-8%, it won’t take long for the interest burden to double. If and when the moratorium on repayment of student loans ends, the younger generation may discover permanent insolvency.

Thank goodness TikTok finally did something to educate a whole generation highly informed about dance moves, but badly in need of a few basic lessons about financial literacy. The videos clearly champion control and responsibility. This is a great start.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.