I first learned about debt jubilees when I took a religion course in college. The concept is rooted in the bible, but it also has antecedents in the way religious leaders and kings curried favor with their subjects to remain in power and avoid rebellion. I asked ChatGPT to for a short history of debt jubilees. Here is its response:

“The biblical history begins with The Book of Leviticus where it is written.”

Leviticus 25:8-17

The Year of Jubilee

8: Count off seven Sabbath years—seven times seven years—so that the seven Sabbath years amount to a period of forty-nine years.

9: Then have the trumpet sounded everywhere on the tenth day of the seventh month; on the Day of Atonement sound the trumpet throughout your land.

10: Consecrate the fiftieth year and proclaim liberty throughout the land to all its inhabitants. It shall be a jubilee for you; each of you is to return to your family property and to your own clan.

11: The fiftieth year shall be a jubilee for you; do not sow and do not reap what grows of itself or harvest the untended vines.

12: For it is a jubilee and is to be holy for you; eat only what is taken directly from the fields.

13: In this Year of Jubilee everyone is to return to their own property.

14: If you sell land to any of your own people or buy land from them, do not take advantage of each other.

15: You are to buy from your own people on the basis of the number of years since the Jubilee. And they are to sell to you on the basis of the number of years left for harvesting crops.

16: When the years are many, you are to increase the price, and when the years are few, you are to decrease the price, because what is really being sold to you is the number of crops.

17: Do not take advantage of each other but fear your God. I am the Lord your God.

The idea of the debt jubilee was also adopted by kings, religious leaders and emperors throughout history with the most notable jubilees being listed below with the help of Chat GPT:

Rulers Who Used Debt Jubilees and Their Results

Ancient Mesopotamia

- King Urukagina of Lagash (c. 2380 BCE):

- Action: Instituted one of the earliest known debt cancellations, freeing citizens from various forms of debt bondage.

- Result: Improved social stability by reducing economic inequality and restoring freedom to many citizens.

- King Hammurabi of Babylon (c. 1792–1750 BCE):

- Action: Known for the Code of Hammurabi, which included provisions for the cancellation of debts in times of crisis.

- Result: Helped to stabilize the economy and maintain social order by preventing the enslavement of debtors.

- Kings of Assyria and Babylon:

- Action: Periodically proclaimed amnesties called “andurarum” or “misarum,” canceling debts and freeing debt slaves.

- Result: These actions were crucial for maintaining the balance of society, preventing widespread poverty, and averting potential uprisings.

Ancient Israel

- Biblical Law (Leviticus 25):

- Action: The Jubilee year mandated debt forgiveness, the freeing of slaves, and the return of lands to original families every 50 years.

- Result: Aimed at preventing the accumulation of wealth and power in a few hands, promoting economic equality and social harmony.

Medieval Period

- Roman Emperors:

- Example: Emperors like Hadrian (117-138 CE) occasionally granted debt amnesties to relieve economic distress among citizens.

- Result: These measures helped to alleviate economic pressures on the population and maintain social stability.

- Medieval European Kings:

- Example: Various kings, such as Edward III of England, periodically forgave debts, particularly in times of economic hardship or following natural disasters.

- Result: Provided temporary economic relief to the population, although not always effectively addressing underlying systemic issues.

Modern Era

- King Leopold II of Belgium:

- Action: After the brutal exploitation of the Congo Free State, international pressure led to some forms of debt relief for the region.

- Result: While not a classic debt jubilee, it marked an early form of international intervention for debt relief, though with limited success in alleviating long-term suffering.

- Post-World War II Germany:

- Action: The London Debt Agreement of 1953, supported by various countries including the US and UK, significantly reduced West Germany’s war debts.

- Result: Enabled Germany to recover economically, contributing to the “Wirtschaftswunder” (economic miracle) and stabilizing Western Europe during the Cold War.

- Jubilee 2000 Campaign:

- Action: A global movement advocating for the cancellation of debt for the world’s poorest countries by the year 2000.

- Result: Led to substantial debt relief for several developing nations, allowing increased investment in health, education, and infrastructure, contributing to poverty reduction and economic growth.

This short history is useful for understanding one possible path central banks all over the world may take to solve a debt crisis of their own making. But before that option is explored it is also important to understand the economic theory that permits money printing.

Modern Monetary Theory Encourages Unrestrained Debt Creation

The face of Modern Monetary Theory is Stephanie Kelton, a professor at Stony Brook University and the author of “The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy.” The reasoning is a nation can simply print money to repay debts denominated in that nation’s currency.

When you are the reserve currency for the world like the United States has been for my lifetime you have the privilege of having your currency under pin most of the world’s economic activity. Most emerging nations have to finance by issuing debt repayable in US dollars because their native currencies are volatile and untested, and credit won’t be extended unless it is repayable in a dependable currency like the USD.

The MMT epiphany is that a sovereign nation cannot default as long as its debt is repayable in its own currency. This is true and convenient for leaders who simply want to run successive budget deficits and remain elected through unfunded social and economic programs, but is too simplistic to accept.

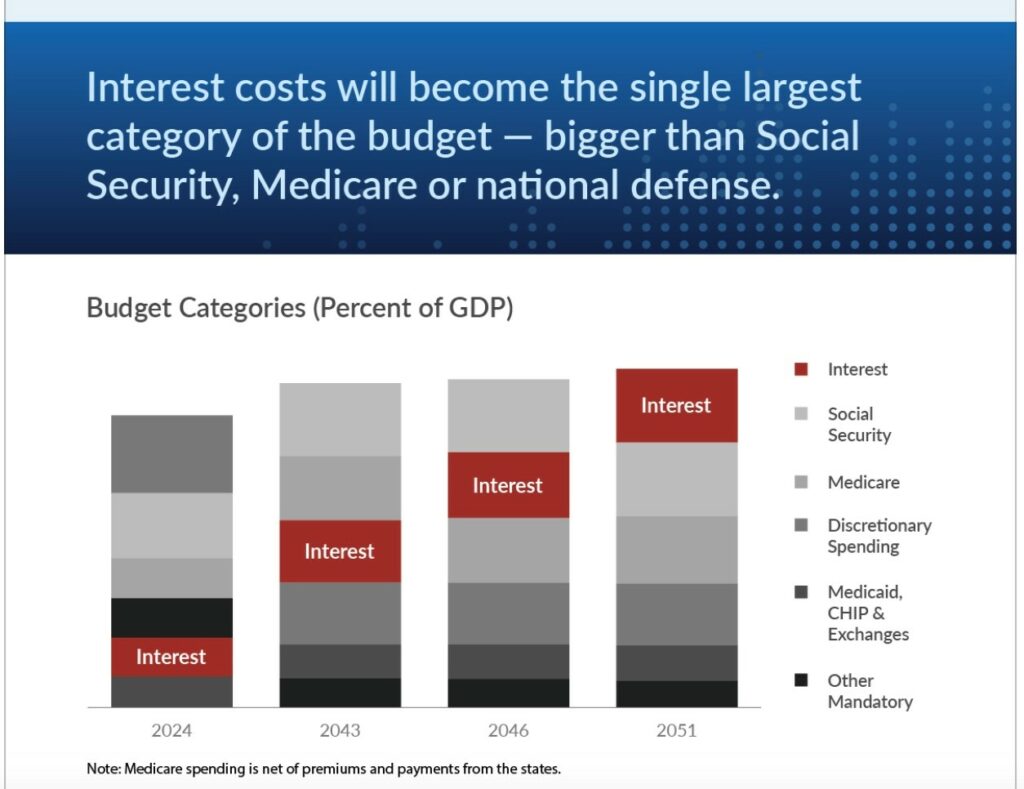

Left unchecked, MMT leads to hyperinflation like you see in Argentina every decade or so and the inflation we have seen in the United States since 2021. It also leads to an interest burden on governmental debt that crowds out social welfare programs like Social Security, Medicare and Medicaid, and critical security and economic programs like defense spending, maintaining roads and bridges, and government research and development.

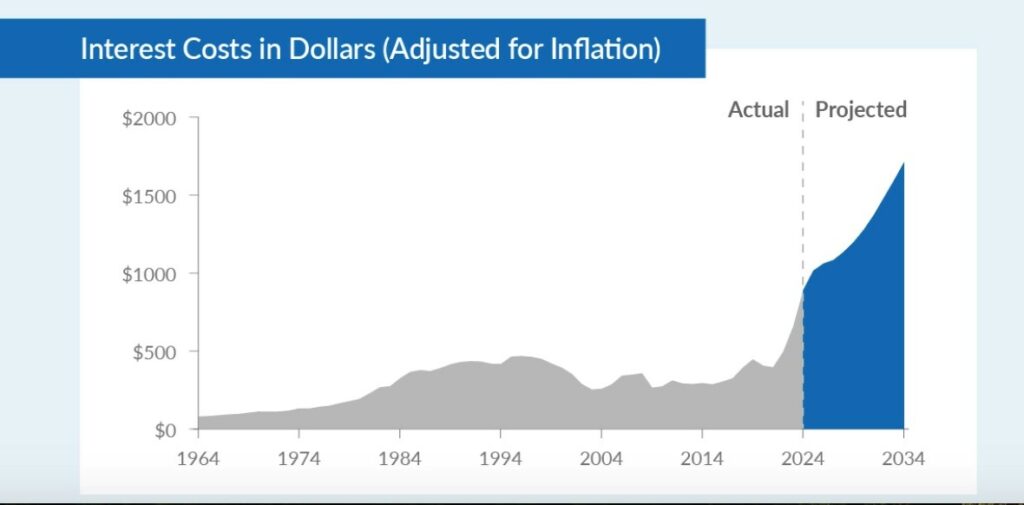

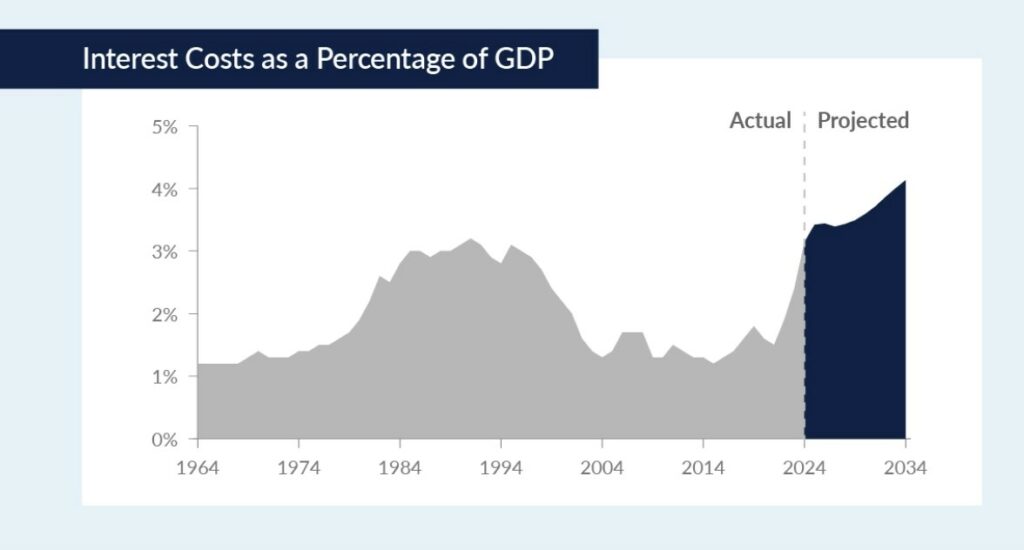

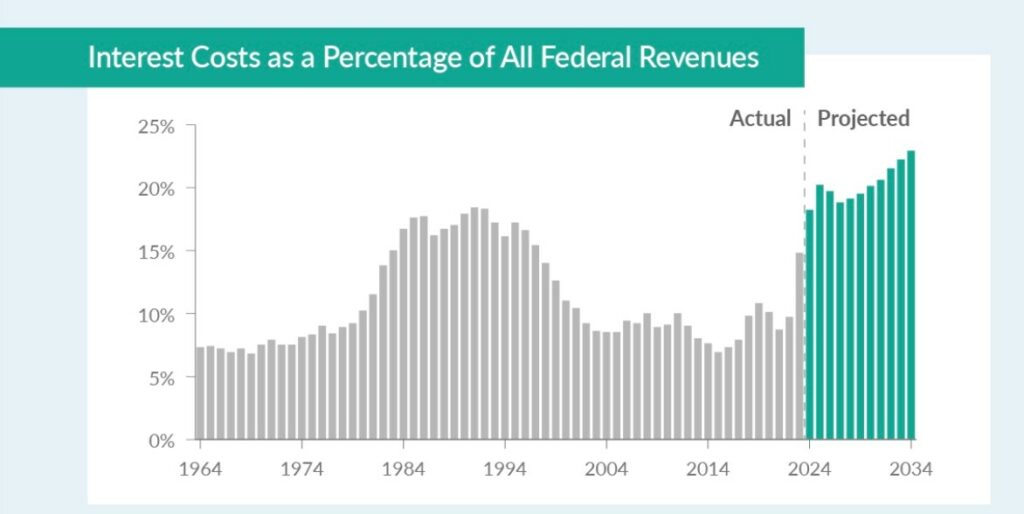

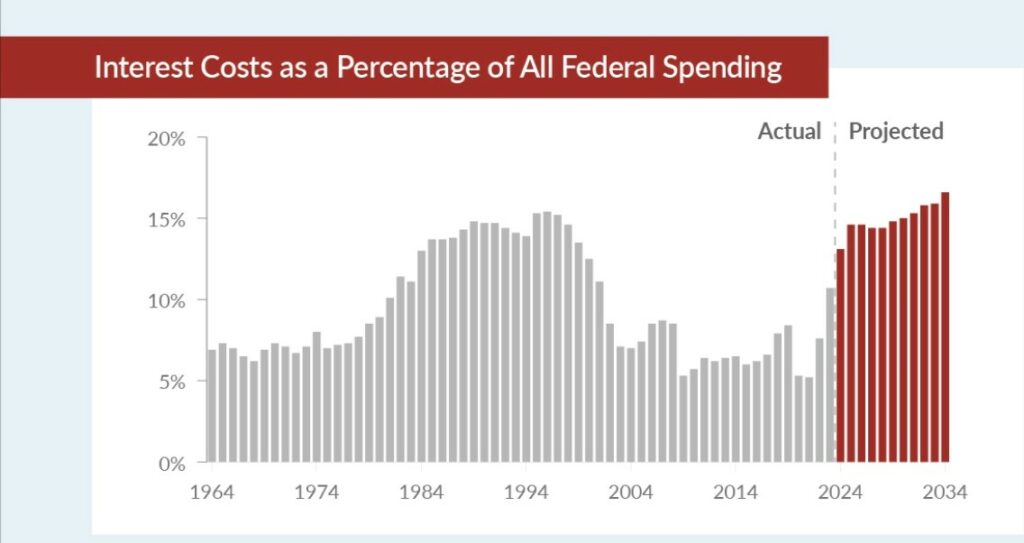

Here are 5 charts from the Peter G. Peterson Foundation that show the trajectory of the federal debt and the implications of its interest burden. The first chart shows a 2024 interest estimate approaching $1 Trillion and growing through 2034:

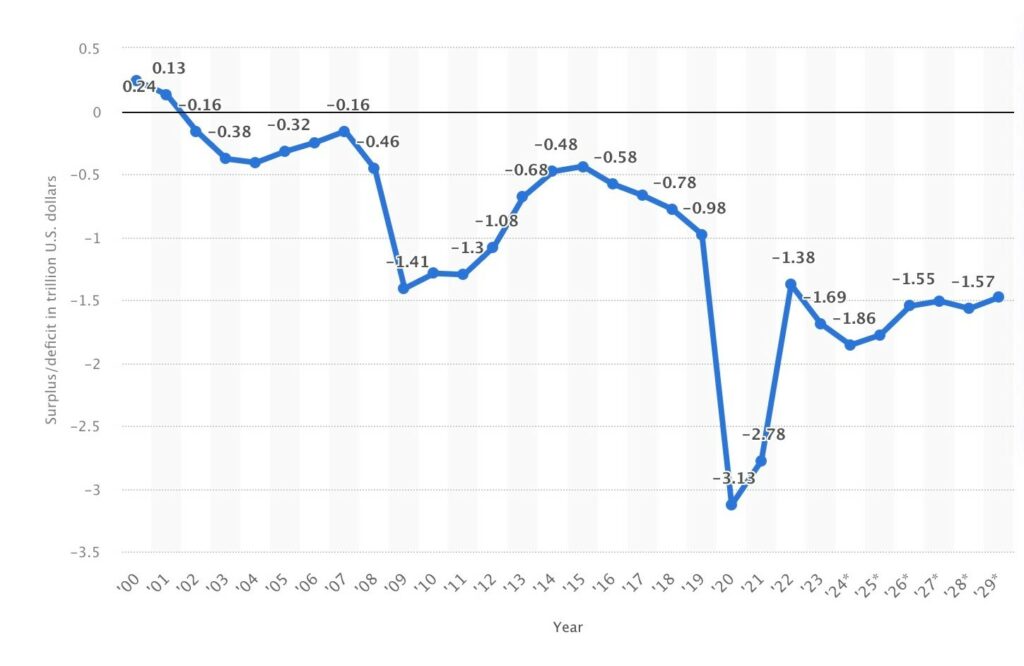

The current Federal Reserve Bank monetary plan is curbing the inflation created by unfunded social and economic programs many of which were launched as a response to Covid-19. These programs, however, have continued after Covid-19 and have resulted in a string of massive annual budget deficits. Here is a chart of budget deficits since 2000 as well as projected budget deficits by Statistica Research through 2029 in Trilions of Dollars. (Statistica July 5, 2024)

There is an increasing recognition that irrespective of political outcomes in 2024 debt creation will continue to a point where the interest on sovereign debt will itself be unpayable unless the US dollar has inflated to a point where a loaf of bread costs $1000. This outcome might lead to the kind of bloody regime change you expect in an undeveloped country.

Leviticus To The Rescue

There is a new grudging acceptance of the inevitability of interest expense on the Federal debt exceeding the budget for national defense and some understanding that it is too late for belt tightening or any form of balanced budgets. The Biden administration has channeled Leviticus by declaring debt jubilees for certain categories of student loans. If elected, it is possible the Trump administration will find worthy recipients of its own debt jubilees?

While some courts are quick to rule this debt forgiveness is an illegal usurpation of a Congressional authority, debtors all like the result and you may start hearing it suggested a lot more often than every 50 years like biblical times.

My bet is the incumbents won’t be that transparent and will opt for a backdoor debt jubilee using three monetary tools developed since 2012: debt monetization, yield control, and market making control. Recall that “monetizing the debt” means the Fed buys debt issued by the US Treasury and puts that debt on the Fed’s balance sheet. In essence the US it buys its own debt. “Yield Control” means the Fed sets rates of interest on auctions of Treasury bills and notes by being a willing monetizer irrespective of what a market rate of interest may be. Even if there are no buyers at a low yield, the Fed can still monetize that debt by putting it on the Fed balance sheet. This two-pronged approach is referred to as Quantitative Easing or “QE”. QE had a third dimension where the FED made direct open market purchases of stocks and bonds to settle markets and avoid panics. That practice continues today with Fed support of money markets through overnight REPO purchases of treasury securities.

One Possible Jubilee Playbook

The Leviticus 25:8-17 debt jubilee will relieve debt pressures and will certainly be popular, but he enormity of the US debt, and its status as the world’s reserve currency make it impossible to forgive outright.

An interesting newsletter about debt jubilees was written by Lyn Alden in February 2022. Ms Alden’s newsletter is free but she also consults with wealthy clients https://www.lynalden.com/investing-newsletter/. She outlines a sleight of hand debt jubilee thesis where the Fed will orchestrate a jubilee by reviving the QE playbook while maintaining an outward appearance of gravity and responsibility.

In essence she thinks the Fed will stop selling off its bond portfolio and return to the Covid-19 practice of interceding in the private markets to provide confidence and liquidity and at the same time supplement market stability by buying low yielding Treasury Bonds directly from the Treasury. In addition, it will excise yield control such that the yield on treasury debt will always lag the rate of inflation. That lag has been true for at least the last five years.

At the point where the Fed’s balance sheet is massively insolvent (it is arguably insolvent today), the Fed will then convert all the federal debt it has monetized on its balance sheet into 100-year maturity zero coupon notes. What that swap means is if you hold a 10-year Treasury note with interest at 2% you will get a substituted Treasury Note that has no interest at all and no payments of principal until a full century later.

The horns will sound, and the upshot is all the liquidity supplied by the Fed to buy Treasury Bonds at artificially low interest rates (quantitative easing) will be rendered as worthless and illiquid as an Argentinian peso.

But just like every debt jubilee this may save the ruling class, extinguish large swaths of the monied class, and let everyone start over as “equally broke”.

While Ms. Alden’s theories are all conjecture, I do think she realizes our national debt situation cannot be solved without an eventual jubilee. I wish I really understood what happened in Japan from 1980 to 2020, but I think they also had a bundle of public and private debt that could not be repaid, and it took 40 years for it to be forgiven or restructured to oblivion in a version of a debt jubilee. The same appears to be happening in China right now with their real estate property debacle. So, there is precedent for the creditors not collecting and a jubilee reset.

The problem is the US Dollar is the bedrock of the world’s economy so contagion will spread to every household in the world. That’s the problem with debt – you can only get rid of it by repaying it, defaulting on it or rendering it worthless. I think Ms. Alden realizes we only have the political will to make it worthless and the debt jubilee will be the method.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.