When I was first introduced to the stock market by my aunt, a securities analyst for a leading regional securities firm, her formula for success was picking companies that were growing revenues fast and also paying dividends. In the 1960’s the so-called “Nifty Fifty” had many of those attributes and, like millions of Americans, I became a stockholder.

My timing was horrible and like millions of Americans I lost my tiny investment as the financial system imploded. While the depth of that market crash was not as bad as 1929, its breadth was much worse. Many Americans had moved their entire net worth into the surging Nifty Fifty and they lost it all as the financial system itself fell apart.

What I remember was the losses stemmed in part from eroding financial performance of the companies but mostly from the sudden lack of liquidity in all markets. I began to understand liquidity is often the greatest risk for all stocks, especially smaller capitalization companies.

Since that time public market liquidity has shifted to Mutual Funds, Hedge Funds, Exchange Traded Funds, and, most recently, the public companies themselves. It is quite ironic but like the end of the 1960’s the breadth of wealth committed to U.S. equity markets is epic. The SEC estimates as of April 6, 2023, $38 Trillion-almost, 60% of the U.S. stock market- is owned by American households, either directly or indirectly through mutual funds, retirement accounts and other investments. Much of the worldwide confidence in U.S. equity markets is a function of 15 years of market liquidity spurred by low interest rates, plentiful money printing, Covid-19 relief monetary infusions, willing lenders and dysfunction in most of the alternative trading markets worldwide, especially China.

New Liquidity From Cash Flowing Companies

I recall from the 90’s and the early 2000’s that one of the most bullish signs of an undervalued stock was a Board of Directors deciding to buy in its stock. Numerous newsletters tracked this buy signal and clever repurchase systems like “Dutch Auctions” were invented to keep news of these buy backs from spoiling the bargain.

The buybacks were also financed largely with cash from accumulated profits, not from banks or the bond market. In essence shareholders’ equity was used to purchase traded securities only because they were cheap.

Today, Buy Backs often support management compensation plans tied to stock performance by adding buying pressure in companies with oligopolistic positions.

Here is information from Capital IQ about the largest liquidity providers showing what portion of their cash from operations (after capital expenditures) is devoted to dividends and buybacks:

| Company | LTM Cash From Ops | LTM Dividend | LTM Stock BuyBack |

| APPLE | 109 B | 14.9 B | 91 B |

| MSFT | 83.0 B | 19.3 B | 9.4 B |

| META | 50.3 B | 0 | 31.4 B |

| 89.8 B | 0 | 60 B | |

| AMAZON | 54.3 B | 0 | 44.3 B |

| Berkshire Hathaway | 39.1 B | 0 | 9.1 B |

| JP Morgan | 37.5 B | 13.5 B | 3.3 B |

| WALMART | 37.2 B | 6.1 B | 8.2 B |

| P&G | 15.2 B | 8.9 B | 8.6 B |

| United Healthcare | 37.2 B | 6.1 B | 6.5 B |

For illustrative purposes only.

Why The Fuss?

If you are wondering what drives stock performance, it seems pretty clear to me it is demand from retail and institutional investors as well as the companies themselves. Investors seem to prefer thematic Exchange Traded Funds where the constituent companies’ stock all goes up or down based on the funds flow from investors. In addition, the very largest of the individual companies provide their own demand through leveraged and unleveraged stock buy backs. For example, on top of hundreds of Exchange Traded Funds that own Apple, Apple itself bought back almost $100 Billion of its own stock over the last 12 months.

If you are thinking about the margin of safety in equities, it seems logical that you want to own either individual companies that can use their retained earnings to support price momentum in their stock or exchange traded funds with high cash flowing constituent members. There are not that many companies like Apple, Microsoft, NVIDIA, GOOGLE or Facebook that have the balance sheets to continuously buy their stock or predictable earnings power to replenish annually what is spent on buy backs.

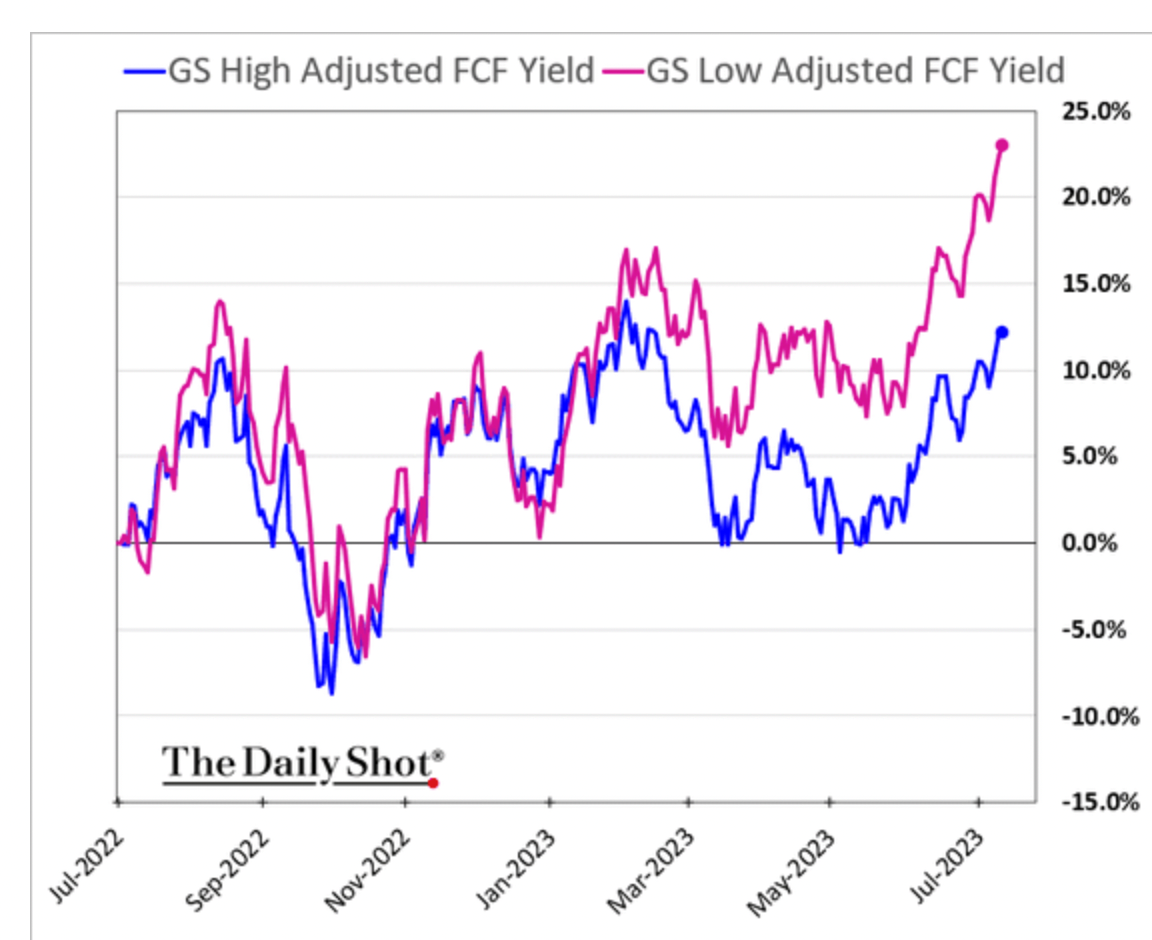

However, as smart as this strategy sounds, the 2023 stock market is not rewarding this extra source of liquidity. Here is a chart from the Daily Shot on July 13, showing stocks with strong cash flow underperformed those with lesser cash flow:

So this either an anomaly and a chance to pick up some bargains, or it is an unsupported thesis to be avoided. However, when I added one more variable to the equation, the stock buy back advantages became clearer.

What About Taxes?

Also notice the number of companies in my first chart that do not return capital to shareholders through dividends. In my small sample Meta, Google, Amazon and Berkshire Hathaway only return capital through stock buy backs. This tactic is tax-efficient for all the shareholders who do not sell into a buyback because, without a realized taxable gain it usually raises the stock price by improving the earnings per share on an ever-shrinking number of shares outstanding. Contrasted to dividends where the receipt is taxed as ordinary income and often at the highest bracket, the stock buy back program seems like alchemy.

It is such a good thing that a number of politicians believe a wealth tax on unrealized “book” wealth is the only fair system. Interestingly, the U.S. Supreme Court has agreed to address that issue in its session next year when it considers Moore v. United States dealing with a 2017 Tax Act provision allowing a tax on unrealized foreign gains.

All I can point to is history. When markets fall like they did in the 1970’s and again in 2008, the single biggest culprit was lack of liquidity. Even though investment capital apparently has a contrary point of view right now, it seems to make sense to own companies that can provide their own tax advantaged liquidity as a partial hedge against a sudden reversal of capital flows.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.