If you explore the history of money, you begin to understand why crypto currencies are beginning to compete with monopolistic monetary systems dominated by central banks.

First Money Was Jack And the Beanstalk Model

The first system was a “Jack and the Beanstalk” economy where a farmer could physically trade a cow for something else like silver, sheep or seed corn, or, if you were a speculator like Jack, magic beans. It was a peer-to-peer economy without central supervision, permission or middlemen and ordinary citizens could dream of waking up with a beanstalk leading to a pot of gold.

However, that decentralized system did not work if you had to travel with your cow across the ocean to trade for silk so the English came up with a centralized system. The East India Company was chartered by Elizabeth I as the exclusive trading organization between England and Asia.

If you wanted to trade your cow in England for silk in Asia, the East India Company would make that market by issuing its letter of credit in pounds for the cow at a port city like Liverpool and an individual could take a ship to Asia and present the letter of credit to the East India Company office there and shop for silk in the native currency.

The system had lots of middlemen who charged fees along the way for providing currency, much like Western Union today. It worked based on trust and the implicit backing of the Queen of England. It was a permitted monopoly and the beginning of crony capitalism as a successful partnership model for expansionist governments and eager capitalists everywhere.

Banks Became The Next Private Monopolies

Over time, private banks replaced the East India Company, but the concept was the same. Banks were chartered by states and governments as private monopolies .You could sell your cow for silver and deposit it in a bank and the bank would protect your silver and post your balance for all of its branches to allow you to make withdrawals. The banking system was scalable and centralized, but not secure. Every 10 or 12 years too many of the banks would fail and the wealthy owners of these implicit monopolies would be wiped out. Too many bankers were lending depositor money for magic beans and depositors did not trust the banking system. Runs on the bank were commonplace.

A New Cartel Gets The Power To Print Money

To promote confidence in the system, centralized banks representing governments began to emerge. They put their full faith and credit (and the taxpayers’ wallet) behind the always failing banking system. For example, The Federal Reserve System in the United States was secretly created in Jekyll Island in 1913. A flimsy, unreliable decentralized banking system comprised of geographic monopolies became more stable and secure once it was controlled by a central bank.

In addition, this new central bank was largely unsupervised. The Federal Reserve Act granted it central authority to create money. The only supervision was its Board of Governors appointed by the President. Taxpayers underwriting the money creation did not have a seat at the table. Congressional approval was not necessary.

However, runs on the bank could now be handled by Federal Reserve cash infusions. Bank owners were happy and depositors were happy, but monetary expansion was still hobbled by the pesky gold system where money creation was tied to gold reserves.

System Decouples From Gold

That would change in 1933 when FDR abrogated the gold contract and again in 1971 when Nixon abolished the gold standard completely. Suddenly, money creation was not only unsupervised and unregulated, but its expansion was no longer tethered to a finite resource like gold.

Today, central banks all over the world manage fiat economies by dictating the currencies that will be accepted for commerce and by lending their money creation support only to those currencies. Central banks worldwide have followed the United States’ playbook and also gained the power to create money. We are now experiencing an era of unprecedented monetary expansion

Not Much Had Changed Since the 1600’s.

These central banks are also influenced by the same money cartels that influenced the creation of The Federal Reserve System. Unsurprisingly the same implicit monopolies emerged. The East India Company was reincarnated as Goldman Sachs and JP Morgan.

Thirty years later there was the Dot Com Crash

Thirty-seven years later there was The Big Recession

Without Fanfare Bitcoin Was Introduced In 2009

Thirty-eight years after the monetary system went off the gold standard Satoshi Nakomoto introduced Bitcoin and the decentralized blockchain ledger that validates ownership.

Since then more than 100 different crypto currencies have been created most of which work on the idea of ownership being validated by the users, not by fiat or the implicit guarantee of a third party. These systems are also permissionless and without boundaries. Because it is digital and connected by the internet it is accessible all the time all over the world.

An Immutable Constitution

Along the way communities of supporters and believers began to warm to its democratic principles where a centralized source of power and wealth is not picking winners and losers and where the value of the new currency is based on a limited supply and an immutable constitution. For the first time since Jack and The Beanstalk implicit monopolies were being challenged by a peer-to-peer system where the upstart users were in control, but no single party had undue influence or control.

Validators of blockchain authenticity were paid in that currency. Security was based huge computing power based on large investments in hardware and electricity. The incentive to corrupt the system was overridden by the huge expense of gaining a 51% control and the possible loss of huge financial gains from Bitcoin’s rapid appreciation.

Internet, Moore’s Law and Populism Define Its Future

The implications for crypto have become clearer for me. The cost of computing power has fallen according to Moore’s Law to match the security model for blockchains based on proof of work which requires increasing computer power and huge amounts of energy. Proponents are “hodlers” meaning they are long term holders and will never sell. Scarcity is not only built into the constitution that limits the creation of Bitcoin to 21 million, but also in the trading characteristics of its supply and demand.

Crypto alternatives are decentralized, permissionless, borderless, worldwide, “always on” and proven. Bitcoin is called digital gold because it has a finite supply. It has a predictable creation schedule and its blockchain has never been corrupted. It is co-existing with fiat systems because it is accepted as a legitimate store of value. Ethereum is emerging as the most logical disrupter of currencies and permission based middlemen.

Populists all around the world are tiring of wealth creation in the 21st century not having advanced much from crony capitalism based on who you know and getting implicit monopolies like the East India Company did in the 1600s. Too many “magic beans” from bailed out speculators started showing up on The Fed’s balance sheet in 2008 and again in 2020

Finally, a younger cohort all around the world supports crypto. They remind us every day of their power to spin straw into gold. First it was Bitcoin, then Hertz, GameStop and AMC and most recently Dogecoin. This cohort understands the power of scarcity and concerted action.

You Can’t Buy Pizza

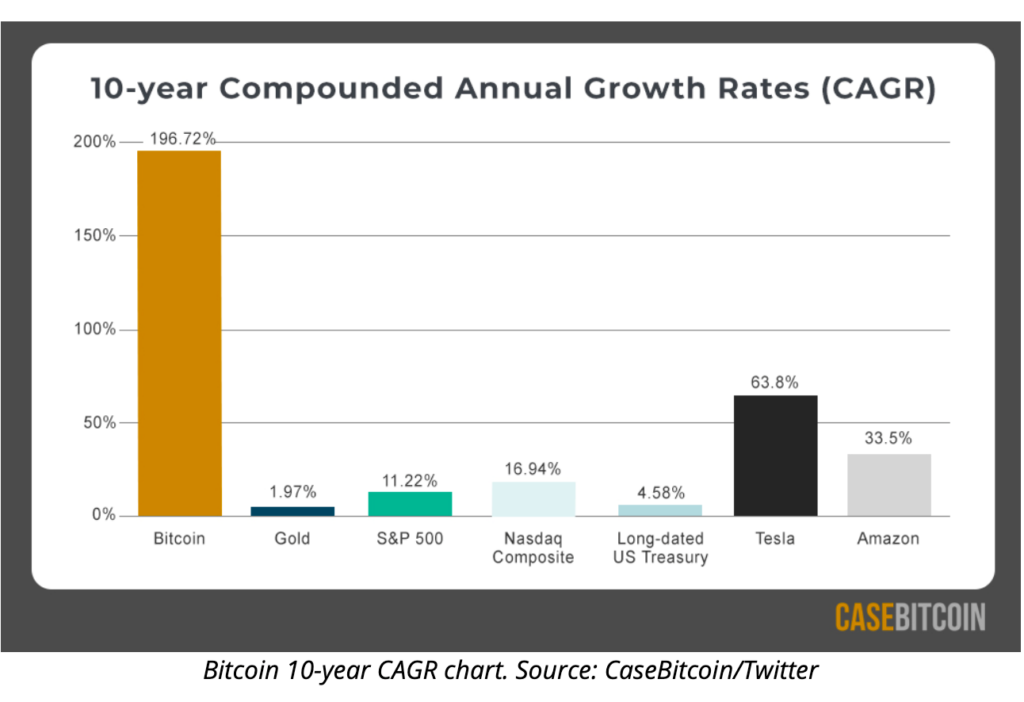

Detractors are mostly insiders like Jamie Dimon and Charlie Munger. People who say Bitcoin is a fraud because you can’t buy pizza with it miss the point that you would never spend something viewed as a store of value appreciating at triple digit rates every year when you can spend US Dollars worth less every day.

The only question is which currency is really the magic beans. Crypto “hodlers” think they know the answer.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.