Although the recent inflation message from Chairman Jerome Powell in response to Congressional inquiries is heartening, it does not jive with some really lopsided conditions I am seeing that remind me of the 1970s. Here is what Chairman Powell said on March 23, 2021 as he and Treasury Secretary Yellen testified before Congress:

“We’ve been living in a world of strong disinflationary pressures for the past quarter century. We don’t think a one-time surge in spending leading to temporary price increases would disrupt that.”

Later in April, in response to written questions from Florida Senator, Rick Scott, he addressed the concern about inflation exceeding the policy objectives of 2%:

“We do not seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged period.”

While I am always reassured by a central banker of Powell’s pedigree, I am not sure our leaders in Washington get out much, and they may not see some of the hints of inflation the rest of us are experiencing.

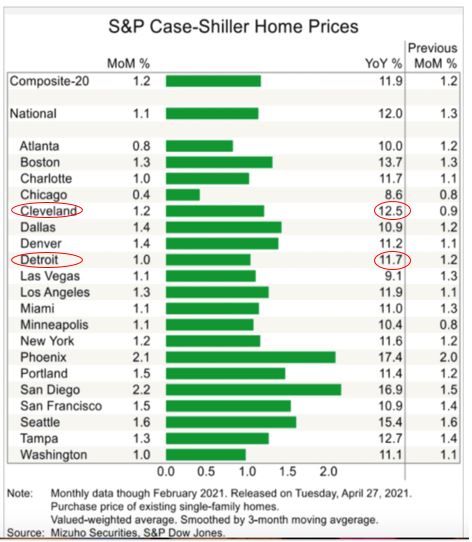

My first head shaker is how Cleveland can have the fifth highest year over year home price appreciation in the USA according to a recent Case-Shiller report (April 27, 2021), and how Detroit can even be on that list?

I can understand San Diego, Tampa and Phoenix where the sun shines more than 300 days a year, but why Cleveland and Detroit where the sun hasn’t appeared more than 300 days in this decade, and where Ohio is losing a congressional seat because of population decline? When Cleveland and Detroit make this list, the Fed may have found the inflation it is seeking.

This is confirmed by my brother’s search for a home in Cleveland. He reports there are multiple bids for every house property, and everything sells above asking price. He cannot find a home at any rational price. I told him he could buy an 18 room Red Roof Inn on Route 8 for the same prices he is seeing now.

This Is Not A “Base Effect” Anomaly

I guess Mr. Powell doesn’t see meaning in the average year over year national average price appreciation of 12%. Normally, in a “big dipper” economy like we had from March 2020 to March 2021, that percentage increase could make sense because the base prices were so depressed. However, this recession came with real estate price supports, like moratoriums on mortgage foreclosures, and a healthy mortgage lending climate at almost every bank. So, the base prices mostly stayed intact.

I then reread Chairman’s Powel’s quote and he is only promising the Fed does not “SEEK” inflation above 2% but I guess 12.5% in Cleveland is ok if you are not seeking it and we should not be alarmed?

Finally, Something Fed Can Manage

Mr. Powell reminds me of a beleaguered freedom fighter who is out of weapons after having laid siege to an impregnable city called DEFLATION for 25 years. Suddenly he has “shelled out” enough money to walk through its front gate with a big sword of INFLATION. His joy is infectious. He has finally created something he can manage. Here is another excerpt from Mr. Powell’s response to Senator Scott:

“We understand well the lessons of the high inflation experience in the 1960s and 1970s, and the burdens that experience created for all Americans. We do not anticipate inflation pressures of that type, but we have the tools to address such pressures if they do arise.”

Signs Of Inflation Abound

Common sense would suggest we all think about the biggest driver of inflation. In almost every instance, like 1970-1974, it is scarcity in goods and services. So what is scarce?

Think about labor. The various unemployment safety nets are crowding out entry level employees. The federal employee minimum wage may rise to $15.00/hour by Presidential decree. Every surviving restaurant in America is looking for help, and is thinking about robots instead. The manufacturing sector is struggling to fill open positions. Manufacturing price increases are becoming commonplace and more frequent.

Raw materials are up. Anything associated with your home and its care is up. Silicon chips are up. Natural resources and commodities, including oil, are up.

Services are up, and good luck finding anyone to do that work.

Netflix is up. The price of Apple products is up.

Higher education has gone virtual, but tuition prices are still growing.

Constraints On The Fed

I agree the Fed has the tools to fight inflation (increase interest rates and stop injecting money into the economy) but the real question is whether they are so constrained by underfunded public pensions, leveraged equity markets, retail stock ownership, and political pressures they won’t have the will.

Buckle your seat belts. We may soon understand how scary a fully fueled, self-driving economy can be.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.