I hope this blog headline got your attention because I know of only one way you can earn 21% compound interest risk free in today’s financial markets. But before I reveal this windfall for your wallet let me pick up on a blog I wrote in June of 2022 Credit Card Toxicology Report (click to read) when the combination of rising inflation, rising interest rates and falling Covid era relief payments warranted a financial checkup for the US consumer.

What I found in mid 2022 was average credit card APRs of 16-18%. Those rates were close to the record rates recorded in the 1980’s when credit card APRs topped out at 19%. According to Lending Tree in an article written by Martin Schulz on April 7, 2023, titled “2023 Credit Card Debt Statistics“ just nine months later in Q1 of 2023 the average APR was 20.09%. New credit is being offered today at rates far exceeding that. Here is a report from Lending Tree on the interest rates on the most popular cards with the spreads being 19.5%- 28.4% determined by credit scores for the card holder. I was surprised that my Chase Freedom card is offering me a 21% APR. In the 15 years we have had that card we may have carried a monthly balance forward only once:

| Bank Americard | 15.74- 25.74% |

| Chase Freedom | 19.49- 28.84% |

| Capital One | 19.74-29.74% |

| Wells Fargo | 19.74-24.74% |

Also, when I wrote in 2022 the aggregate outstanding credit card debt was $ 861 Billion and today it is $986 Billion. This is a 14% increase in aggregate credit card debt in only nine months and it demonstrates how compounding inflation on goods and services robs the consumer of purchasing power!!!! According to The Federal Reserve Bank the amount of credit card debt accruing interest is the highest since 1994 when those statistics were first recorded.

The adage that “inflation helps a debtor” by allowing him to repay in the future with inflated, less valuable dollars should be rewritten to say, “except when the debt is variable and compounding at a higher rate of interest than the inflation rate, like all credit card debt.” Clearly, rising inflation in goods and services and rising interest rates to combat inflation are a double whammy for the consumer and an unsustainable financial structure when the most available credit comes in the mail without solicitation in the form of a credit card compounding daily at 21% annually or more. Here is a chart from Lending Tree showing the many different kinds of Credit Cards customized to the US consumer through co-branding and rewards options as well the rate of interest they charge:

Luckily Household Savings Are Impressive

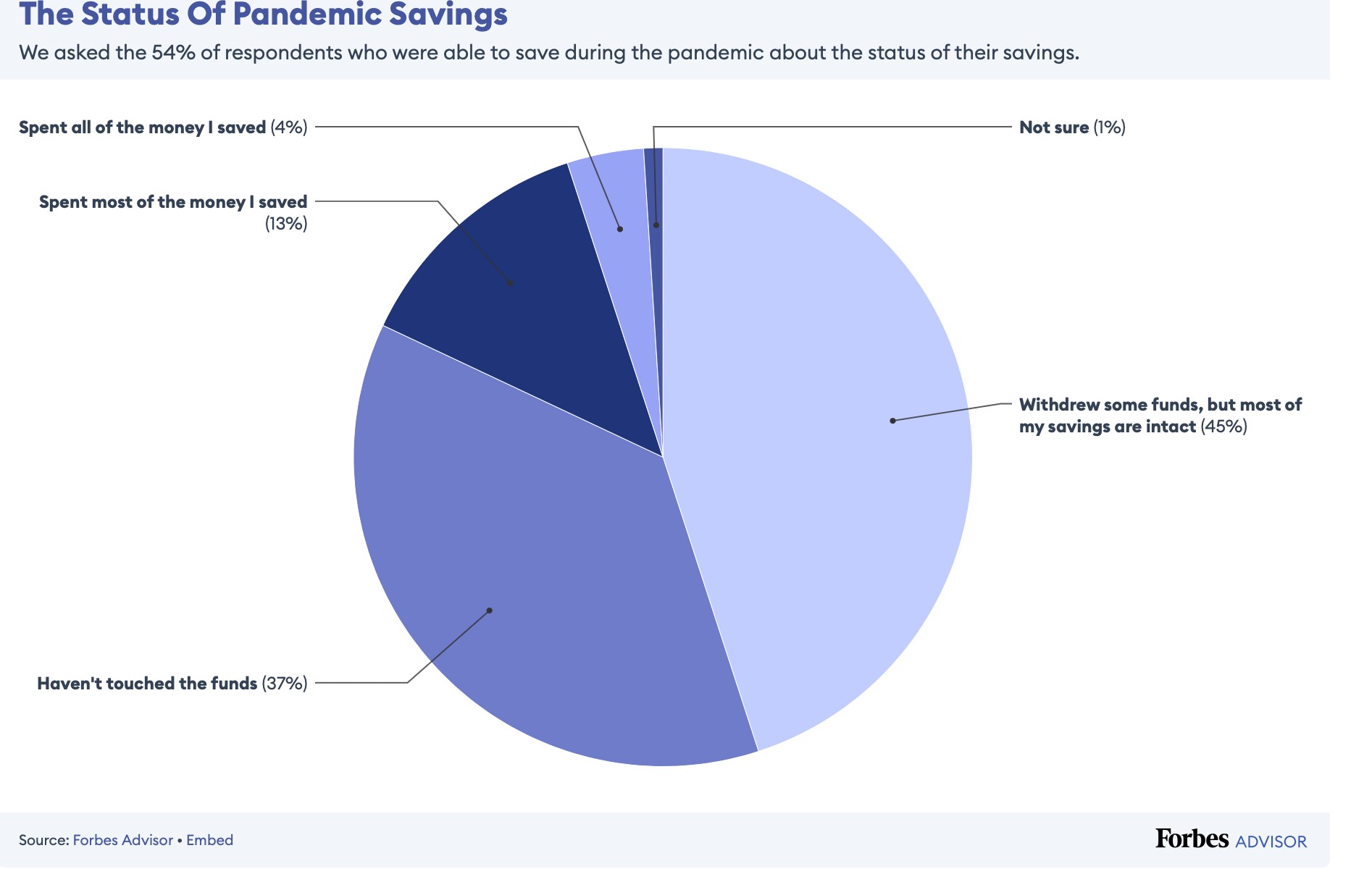

I am also heartened by the financial responsibility Americans are showing post-Covid. In an article by “Forbes Advisor” titled “48% of Americans Are Maximizing Their Savings Through A High Yield Savings Account” written by Cassidy Horton dated March 23, 2023, Ms. Horton discovers surprising intelligence and discipline among American consumers. Not only are Americans saving but they are also maximizing short term yields offered up by the inverted yield curve. Instead of incurring credit card debts at 21+% they are saving and earning 4-5% annually on quality money market funds and T-bill ladders. Here is a summary from Ms. Horton’s article:

Americans Are Understanding Inflation and Credit

My conclusion about the US consumer is a hopeful one. Americans seem to understand how variable rate debt at 21-23% will be like the myth of Sisyphus where a greek king is punished by having to roll a boulder up a hill only have it fall back again and again. Not only are the costs of grocery, rents, auto, clothing and travel compounding at a high single digit rate but so are the APR’s on the multitude of designer credit cards.

Undaunted, the US consumer is answering the question I posed in the title of this blog. They are taking the sure thing by paying down 21% APR credit card debt or not incurring it at all and, in so doing, are actually getting 21% interest. This may be the smartest investment of their life.

For those consumers who cannot pay off their credit card debt the story is horrible. Take John Q Public with $2000 of credit card debt and the limited ability to pay off his balance at the rate of $60 per month. It will take 15 years during which he will have paid $4,241 of which interest alone will be $2,241.

If there is going to be a debt holiday for Americans who have both student loans and credit card debt, clearly credit card debt is the more damaging. Better regulation of who is being offered credit is urgently needed. Financial slavery in the 21st century is simply unacceptable notwithstanding the power of the credit card lobby. This is something worthy of Senator Warren’s attention.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.