One of the smartest investors I know taught me “you don’t bank percentages” so even if your bonus is ten percent, if it is applied to below market base pay you likely would be earning less than someone who got 5 % bonus on a higher base. In addition, the base number is a fixed promise- a sure thing- whereas the bonus is discretionary. Employers are on the other side of that trade and understand large percentages should always apply to the lowest base possible.

Before Covid tipping was pretty straight forward and mostly limited to restaurants, and personal services like barbers, valets, concierges and doormen. You added a dollar amount to your payment. There were all kinds of math aids to help people figure out if your dollar tip was a respectable percentage.

During Covid when the service industry was risking personal health by providing services like personal shopping, takeout food, and house keeping your interactions went from in person to on the phone, on line or Venmo. Also, a new Covid point of sale software (“POSS”) started showing up. It allowed you to choose a tip of 10%, 15%,20% or “Other” to the invoice amount. No one would choose “Other” because it meant you had to spend time exposed to the person at the takeout window or the person hacking up a lung behind you in line. Also, no one chose 10% because it showed a complete disregard for the risks the service provider was taking. At the outset I was always choosing 20% because I was so grateful. Also, like most people, I stopped asking for a copy of my final bill. I was just thrilled to have takeout at any cost and I did not want exposure to anything like a virus on a piece of paper. When asked, if at all, what did it all cost my answer was the same as most Americans “who cares… we don’t have to cook tonight.”

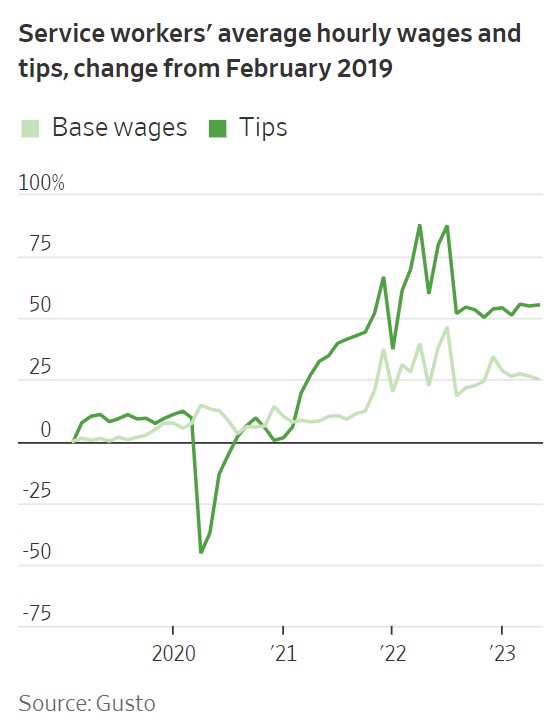

Unbeknownst to the consumer, Covid ushered in a new compensation opportunity for workers’ wages. When inflation started to show up in goods and services and everything you read was about percentage increases in “input costs” there were virtually no Americans who had the computational aptitude to understand how the Covid point of sale tipping regimen had set the table for passing on wage inflation to the consumer.

My Pruning Shears Taught Me A Lesson

I first realized what was happening when I tried to get pruning shears sharpened this year. Two years ago, the service guy charged me $10 and the POSS had a tipping option for which I reluctantly chose 20% so my final bill was $12. Two years later in 2023, the same guy said, “I am too busy to write this up, but I can have this done tomorrow and let’s just call it $15 cash”. I was mindful of successive years of high single digit inflation and was relieved I did not have to decline the tipping option. I just said “OK” and gave him cash. I needed the pruner for marital harmony.

I forgot about the base price being $10 not $12 in 2021 and the power of compounding. His input cost of living probably compounded at 7% or 8% for 2 years and the service price should have been $11.66. Instead of giving him a raise, his boss probably told him he could keep the tips above $10. The all in cost had compounded at 22.4% and all I would remember would be the $15 price I paid in 2023. His boss avoided a raise, and he was way ahead of inflation. Two years from now when I need the same service, he probably can compound at 5% and charge me either $16.50 with the POSS tipping option or $20 cash?

Ask yourself if this is not happening all the time? The consumer has no idea what the provider’s input costs really are. He just knows two things for sure: 1. He does not want to tip for sharpening pruning shears, but he carries great embarrassment about declining to tip on the POSS. 2. He never got used to what portion of his final bill was tip or base price because he either did not get a copy of his invoice or he did not know how to compute percentages. In either case an employee who has the skill to sharpen blades and can ask for a tip can profit from inflation without his employer raising his base pay.

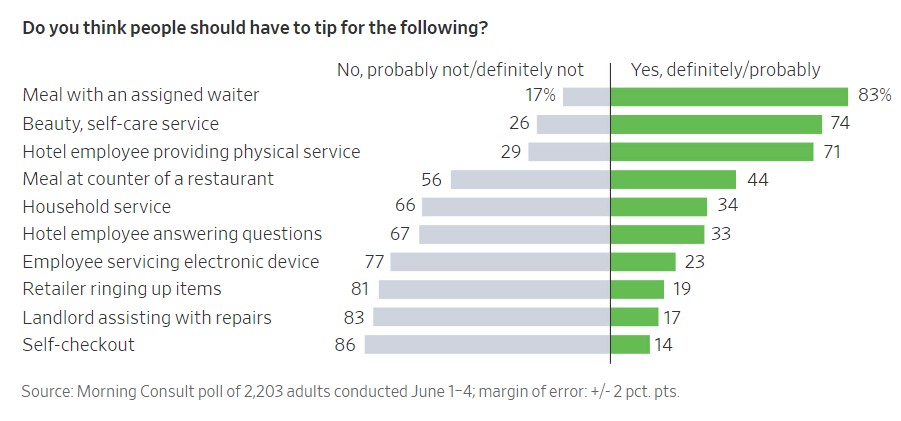

My concerns are just beginning to be noticed in the popular press. In an article published on July 23 in “The Wall Street Journal” written by Rachael Wolfe, Ms. Wolfe explains that tipping has now expanded into industries other than personal service and serves as a way for employers to augment compensation without raising base pay. Here is her survey results and notice that tips are replacing increases in base pay:

Ms. Wolfe also demonstrates the scope of industries where tipping is now part of the wage pricing strategy has expanded to include outliers like self-checkout and counter service, I am conditioned to tip servers, bar tenders, barbers and car valets but the universe of recipients has expanded.

For instance, my granddaughter handles telephone takeout orders for a pizza chain. She is paid a minimum wage and shares in a daily takeout tip pool. The pizza company has raised its base prices by almost 30% over the last two years but base employment costs have stayed the same. The tip pool from take out alone is so good not one employee has even thought about a raise or looking for employment elsewhere. The customers are handling wage inflation through Covid era tipping habits. My granddaughter is getting meaningful tips for answering the phone.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.