Depending on whom you ask you will get a different perspective about having the U.S. Dollar as the reserve currency for the world and the medium of exchange for oil and other essential commodities.

If you live in Turkey, Venezuela, or Argentina, and have persistent, high double-digit inflation, holding U.S. dollars as a store of value is smart move. Recently a candidate for President of Argentina has proposed shutting down the Argentine central bank and adopting the U.S. dollar as the Argentinian currency.

If you are a Russian oligarch with wealth denominated in U.S. dollars, the opposite is true. Punishing the ruling class of an enemy nation by seizing and freezing their dollar – denominated assets is now a widespread playbook for pressuring rogue nations.

Competitors and enemies like China, North Korea, Iran, and Russia all want a system that allows trade to be settled in something other than U.S. dollars because the current regimen forces them to support the U.S. financial system by buying and holding dollars. Right now there is reluctant acquiescence.

With the downgrade of the Ten-Year U.S. Treasury Note from a AAA rating to an AA rating by Fitch earlier this month, the world is reminded about the vulnerabilities that come with having to buy and hold U.S. dollars. This is front of mind for all participants in world trade. When an alarming share of the U.S. budget is devoted to just paying interest on Treasury obligations, this forced ownership of a weakening currency is unsettling.

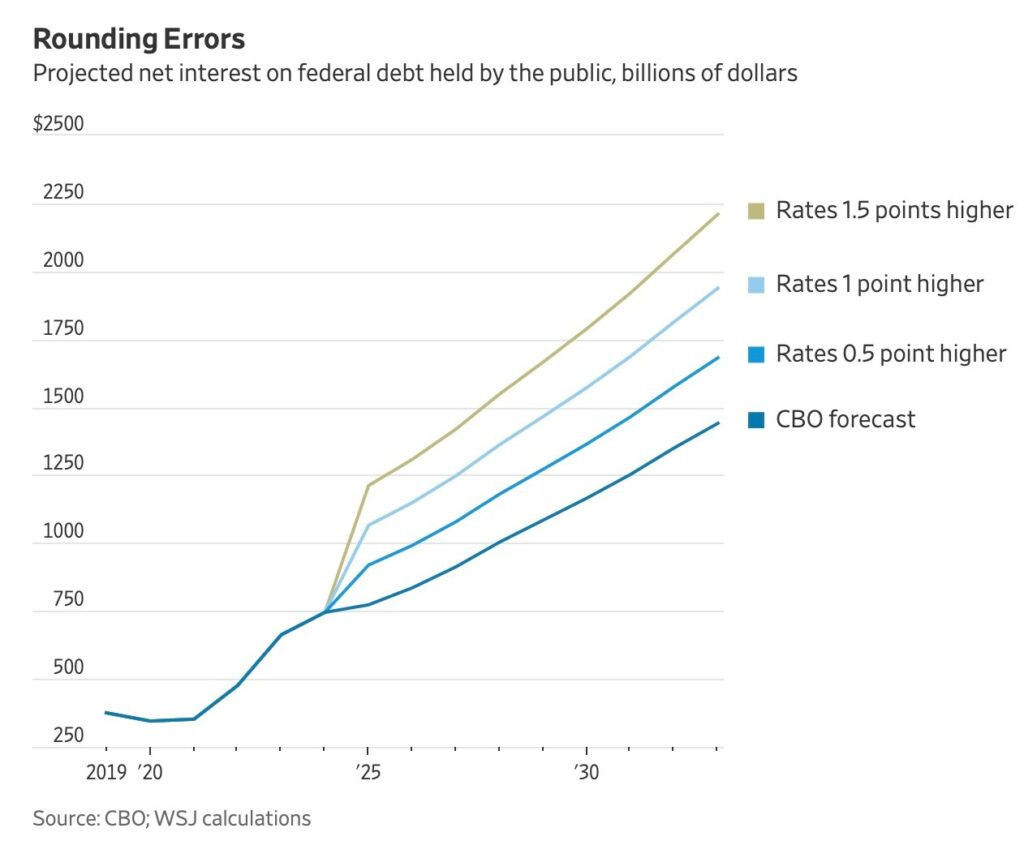

In an article by Spencer Jakab writing for The Wall Street Journal titled “The Scary Math Behind the World’s Safest Asset” published on August 12th, the author tracks the growing interest burden on U.S. Treasury Bills and Notes. Mr. Jakab also considers the possibility that the $25 Trillion in Treasury debt with maturities under 5 years may have to be refinanced at even higher interest rates than expected. Here is a chart showing the ever-increasing interest burden and how small changes in rates can mean huge swings in interest:

Mr. Jakab also fears the power of compounding may push the interest burden alone to $2.0 Trillion by 2033. For perspective, tax receipts in 2023 are only expected to be $2.5 Trillion.

Bretton Woods Accord Went With The Gold

You may recall that the U.S. dollar became the reserve currency by world agreement after a conference at Bretton Woods in 1944. It replaced the English pound as the most accepted medium of exchange for trade by promising it would convert dollars into gold at a fixed price of $35 for an ounce of gold. That promise only lasted for 27 years, and when a number of countries began to demand swapping dollars for gold in 1971 President Nixon reneged on that promise. The message was clear – you have no choice but accept dollar dominance without it being tied to anything of value except the exceptionalism of the U.S. financial system.

That was 52 years ago

Fast forward to 2023, and the U.S. dollar is still the reserve currency of the world, and U.S. economists have all concluded you cannot default on your promises to pay creditors as long as you can print money and your debt is repayable in dollars. While completely irresponsible, this modern monetary mantra is basically a middle finger in the air to the rest of the world.

I have written about this dilemma in the past and have reached the conclusion that the U.S. dollar is the best currency for international order notwithstanding all of its challenges. However, a recent article from “The Wall Street Journal” titled “Stablecoins Can Keep the Dollar the World’s Reserve Currency” educated me about bi-partisan measures under consideration by the House Financial Services Committee.

This Committee is considering a stablecoin currency administered on a block chain and backed by U.S. Treasuries. This new approach is codified in legislation called “The McHenry Bill” for which there had been bi-partisan support. Last week the McHenry Bill was approved and reported out by the House Financial Services Committeefor Congressional consideration.

I asked ChatGPT for a short explanation of stablecoins and here is what I got:

“Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to another asset, such as a fiat currency like the US dollar or a commodity like gold. While stablecoins have gained attention for their potential applications in international trade and settlements due to their potential stability and efficiency, their regulatory and policy implications are complex and evolving.”

This is a severe understatement of the complexity of rearranging the world financial system, especially as it relates to international trading in commodities. A stablecoin also does not seem so stable to me if it is backed by the same revenue source that can credibly be projected by “the Wall Street Journal” to be almost insufficient to just cover the interest on Treasury and other U.S. debt.

Misuse of Reserve Privileges Can Lead To Conflict

The rest of the world is keenly aware of the U.S. debt problem and leaders of China, Russia, Brazil, India spin the prospect of a new “BRIC”- Brazil, Russia, India and China-trading currency. World events, however, debunk the myth of a viable competitor right now. China’s property sector smells like the U.S. real estate market in 2008. Russia just negotiated a truce with a mercenary army threatening a coup, and Brazil is having a bout of South America inflation. Only the Indian Rupee seems somewhat stable, but it is considered less valuable than the U.S. Dollar even after the Fitch downgrade.

Modern Monetary Theory taken to its extreme could make the price of commodities settled in USD $10x what the rest of the world is paying today. A monetary alliance of nuclear powers like Russia, China, North Korea, India, Pakistan, Iran and Brazil could reset the world economic order by issuing its own stablecoin to replace the dollar. While this seems a remote possibility right now there are plenty of world economies that are controlled by dictators that may be willing to protect their money with their nukes and their armies.

In any event the “exorbitant privilege” of having the world’s reserve currency is meant to come with an equal share of financial responsibly. Instead we have a new monetary theory that is as dangerous as flipping off our enemies and competitors.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.