This was the first summer I can remember when there was not a stretch of good weather for more than 5 days in a row. What I mean by good weather is also being redefined. Endless rain, big winds, small craft warnings almost every day, and serious flooding were commonplace in New England. But you get used to it, and play golf with flippers and a mask or take boat trips on lakes.

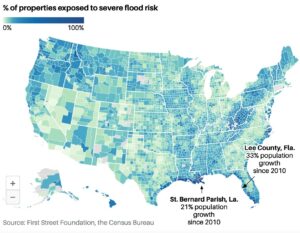

While the investment world is starting to consider weather as a variable in its recommendations for stocks and the insurance industry is beginning to back away from underwriting coastal flood zones, there is still high confidence in our species’ ability to subjugate nature. Here is a chart from First Street Foundation and the Census Bureau showing the growing concentration of home ownership on the coasts:

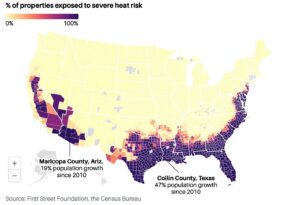

Think about our crude tools for fighting climate change: air conditioning, ocean sea walls, fire retardants, homeowner’s insurance, 911 alerts and even sandbags. If your air conditioning fails, the most populated states like California, Texas, Florida, and Arizona become unlivable. If you remove flood insurance, the property values in Florida to Maine and California to Washington State are all in doubt. Here is a chart from First Street Foundation and the Census Bureau showing the escalation of temperatures throughout the U.S.:

Veronica Dagher writing for The Wall Street Journal on August 28th in an article “Americans Are Bailing on Their Home Insurance,” says Americans are dropping their coverage because they can’t afford the 20% increase from last year. Ms Dagher says it now costs $1428.00 per year to insure a home valued at $250,000.

Rather than playing the mega millions lottery at $1.00 per ticket, a wide swath of homeowners are now playing the hurricane lottery with their coastal homes as the ante. While this trend usually applies to homeowners without mortgages it still suggests a misplaced confidence in a mix of favorable outcomes— the hurricane won’t hit me; if it does, the storm surge won’t reach me, even if the worse happens and I have to tear my house down, I can still sell the vacant lot to a developer for 80% of the former fair market value.

The other new phenomenon is wildfires. We all grew up with Smokey the Bear educating a whole generation of baby boomers about the risks of forest fires and advocating personal responsibility for wildfires and fire prevention. Unfortunately, the U.S. Forest Service Department retired Smokey in 2021 just in time for the worst 3 years in wildfire history. His replacement is “Ember The Fox” and Ember acknowledges wild fires as a natural phenomenon and something to be controlled through forestry changes. This is puzzling given more than 80% of wildfires are caused by humans, not nature. Here is a picture of a tired Smokey and a quite lively Ember:

I hope Ember is able to meet the new fire disaster objective of dealing with wildfires as a natural phenomenon and not a human responsibility because “Forbes” just published this chart showing regions of the U.S. most prone to wildfires in 2022:

As the viability of American coastal property becomes a roll of the dice, there seems to be no fear of loss. Maybe the prevalence of 100 year storms every 5 years goes unnoticed, or is just something that happens to other people? Maybe homeowners expect a bail out?

Possibly, the Maui wildfires will bring a human cost to all the smoke in the air that now seems commonplace, whether it is from Canadian forest fires or localized blazes? In any event, I don’t see Ember The Fox changing habits, and I doubt Americans will recognize the omnipotence of nature until it is too late.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.