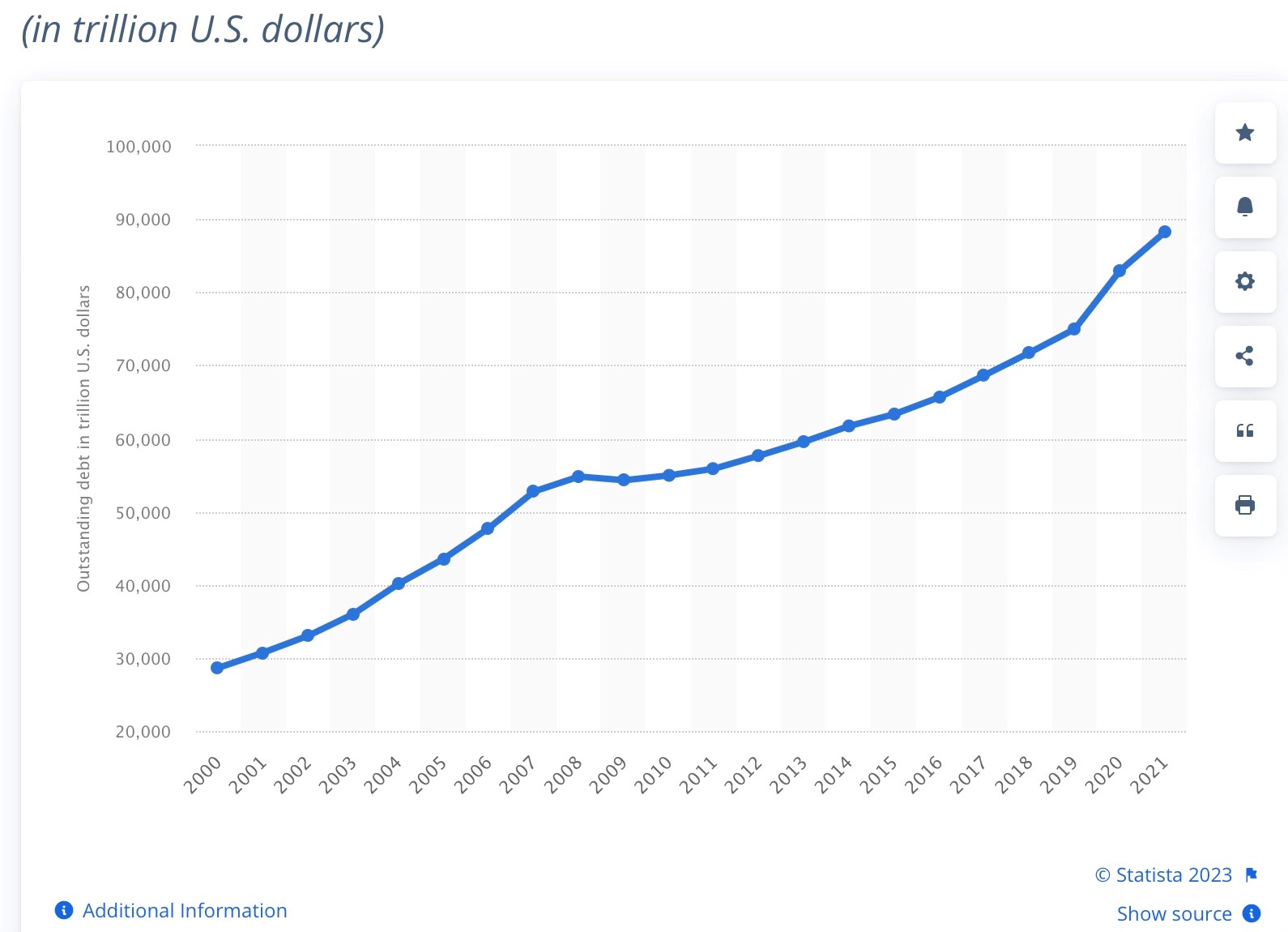

Several years ago, I was engrossed in a series of investment insights from Ray Dalio’s book “Principles For Dealing With A Changing World Order.” Mr. Dalio is the founder of Bridgewater Associates said to be the largest hedge fund in the world. In a series of monthly chapter releases, Mr. Dalio’s book explored the macro view for US and world economies. From his perch atop the world of finance Mr. Dalio’s crystal ball showed a gentle deleveraging of the massive governmental and private sector leverage that had accumulated since 2000 estimated by Statistica to exceed $90 Trillion.

By the final chapter release, however, Mr. Dalio had concluded that the amount of that debt was just too large and instead of a gentle deleveraging, the US would just inflate the dollar and repay interest and principal the same way South American countries do it—by printing more money. Here is that chart from Statistica showing the unbroken advance from 2000 to $90 Trillion in public and private sector debt in 2022.

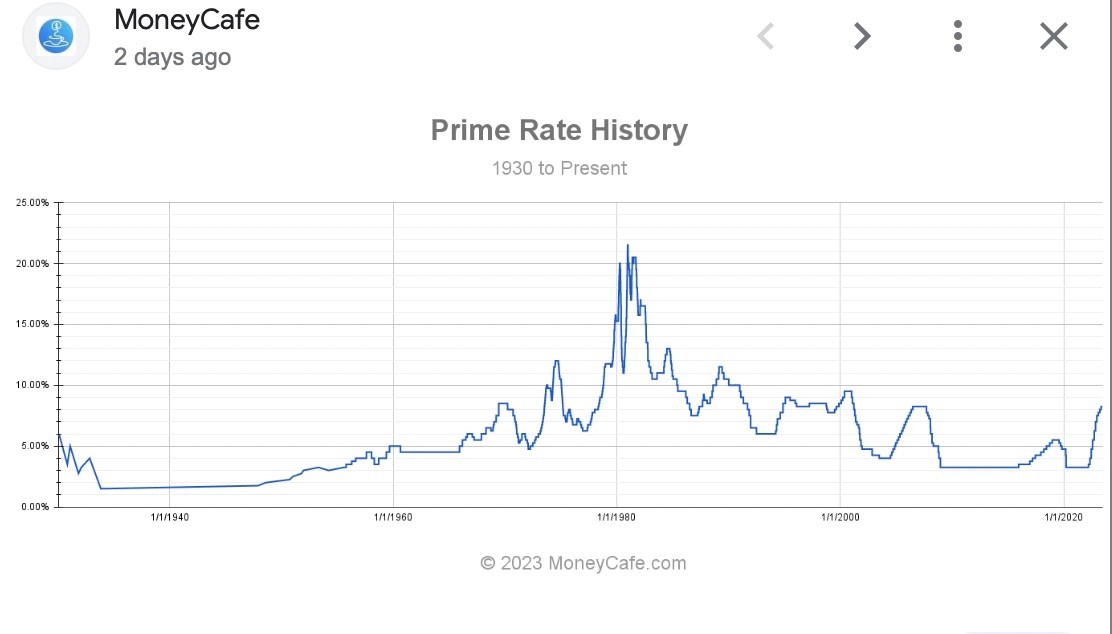

However, Mr. Dalio’s macro view may have missed one interim rogue actor playing the part of an inflation reaper. Instead of a gentle unwinding and refinancing at affordable rates ranging from 3% to 5%, inflation fighting rapidly readjusted the cost of debt above 5% as the Fed responded with 10 successive rate increases over a 14 month period. At first, the reaction to that inflation fight depended entirely on whether you were the debtor or creditor, and whether the interest on your debt was fixed or variable. For example, banks were still paying less than ½ of 1 % for deposits as recently as December 2022, even though they were issuing mortgages at 5.5%. This was a quite attractive net interest margin. The same delayed pain was experienced late for the private equity asset class with rates doubling from around 5% in 2021 to almost 10% today.

The Silicon Valley Bank failure rapidly accelerated deposit migration from banks paying almost nothing to the private sector offering 3-5% for short term funding and the US Treasuries offering even more. Suddenly, the whole banking system had to compete to hold deposits and their cost of funding went from practically zero to 4%.

Mr. Dalio’s expectation of continual money printing and monetization of the unpayable debt evaporated by the end of April 2023. A “sea change” had happened between December 2022 and April 2023, as had been predicted by a venerable value investor named Howard Marks. I wrote about Mr. Mark’s prediction in my blog dated January 23, 2023, titled Howard Marks Has New Advice for Investors, which you can read here (click link to read). After more than 40 years of interest rates falling, and all boats being lifted by the tide of low-cost liquidity, the tide turned and quickly began to recede. Here is that chart from Money Café showing changes in the prime rate of interest from US banks. Remember, this is the rate the best credit customers get:

The current picture has become much clearer. Inflation stubbornly refuses to put its sickle down and that is a short-term political issue. The Fed has no choice but to hold rates steady especially as we approach a general election in 2024. The Fed has put the entire banking system at risk by missing the whipsaw effect of zero cost bank deposits suddenly having to compete for funding with not only the private sector actors like Apple (4.15%) but also the US Treasury now offering 5.5%+ for 4 week paper.

While inflation may help debtors repay principal with ever less valuable dollars, the unaffordable rise in interest expenses and unrelenting price increases in household goods and services present pressing political issues. In addition, the higher base rates for short term funding threaten bank deposits and set a benchmark for valuing bank assets.

Here are some of my predictions about the new normal for the next 12 months:

- With the risk free rate now at 4.5-5.5%, medium duration bank assets yielding 3% fixed are underwater on a mark-to-market basis.

- The rate of valuation growth for levered asset models like real estate and private equity will likely slow down or reverse.

- Debtors may pay 2x the historic interest expense when they refinance in 2023 or 2024.

- Zombie corporations that cannot afford their interest now may become so irretrievably insolvent they cannot be touched without setting off a banking crisis.

- Leverage and credit will get tighter for now.

- Liquidity will come at a new, “Are You Kidding” price.

- Leveraged public stock buybacks will slow down and then disappear except for companies with fortress-like balance sheets

- Liquidity in all markets will tighten.

Longer term after the 2024 General Election, the Federal Reserve Bank may return to its money printing and debt monetization strategy as the only way out of the mess it has created. For now, the only short-term financial strategy for leveraged business models like banks, hedge funds, private equity, and real estate is to expect the hand you hold to be the hand you play.

The above commentary is for informational purposes only. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Opinions expressed in this commentary reflect subjective judgments based on conditions at the time of writing and are subject to change without notice.